Hospitality is hot—and, as we shall see, it’s also cool. Very cool.

The global hotel construction pipeline hit a 10-year high in 2018, according to Lodging Econometrics. In the U.S., nearly 670,000 rooms were in development or under construction last year—116,000 rooms shy of the 2008 peak. New York, Los Angeles, Nashville, Dallas, and Houston are particularly robust.

Upgrading the guest experience is a major focus of the sector. “Amenities are getting designed early,” says Ed Cettina, CEO, Global Building Construction, AECOM.

In some cases, the property is conceived around amenities, particularly dining and wellness spaces. A growing number of hotels and resorts have partnered with third-party restaurateurs to create multiple dining options under the same roof. “Large resorts might have seven to fifteen food and beverage venues,” says Eddie Abeyta, AIA, LEED AP, Principal, Chief Design Officer, HKS.

Lush spas are a must for new four- and five-star properties. In the casino/resort submarket, “there is a trend to capture more overnight stays by offering well-appointed spas for spouses,” says Brent Hughes, Vice President of Operations, C.W. Driver Companies.

Related content: Top 110 Hotel Architecture Firms for 2019

Related content: Top 70 Hotel Engineering Firms for 2019

Related content: Top 85 Hotel Construction Firms for 2019

Fitness and wellness are strong themes in many new developments. The recently opened Equinox Hotel at New York’s Hudson Yards boasts “the world’s most advanced fitness experiences, 24 hours a day.” Equinox owns hundreds of upscale gyms nationwide, but Hudson Yards is its first in the hospitality realm—and, at 60,000 sf, its largest.

Some properties are offering medical treatment, even surgical facilities, on site, says Ben Martin, HKS’s Principal and Director of Consulting. Hair transplants, Botox, liposuction, and nips and tucks can be had in private resort settings offering luxurious recovery rooms.

Hospitality sector turns to destination tourism

A new resort will offer guests an agritourism experience. The project, being developed by a well-known brand, addresses two strong industry trends: wellness and regional authenticity, says Melissa Voelker, AIA, NCARB, LEED AP, HKS’s Senior Vice President, Hospitality Group. Located in a pastoral setting about two hours from Philadelphia, the resort will offer rest, relaxation, spa pampering, and excursions to local farms to harvest fruits and vegetables.\

Participants will then trek to a resort restaurant for a lesson from the chef in preparing the harvest for that night’s dinner. “Tourism is changing,” Voelcker says. “Travelers are looking for destinations where they can touch the community and the lifestyle.”

Tourists are also demanding venues in far-flung outposts, even in the Arctic Circle and Antarctica. “Cold is the new hot,” says Martin. Norway’s Svart Hotel is billed as “the world’s first energy-positive hotel concept by the Arctic Circle.” Set to open in 2021, the generously fenestrated donut-shaped structure will offer panoramic views of a glacier, arctic landscape, and the Northern Lights. At the other end of the earth, the White Desert Resort in Antarctica serves those who want “a carbon-neutral experience that is as luxurious as it is adventurous.” Travelers can check out the local Emperor penguins.

At a more mundane level, hotels are delivering a home away from home experience with large-screen TVs and digital entertainment options, says Hughes. Guests want to binge watch their favorite Netflix shows and view YouTube clips on the road, just like at home. “Wi-Fi is incredibly important,” Hughes says. “Bad Wi-Fi will definitely get mentioned on Yelp.”

Technology is also having a big impact behind the scenes, particularly on project programming and preliminary design. Leo A Daly designers use tools powered by artificial intelligence to compare thousands of possible building forms and parameters—site topography, zoning requirements, the structure’s footprint, orientation, guest room sizes, and corridor widths. AI tools can crunch hundreds of thousands of factors, taking into account the clients’ financial models and looking at the ramifications of different design parameters, and produce a dozen basic building models. From there, designers can evaluate the options for presentation to the clients.

The technology reduces the time needed to develop the basic outline of a design, leaving more time to explore the finer aspects, says Ryan D. Martin, AIA, NCARB, Vice President, Director of Hospitality Architecture, Leo A Daly. AI-driven tools are good at repetitious, rule-of-thumb processes. “We’re trying to let AI do that, so we can spend more time on the fun stuff,” he says.

AI-aided models can incorporate empirical business data, such as projected revenue per room, to guide designers’ decisions on the guest experience, functional flow, and spatial adjacencies within the financial context of the project. “AI lends credibility to the decisions we make,” says Martin.

AI tools are not right for every project, says Martin. “Some are too small; some do not have enough variation in them. But they are increasingly a part of our process.”

HOTEL SECTOR TAKING IN MODULAR

Hospitality project innovation is extending to construction techniques. Marriott International said in April that it will build the world’s tallest modular hotel in New York City. The $65 million, 360-foot-tall AC Hotel New York NoMad is scheduled for final on-site assembly in late fall, with a late 2020 planned opening. The property’s 168 prefabricated fully furnished guest rooms will be stacked on top of a traditionally built podium.

Since 2017, Marriott’s development partners in North America have opened 31 low-rise structures that incorporate prefabricated guestrooms or bathrooms. The hospitality giants’ goals for modular include reducing construction costs for its franchisees, speeding up scheduling, and coping with the U.S. construction labor shortage.

Innovation in programming, design, and construction is making the hospitality segment a highly engaging market for AEC firms.

MORE FROM BD+C'S 2019 GIANTS 300 REPORT

Related Stories

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 9, 2023

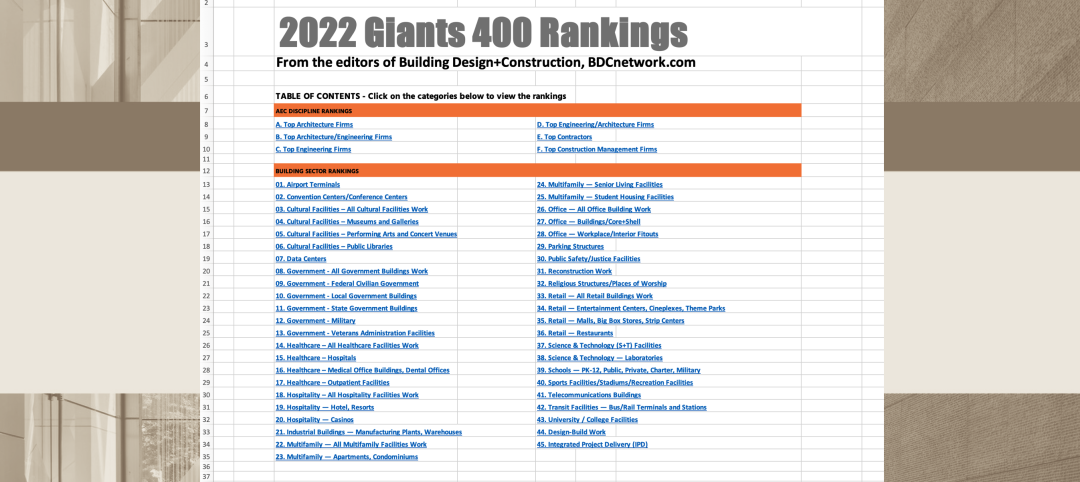

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Feb 6, 2023

2022 Reconstruction Sector Giants: Top architecture, engineering, and construction firms in the U.S. building reconstruction and renovation sector

Gensler, Stantec, IPS, Alfa Tech, STO Building Group, and Turner Construction top BD+C's rankings of the nation's largest reconstruction sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Transit Facility Giants: Top architecture, engineering, and construction firms in the U.S. transit facility sector

Walsh Group, Skanska USA, HDR, Perkins and Will, and AECOM top BD+C's rankings of the nation's largest transit facility sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Telecommunications Facility Sector Giants: Top architecture, engineering, and construction firms in the U.S. telecommunications facility sector

AECOM, Alfa Tech, Kraus-Anderson, and Stantec head BD+C's rankings of the nation's largest telecommunications facility sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Religious Sector Giants: Top architecture, engineering, and construction firms in the U.S. religious facility construction sector

HOK, Parkhill, KPFF, Shawmut Design and Construction, and Wiss, Janney, Elstner head BD+C's rankings of the nation's largest religious facility sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Justice Facility Sector Giants: Top architecture, engineering, and construction firms in the U.S. justice facility/public safety sector

Stantec, DLR Group, Turner Construction, STO Building Group, AECOM, and Dewberry top BD+C's rankings of the nation's largest architecture, engineering, and construction firms for justice facility/public safety buildings work, including correctional facilities, fire stations, jails, police stations, and prisons, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Parking Structure Giants: Top architecture, engineering, and construction firms in the U.S. parking structure sector

Choate Parking Consultants, Walker Consultants, Kimley-Horn, PCL, and Balfour Beatty top BD+C's rankings of the nation's largest parking structure sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.