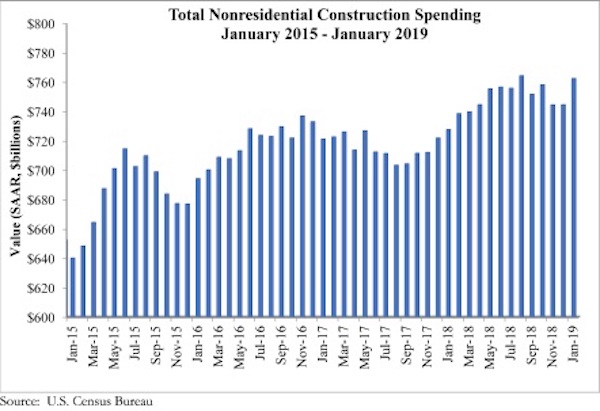

National nonresidential construction spending rose 2.4% in January, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data released today. At a seasonally adjusted annualized rate, nonresidential spending totaled $762.5 billion for the month, an increase of 4.8% over the previous year. Public nonresidential construction spending expanded 4.9% in January and private spending increased 0.8%. Both public and private nonresidential spending are up 8.5% and 2.4%, respectively, on a yearly basis.

“An uptick in investment in certain infrastructure categories has been at the center of the ongoing nonresidential construction spending cycle,” said ABC Chief Economist Anirban Basu. “During the past year, construction spending has increased at rapid rates in conservation and development, highway and street, and transportation. While there has been much discussion about expanding infrastructure investment at the federal level, most of that investment has taken place at a state and local level, especially as government finances have improved in much of the nation, therefore supplying more support for infrastructure outlays. Significant job growth also has helped bolster income tax collections while rising real estate values have triggered improved property tax collections.

“Meanwhile, still reasonably strong consumer spending has helped support growing construction in segments like lodging,” said Basu. “Construction of data and fulfillment centers also has created demand for nonresidential construction services. The recent moderation in construction materials price increases has helped support construction starts because more developers and their financiers are concluding that new projects make business sense.

“While there has been some reduction in business and consumer confidence, the nonresidential construction spending cycle remains firmly in place for now,” said Basu. “Despite the recent dip in ABC’s Construction Backlog Indicator, backlogs remain sufficient to support solid nonresidential spending activity through the balance of 2019. And while many economists remain concerned about economic prospects in 2020 and beyond, nonresidential construction’s outlook remains benign at least into 2021.”

Related Stories

Market Data | Sep 3, 2020

6 must reads for the AEC industry today: September 3, 2020

New affordable housing comes to the Bronx and California releases guide for state water policy.

Market Data | Sep 2, 2020

Coronavirus has caused significant construction project delays and cancellations

Yet demand for skilled labor is high, new survey finds.

Market Data | Sep 2, 2020

5 must reads for the AEC industry today: September 2, 2020

Precast concrete tower honors United AIrlines Flight 93 victims and public and private nonresidential construction spending slumps.

Market Data | Sep 2, 2020

Public and private nonresidential construction spending slumps in July

Industry employment declines from July 2019 in two-thirds of metros.

Market Data | Aug 31, 2020

5 must reads for the AEC industry today: August 31, 2020

The world's first LEED Platinum integrated campus and reopening campus performance arts centers.

Market Data | Aug 21, 2020

5 must reads for the AEC industry today: August 21, 2020

Student housing in the COVID-19 era and wariness of elevators may stymie office reopening.

Market Data | Aug 20, 2020

6 must reads for the AEC industry today: August 20, 2020

Japan takes on the public restroom and a look at the evolution of retail.

Market Data | Aug 19, 2020

6 must reads for the AEC industry today: August 19, 2020

July architectural billings remained stalled and Florida becomes third state to adopt concrete repair code.

Market Data | Aug 18, 2020

July architectural billings remained stalled

Clients showed reluctance to sign contracts for new design projects during July.

Market Data | Aug 18, 2020

Nonresidential construction industry won’t start growing again until next year’s third quarter

But labor and materials costs are already coming down, according to latest JLL report.