Transwestern’s first quarter national office report confirmed the general opinion that the U.S. office market remains strong, with overall vacancy holding steady at 9.8%. National average asking rents nudged higher during the quarter to $26.63 per square foot, reflecting a 4.1% annual growth rate that exceeded the five-year compound annual average (CAGR) of 3.4%.

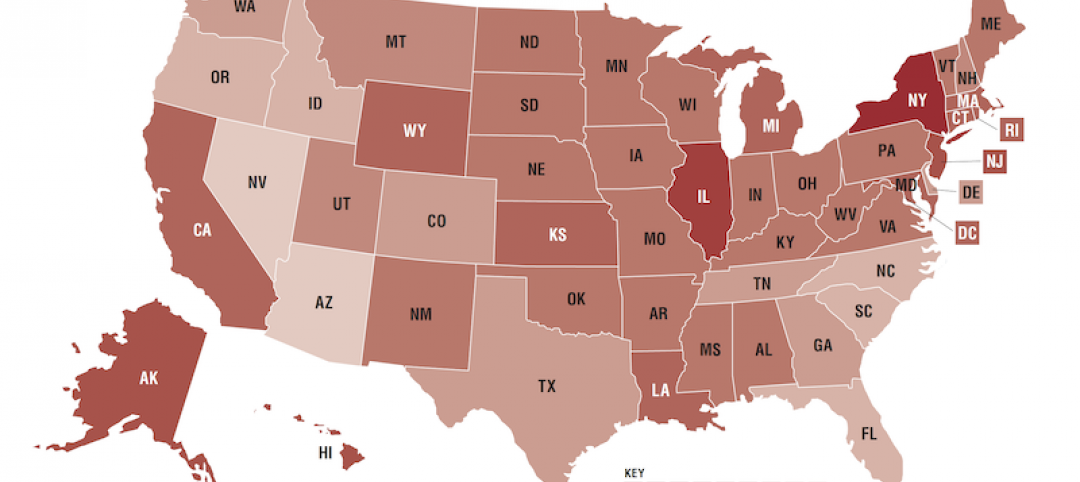

Of the 49 U.S. markets tracked by Transwestern, 45 reported positive rent growth, with 24 of those recording rates above 3.0%. The leaders in rent growth included Minneapolis; San Francisco; San Jose, California; Nashville, Tennessee; Raleigh/Durham, North Carolina; Tampa, Florida; Pittsburgh; California’s Inland Empire; Manhattan; and Charlotte, North Carolina.

“The U.S. economy grew 3.2% in the first quarter, the highest first-quarter growth in four years,” said Ryan Tharp, Research Director in Dallas. “That said, we are closely watching how factors such as U.S. trade conditions might impact the domestic economy in the remainder of 2019.”

Overall office leasing activity in the U.S. has slowed since 2016 but still ended the first quarter 1.5 million square feet higher than a year ago. Net absorption fell to 10.9 million square feet, with sublet space recording negative growth of 1.6 million square feet.

Construction activity jumped 9.7% during the past year, the highest level in the current cycle, but rising land and construction costs and labor challenges continue to limit new building deliveries and stave off systemic overbuilding that undermined some previous cycles.

“Solid fundamentals and adequate debt and equity capital bode well for continued, healthy performance in the office sector and cap rates remain at historic lows,” Tharp said. “We expect asking rents to settle at an annual rate of growth between 3.0% and 3.5% by the end of the year.”

Download the full National Office Market Report at: http://twurls.com/1q19-us-office

Related Stories

Market Data | Nov 22, 2019

Architecture Billings Index rebounds after two down months

The Architecture Billings Index (ABI) score in October is 52.0.

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.

Market Data | Oct 9, 2019

Two ULI reports foresee a solid real estate market through 2021

Market watchers, though, caution about a “surfeit” of investment creating a bubble.