With an average cost per square foot of $16.11, Stamford, Conn., is the most costly U.S. market for commercial real estate, according to a new study by the Building Owners and Managers Association International. New York and San Francisco are also among the nation's priciest markets.

Using the results from the BOMA 2013 Experience Exchange Report, the group compiled a list of the most and least expensive commercial real estate city-markets in the United States. The annual report aggregates rental income and operating expense figures from the previous year; in 2012, data was gathered from more than 5,300 buildings across 250 markets and 115 cities in the United States and Canada.

Five most expensive city-markets – total operating expenses:

1. Stamford, Conn. $16.11 per square foot (psf)

2. New York $11.80 psf

3. Grand Rapids, Mich. $11.16 psf

4. Newark, N.J. $10.34 psf

5. San Francisco $9.66 psf

Five least expensive city-markets – total operating expenses:

1. Stockton, Calif. $3.57 psf

2. Fresno, Calif. $3.61 psf

3. Huntsville, Ala. $4.31 psf

4. Virginia Beach, Va. $4.64 psf

5. Albuquerque, N.M. $4.80 psf

Total operating expenses incorporate all expenses incurred to operate office buildings, including utilities, repairs and maintenance, roads and grounds, cleaning, administration, and security. Fixed expenses include real estate taxes, property taxes and insurance.

There was a 3.9 percent overall decrease in total operating expenses from 2011 to 2012, underscoring an industry focus on maximizing building efficiency in the face of dwindling income streams. For example, New York, which topped the list of most expensive markets for operating expenses last year, saw a decrease of $0.66 per square foot.

Five most expensive city-markets – total rental income:

1. Washington, D.C. $44.30 psf

2. New York $39.00 psf

3. San Mateo, Calif. $34.96 psf

4. San Francisco $34.49 psf

5. Santa Monica, Calif. $34.04 psf

Five least expensive city-markets – total rental income:

1. Macon, Ga. $8.16 psf

2. Shreveport, La. $11.18 psf

3. Columbus, Ohio $12.09 psf

4. Huntsville, Ala. $12.81 psf

5. Little Rock, Ark. $12.81 psf

Total rental income includes rental income from office, retail and other space, such as storage areas.

While average rental income has dropped somewhat, decreasing 2.9 percent from 2011 to 2012, building owners and managers are compensating for these income losses with greater reductions in expenses.

The Experience Exchange Report is the premier income and expense data benchmarking tool for the commercial real estate industry. The EER allows users to conduct multi-year analysis of single markets and select multiple cities to generate state and regional reports. It also offers the capability to search by building size, height, age and more for broader analysis. Subscriptions are available at www.bomaeer.com.

About BOMA International

The Building Owners and Managers Association (BOMA) International is a federation of 93 BOMA U.S. associations, BOMA Canada and its 11 regional associations and 13 BOMA international affiliates. Founded in 1907, BOMA represents the owners and managers of all commercial property types, including nearly 10 billion square feet of U.S. office space that supports 3.7 million jobs and contributes $205 billion to the U.S. GDP. Its mission is to advance the interests of the entire commercial real estate industry through advocacy, education, research, standards and information. Find BOMA online at www.boma.org.

Related Stories

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Data Centers | Nov 13, 2023

Data center sector trends for 2023-2024

Demand for more data centers is soaring, but delivery can be stymied by supply delays, manpower shortages, and NIMBYism.

Education Facilities | Nov 9, 2023

Oakland schools’ central kitchen cooks up lessons along with 30,000 meals daily

CAW Architects recently completed a facility for the Oakland, Calif., school district that feeds students and teaches them how to grow, harvest, and cook produce grown onsite. The production kitchen at the Unified School District Central Kitchen, Instructional Farm, and Education Center, (“The Center”) prepares and distributes about 30,000 meals a day for district schools lacking their own kitchens.

Laboratories | Nov 8, 2023

Boston’s FORUM building to support cutting-edge life sciences research and development

Global real estate companies Lendlease and Ivanhoé Cambridge recently announced the topping-out of FORUM, a nine-story, 350,000-sf life science building in Boston. Located in Boston Landing, a 15-acre mixed-use community, the $545 million project will achieve operational net zero carbon upon completion in 2024.

Retail Centers | Nov 7, 2023

Omnichannel experiences, mixed-use development among top retail design trends for 2023-2024

Retailer survival continues to hinge on retail design trends like blending online and in-person shopping and mixing retail with other building types, such as offices and residential.

Healthcare Facilities | Nov 3, 2023

The University of Chicago Medicine is building its city’s first freestanding cancer center with inpatient and outpatient services

The University of Chicago Medicine (UChicago Medicine) is building Chicago’s first freestanding cancer center with inpatient and outpatient services. Aiming to bridge longstanding health disparities on Chicago’s South Side, the $815 million project will consolidate care and about 200 team members currently spread across at least five buildings. The new facility, which broke ground in September, is expected to open to patients in spring 2027.

Office Buildings | Nov 2, 2023

Amazon’s second headquarters completes its first buildings: a pair of 22-story towers

Amazon has completed construction of the first two buildings of its second headquarters, located in Arlington, Va. The all-electric structures, featuring low carbon concrete and mass timber, help further the company’s commitment to achieving net zero carbon emissions by 2040 and 100% renewable energy consumption by 2030. Designed by ZGF Architects, the two 22-story buildings are on track to become the largest LEED v4 Platinum buildings in the U.S.

Sustainability | Nov 1, 2023

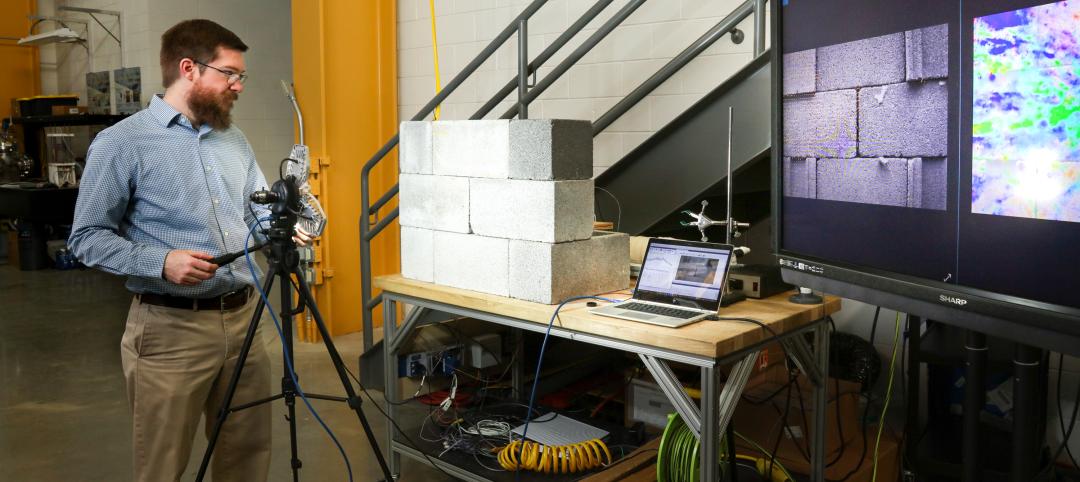

Researchers create building air leakage detection system using a camera in real time

Researchers at the U.S. Department of Energy’s Oak Ridge National Laboratory have developed a system that uses a camera to detect air leakage from buildings in real time.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.