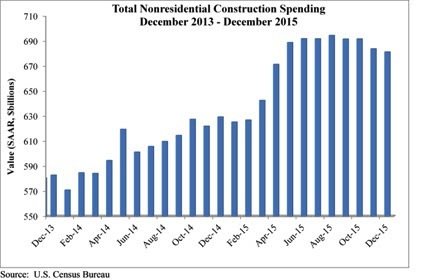

Nonresidential construction spending crested the $700 billion mark on a seasonally adjusted annualized basis in January for the first time since March 2009, according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors (ABC).

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. The Census Bureau upwardly revised December's estimate from $681.2 billion to $684.5 billion, though they downgraded November's figure from $683.7 to $680.5 million. Private nonresidential construction spending increased by 1% for the month, while its public counterpart expanded by 4.6%.

"After several months of relatively weak nonresidential construction spending data, today's data release was most welcome," ABC Chief Economist Anirban Basu said. "While January is a difficult month to interpret and one that should not be overly emphasized, the fact of the matter is that the year-over-year performance in spending is consistent with a host of industry indicators. For many months, the average contractor has been reporting decent backlog. Measures of industry confidence have remained stable even in the face of adverse news coming from various parts of the world.

"While the nonresidential construction spending recovery appears to remain in place, the industry's overall outlook remains murky," Basu said. "The global economy remains weak, and domestic corporate profitability has been slipping. The U.S. economic recovery continues to be under-diversified, with consumers continuing to lead the way. If corporate profitability continues to struggle, given falling exports and a general lack of confidence among CEOs, the pace of employment growth will slow over the course of 2016. That will presumably affect consumer spending, which is already being hampered by rising health care costs. That, in turn, could jeopardize the ongoing economic recovery, now on its way to completing its seventh year."

Spending increased in January on a monthly basis in 10 of 16 nonresidential construction sectors:

- Spending in the highway and street category expanded 14.6% from December 2015 and is 33.9 higher than in January 2015.

- Sewage and waste disposal-related spending expanded 4% for the month and 1.4% from the same time last year.

- Spending in the amusement and recreation category climbed 0.7% on a monthly basis and 16.9% on a year-over-year basis.

- Conservation and development-related spending is 10% higher on a monthly basis and 1.6% higher on a yearly basis.

- Lodging-related spending is up 6.3% for the month and is up 34.8% on a year-ago basis.

- Spending in the religious category grew 4.2% for the month and 0.2% from January 2015.

- Manufacturing-related spending expanded 4.2% on a monthly basis and is up 11.3% on a yearly basis.

- Spending in the power category expanded 2.9% from December 2015 and is 8.1% higher than in January 2015.

- Water supply-related spending expanded 2% on a monthly basis but fell 7.9% on a yearly basis.

- Spending in the office category grew 0.2% from December 2015 and is up 19.6% from January 2015.

Spending in six of the nonresidential construction subsectors fell in January on a monthly basis:

- Commercial-related construction spending fell 4.3% for the month but grew 0.8% on a year-over-year basis.

- Educational-related construction spending fell 1.1% on a monthly basis, but expanded 12.1% on a yearly basis.

- Transportation-related spending fell 2.5% month-over-month, but expanded 0.6% year-over-year.

- Health care-related spending fell 0.1% month-over-month but is up 1.8% year-over-year.

- Public safety-related spending is down 1.5% for the month and 3.2% from the same time one year ago.

- Communication-related spending fell by 4.2% month-over-month but expanded 27.2% year-over-year.

Related Stories

Market Data | Sep 3, 2019

Nonresidential construction spending slips in July 2019, but still surpasses $776 billion

Construction spending declined 0.3% in July, totaling $776 billion on a seasonally adjusted annualized basis.

Industry Research | Aug 29, 2019

Construction firms expect labor shortages to worsen over the next year

A new AGC-Autodesk survey finds more companies turning to technology to support their jobsites.

Market Data | Aug 21, 2019

Architecture Billings Index continues its streak of soft readings

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Aug 19, 2019

Multifamily market sustains positive cycle

Year-over-year growth tops 3% for 13th month. Will the economy stifle momentum?

Market Data | Aug 16, 2019

Students say unclean restrooms impact their perception of the school

The findings are part of Bradley Corporation’s Healthy Hand Washing Survey.

Market Data | Aug 12, 2019

Mid-year economic outlook for nonresidential construction: Expansion continues, but vulnerabilities pile up

Emerging weakness in business investment has been hinting at softening outlays.

Market Data | Aug 7, 2019

National office vacancy holds steady at 9.7% in slowing but disciplined market

Average asking rental rate posts 4.2% annual growth.

Market Data | Aug 1, 2019

Nonresidential construction spending slows in June, remains elevated

Among the 16 nonresidential construction spending categories tracked by the Census Bureau, seven experienced increases in monthly spending.

Market Data | Jul 31, 2019

For the second quarter of 2019, the U.S. hotel construction pipeline continued its year-over-year growth spurt

The growth spurt continued even as business investment declined for the first time since 2016.

Market Data | Jul 23, 2019

Despite signals of impending declines, continued growth in nonresidential construction is expected through 2020

AIA’s latest Consensus Construction Forecast predicts growth.