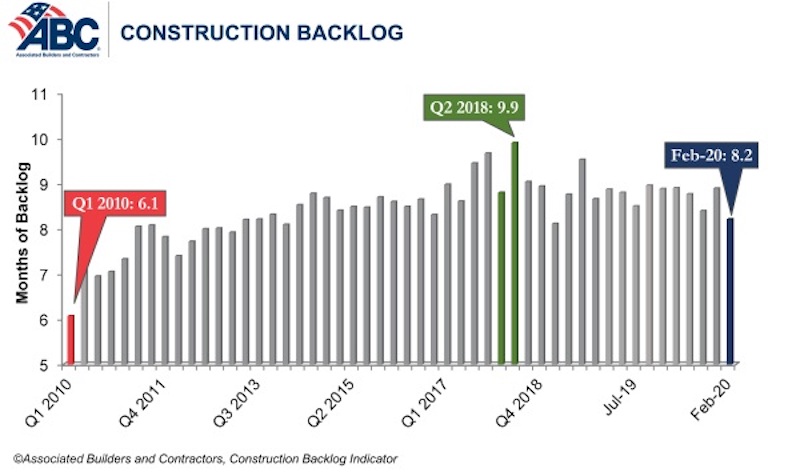

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 8.2 months in February, a 7.7% decrease from January’s reading. Backlog for firms working in the infrastructure segment rose by 1.3 months in February while backlog for commercial and institutional and heavy industrial firms declined by 0.6 months and 0.7 months, respectively.

“The impact of the pandemic on backlog was immediate,” said ABC Chief Economist Anirban Basu. “While financial markets, the National Basketball Association and other elements of American society didn’t respond meaningfully to the emerging crisis until early-March, those who consume construction services appear to have begun responding to the crisis in February, resulting in a significant decline in backlog in commercial and industrial segments. Declining backlog was registered in every region of the country with the exception of the Middle States, where social distancing directives were implemented at a slower rate.

“Backlog is likely to decline further,” said Basu. “Many economic actors are striving to preserve as much liquidity as possible, inducing them into postponing construction projects or perhaps canceling them altogether. While infrastructure-related backlog expanded in February, this is unlikely to persist, as the crisis has crushed the finances of many state and local governments. These governments will complete their current fiscal year with substantial shortfalls—shortfalls that must be addressed during the next fiscal year absent significant additional financial assistance from the federal government.”

Related Stories

Market Data | Mar 24, 2021

Architecture billings climb into positive territory after a year of monthly declines

AIA’s ABI score for February was 53.3 compared to 44.9 in January.

Market Data | Mar 22, 2021

Construction employment slips in 225 metros from January 2020 to January 2021

Rampant cancellations augur further declines ahead.

Market Data | Mar 18, 2021

Commercial Construction Contractors’ Outlook lifts on rising revenue expectations

Concerns about finding skilled workers, material costs, and steel tariffs linger.

Market Data | Mar 16, 2021

Construction employment in January lags pre-pandemic mark in 42 states

Canceled projects, supply-chain woes threaten future jobs.

Market Data | Mar 15, 2021

Rising materials prices and supply chain disruptions are hurting many construction firms

The same firms are already struggling to cope with pandemic impacts.

Market Data | Mar 11, 2021

Soaring materials costs, supply-chain problems, and project cancellations continue to impact construction industry

Costs and delayed deliveries of materials, parts, and supplies are vexing many contractors.

Market Data | Mar 8, 2021

Construction employment declines by 61,000 in February

Association officials urge congress and Biden administration to focus on new infrastructure funding.

Market Data | Mar 2, 2021

Construction spending rises in January as private nonresidential sector stages rare gain

Private nonresidential market shrinks 10% since January 2020 with declines in all 11 segments.

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.

Market Data | Feb 23, 2021

Architectural billings continue to contract in 2021

AIA’s Architecture Billings Index (ABI) score for January was 44.9 compared to 42.3 in December.