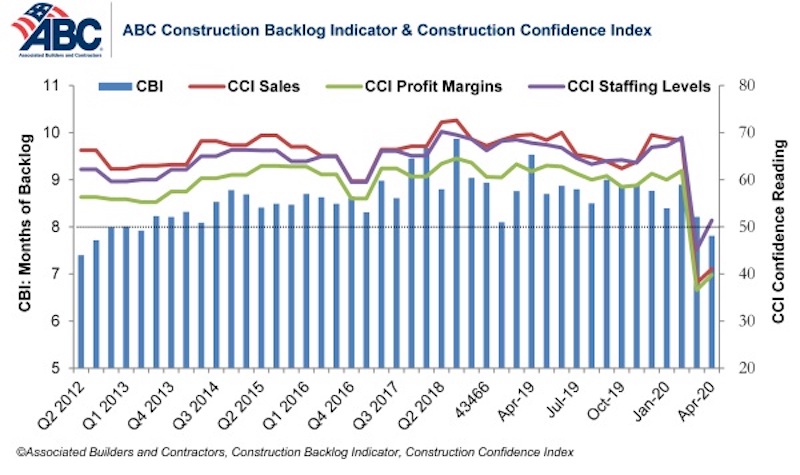

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 7.8 months in April, the series’ lowest reading since the third quarter of 2012. Based on an ABC member survey conducted April 20-May 4, the results indicate that confidence among U.S. construction industry leaders inched higher last month compared to the historically low levels observed in the March survey.

Nonresidential construction backlog is down 0.4 months compared to the March 2020 ABC survey and 1.7 months from April 2019. Backlog has declined year-over-year in every industry classification, region and company size. Backlog in the infrastructure category has been stable, however, and reached its highest level since December 2019.

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels expectations all increased from the historically low levels reported in the March 2020 survey, although sales and profit margin expectations remain below the threshold of 50, indicating ongoing expectations of contraction. The staffing level index rose to 51.4 in April, however, indicating positive hiring expectations over the next six months.

More than 55% of contractors expect their sales to decline over the next six months compared to just 34% who expect them to increase. Only 27% of contractors expect to increase their profit margins over the next two quarters. More than half expect to experience diminished margins.

- The CCI for sales expectations increased from 38.1 to 41.1 in April.

- The CCI for profit margin expectations increased from 36.6 to 39.8.

- The CCI for staffing levels increased from 45.2 to 51.4.

“Backlog has not been quite the protective shield that it normally is during the early stages of an economic downturn,” said ABC Chief Economist Anirban Basu. “These survey data indicate that only 30% of nonresidential contractors have enjoyed uninterrupted work flows recently. Roughly two in five contractors indicate that their work has been interrupted by government mandate. Other sources of interruption to construction projects include labor force issues as well as a lack of personal protective equipment and/or key construction inputs.

“Given the large quantity of businesses that will likely not survive the public health and economic crisis, demand for construction services could be suppressed for quite some time,” said Basu. “Vacant storefronts, empty office suites and shattered state and local government finances do not serve as a solid foundation for robust demand for construction services. For construction activity to rebound briskly, the federal government is going to have to step forward and provide substantial assistance to state and local governments, including to finance infrastructure improvements.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12 to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.

Related Stories

Market Data | Apr 21, 2020

ABC's Construction Backlog Indicator down in February

Backlog for firms working in the infrastructure segment rose by 1.3 months in February while backlog for commercial and institutional and heavy industrial firms declined by 0.6 months and 0.7 months, respectively.

Market Data | Apr 21, 2020

5 must reads for the AEC industry today: April 21, 2020

IoT system helps contractors keep their distance and the multifamily market flattens.

Market Data | Apr 20, 2020

6 must reads for the AEC industry today: April 20, 2020

The continent's tallest living wall and NMHC survey shows significant delays in apartment construction.

Market Data | Apr 17, 2020

Construction employment declines in 20 states and D.C. in March, in line with industry survey showing growing job losses for the sector

New monthly job loss data foreshadows more layoffs amid project cancellations and state cutbacks in road projects as association calls for more small business relief and immediate aid for highway funding.

Market Data | Apr 17, 2020

5 must reads for the AEC industry today: April 17, 2020

Meet the 'AEC outsiders' pushing the industry forward and the world's largest Living Building.

Market Data | Apr 16, 2020

5 must reads for the AEC industry today: April 16, 2020

The SMPS Foundation and Building Design+Construction are studying the impact of the coronavirus pandemic on the ability to attain and retain clients and conduct projects and Saks Fifth Avenue plans a sanitized post-coronavirus opening.

Market Data | Apr 15, 2020

5 must reads for the AEC industry today: April 15, 2020

Buildings as "open source platforms" and 3D printing finds its grove producing face shields.

Market Data | Apr 14, 2020

6 must reads for the AEC industry today: April 14, 2020

A robot dog conducts site inspections and going to the library with little kids just got easier.

Market Data | Apr 13, 2020

6 must reads for the AEC industry today: April 13, 2020

How prefab can enable the AEC industry to quickly create new hospital beds and Abu Dhabi launches a design competition focused on reducing urban heat island effect.

Market Data | Apr 10, 2020

5 must reads for the AEC industry today: April 10, 2020

Designing for the next generation of student life and a mass timber Ramada Hotel rises in British Columbia.