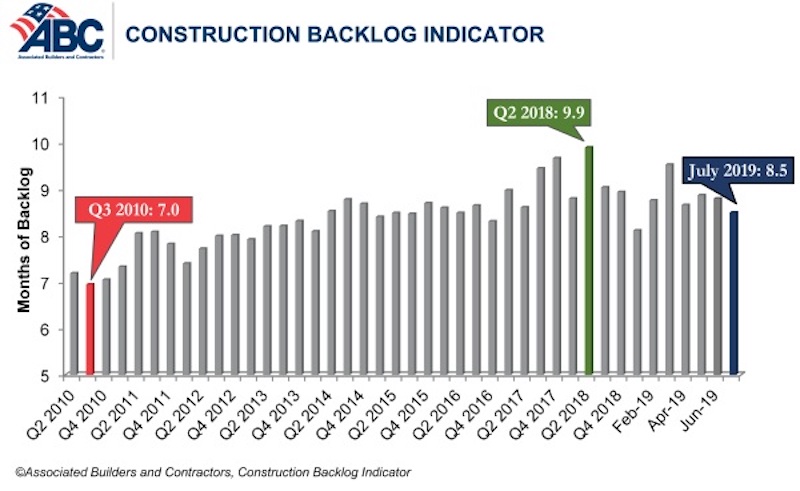

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 8.5 months in July 2019, down 0.3 months or 2.9% from June 2019, when CBI stood at 8.8 months.

“Construction backlog declined in all four major regions in July,” said ABC Chief Economist Anirban Basu. “While the Northeast and South—the regions with the lengthiest backlog—experienced minor dips, the West and the Middle States exhibited more significant declines. Despite the 9.3% monthly decline in the West region, backlog remains above levels observed in early 2019. For the Middle States, however, backlog is at its lowest level since the last quarter of 2015, largely due to a dip in activity in the commercial/institutional segment, the largest segment represented in ABC’s survey.

“Among the three industry subsegments measured by CBI, only the commercial/institutional category experienced a backlog decrease in July 2019,” said Basu. “Backlog in the heavy industrial category increased by 2.3 months and now stands at its highest level in the history of the CBI series. This is largely attributable to the energy sector, with particular strength apparent in the South. Regions tied to traditional manufacturing activities did not fare as well in July.

“Only companies with revenues lower than $30 million per year experienced shorter backlog in July,” said Basu. “This may be cause for concern since smaller firms tend to be more vulnerable to economic fluctuations. Much of the decline in backlog among this group occurred among those specializing in commercial construction.

“Despite the recent, albeit brief, losing streak, backlog levels remain consistent with healthy construction activity over the near-term,” said Basu. “Contractors collectively expect rising sales to continue and are planning to add to staffing levels, though their exuberance has been somewhat tempered in recent months. If the U.S. economy continues to soften, including in the nation’s manufacturing industry, contractor confidence levels will likely continue to subside along with backlog. Yet, for now, the nation’s nonresidential construction segment remains busy.”

Related Stories

Market Data | May 1, 2020

6 must reads for the AEC industry today: May 1, 2020

DLR Group completes LA Memorial Coliseum renovation and over 50% of department stores in malls predicted to close by 2021.

Market Data | Apr 30, 2020

5 must reads for the AEC industry today: April 30, 2020

College programs help prepare students for careers in the construction industry and a national movement to cancel May rent takes shape.

Market Data | Apr 30, 2020

The U.S. Hotel Construction pipeline continued to expand year-over-year despite COVID-19 in the first quarter of 2020

Many open or temporarily closed hotels have already begun or are in the planning stages of renovating and repositioning their assets while occupancy is low or non-existent.

Market Data | Apr 29, 2020

5 must reads for the AEC industry today: April 29, 2020

A new Human performance Center and Construction employment declines in 99 metro areas.

Market Data | Apr 29, 2020

Construction employment declines in 99 metro areas in March from 2019

Industry officials call for new state and federal funding to add jobs.

Market Data | Apr 28, 2020

5 must reads for the AEC industry today: April 28, 2020

A virtual 'city-forest' to help solve population density challenges and planning for life in cities after the pandemic.

Market Data | Apr 27, 2020

5 must reads for the AEC industry today: April 27, 2020

Colleges begin building campus eSports arenas and PCL Construction rolls out portable coronavirus testing centers.

Market Data | Apr 24, 2020

6 must reads for the AEC industry today: April 24, 2020

Take a virtual tour of Frank Lloyd Wright's Robie House and Construction Contractor Confidence plummets.

Market Data | Apr 23, 2020

Construction Contractor Confidence plummets in February

As of February 2020, fewer than 30% of contractors expected their sales to increase over the next six months.

Market Data | Apr 23, 2020

5 must reads for the AEC industry today: April 23, 2020

The death of the department store and how to return to work when the time comes.