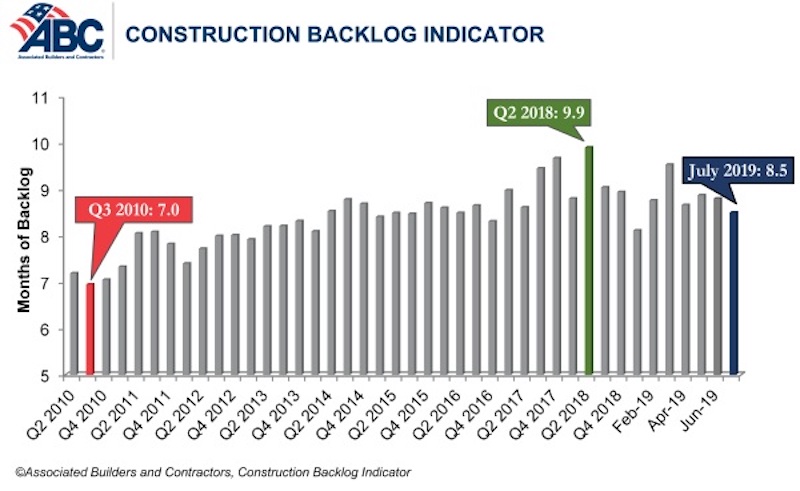

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 8.5 months in July 2019, down 0.3 months or 2.9% from June 2019, when CBI stood at 8.8 months.

“Construction backlog declined in all four major regions in July,” said ABC Chief Economist Anirban Basu. “While the Northeast and South—the regions with the lengthiest backlog—experienced minor dips, the West and the Middle States exhibited more significant declines. Despite the 9.3% monthly decline in the West region, backlog remains above levels observed in early 2019. For the Middle States, however, backlog is at its lowest level since the last quarter of 2015, largely due to a dip in activity in the commercial/institutional segment, the largest segment represented in ABC’s survey.

“Among the three industry subsegments measured by CBI, only the commercial/institutional category experienced a backlog decrease in July 2019,” said Basu. “Backlog in the heavy industrial category increased by 2.3 months and now stands at its highest level in the history of the CBI series. This is largely attributable to the energy sector, with particular strength apparent in the South. Regions tied to traditional manufacturing activities did not fare as well in July.

“Only companies with revenues lower than $30 million per year experienced shorter backlog in July,” said Basu. “This may be cause for concern since smaller firms tend to be more vulnerable to economic fluctuations. Much of the decline in backlog among this group occurred among those specializing in commercial construction.

“Despite the recent, albeit brief, losing streak, backlog levels remain consistent with healthy construction activity over the near-term,” said Basu. “Contractors collectively expect rising sales to continue and are planning to add to staffing levels, though their exuberance has been somewhat tempered in recent months. If the U.S. economy continues to soften, including in the nation’s manufacturing industry, contractor confidence levels will likely continue to subside along with backlog. Yet, for now, the nation’s nonresidential construction segment remains busy.”

Related Stories

Market Data | Mar 23, 2020

Coronavirus will reshape UAE construction

The impact of the virus has been felt in the UAE, where precautionary measures have been implemented to combat the spread of the virus through social distancing.

Coronavirus | Mar 20, 2020

Pandemic has halted or delayed projects for 28% of contractors

Coronavirus-caused slowdown contrasts with January figures showing a majority of metro areas added construction jobs; Officials note New infrastructure funding and paid family leave fixes are needed.

Market Data | Mar 17, 2020

Construction spending to grow modestly in 2020, predicts JLL’s annual outlook

But the coronavirus has made economic forecasting perilous.

Market Data | Mar 16, 2020

Grumman/Butkus Associates publishes 2019 edition of Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Mar 12, 2020

New study from FMI and Autodesk finds construction organizations with the highest levels of trust perform twice as well on crucial business metrics

Higher levels of trust within organizations and across project teams correlate with increased profit margins, employee retention and repeat business that can all add up to millions of dollars of profitability annually.

Market Data | Mar 11, 2020

The global hotel construction pipeline hits record high at 2019 year-end

Projects currently under construction stand at a record 991 projects with 224,354 rooms.

Market Data | Mar 6, 2020

Construction employment increases by 43,000 in February and 223,000 over 12 months

Average hourly earnings in construction top private sector average by 9.9% as construction firms continue to boost pay and benefits in effort to attract and retain qualified hourly craft workers.

Market Data | Mar 4, 2020

Nonresidential construction spending attains all-time high in January

Private nonresidential spending rose 0.8% on a monthly basis and is up 0.5% compared to the same time last year.

Market Data | Feb 21, 2020

Construction contractor confidence remains steady

70% of contractors expect their sales to increase over the first half of 2020.

Market Data | Feb 20, 2020

U.S. multifamily market gains despite seasonal lull

The economy’s steady growth buoys prospects for continued strong performance.