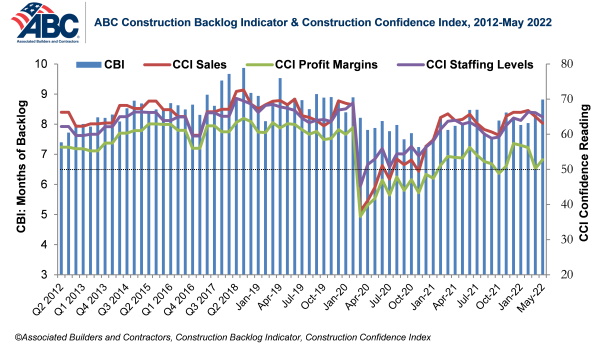

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to nine months in May from 8.8 months in April, according to an ABC member survey conducted May 17 to June 3. The reading is up one month from May 2021.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for May 2022.

Backlog in the infrastructure segment jumped from 8.7 months in April to 9.3 months in May, and the Northeast and South regions continue to outperform the Middle States and the West. Contractors with more than $100 million in annual revenues enjoyed the highest backlog, at 13.2 months.

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels declined in May. The indices for sales and staffing remain above the threshold of 50, indicating expectations of growth over the next six months, while the reading for profit margins was exactly 50 for the month.

“It is simply remarkable that contractors continue to add to backlog amidst global strife, rising materials prices and ubiquitous labor force challenges,” said ABC Chief Economist Anirban Basu. “Backlog is up in every segment over the past year, including in the somewhat shaky commercial category. The largest increase in backlog has been registered in the industrial segment. More American companies are committing to place additional supply chain capacity in the United States, with Intel and Ford representing particularly recent and noteworthy examples.

“For contractors, the challenge will continue to be the cost of delivering construction services,” said Basu. “The risk of severe increases in costs and substantial delays in delivery remains elevated given the volatility in input prices, the propensity of the labor force to shift jobs in large numbers and equipment shortages and delays. This ABC survey indicates that the proportion of contractors who expect that profit margins will expand over the next six months is declining, a reflection of lingering, worsening supply chain challenges.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12, 2020, to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.

Related Stories

Market Data | Oct 2, 2019

Spending on nonresidential construction takes a step back in August

Office, healthcare, and public safety are among the fastest-growing sectors, according to the U.S. Census Bureau's latest report.

Market Data | Sep 27, 2019

The global hotel construction pipeline ascends to new record highs

With the exception of Latin America, all regions of the globe either continued to set record high pipeline counts or have already settled into topping-out formations amidst concerns of a worldwide economic slowdown.

Market Data | Sep 25, 2019

Senate introduces The School Safety Clearinghouse Act

Legislation would create a federally funded and housed informational resource on safer school designs.

Market Data | Sep 18, 2019

Substantial decline in Architecture Billings

August report suggests greatest weakness in design activity in several years.

Market Data | Sep 17, 2019

ABC’s Construction Backlog Indicator inches lower in July

Backlog in the heavy industrial category increased by 2.3 months and now stands at its highest level in the history of the CBI series.

Market Data | Sep 13, 2019

Spending on megaprojects, already on the rise, could spike hard in the coming years

A new FMI report anticipates that megaprojects will account for one-fifth of annual construction spending within the next decade.

Architects | Sep 11, 2019

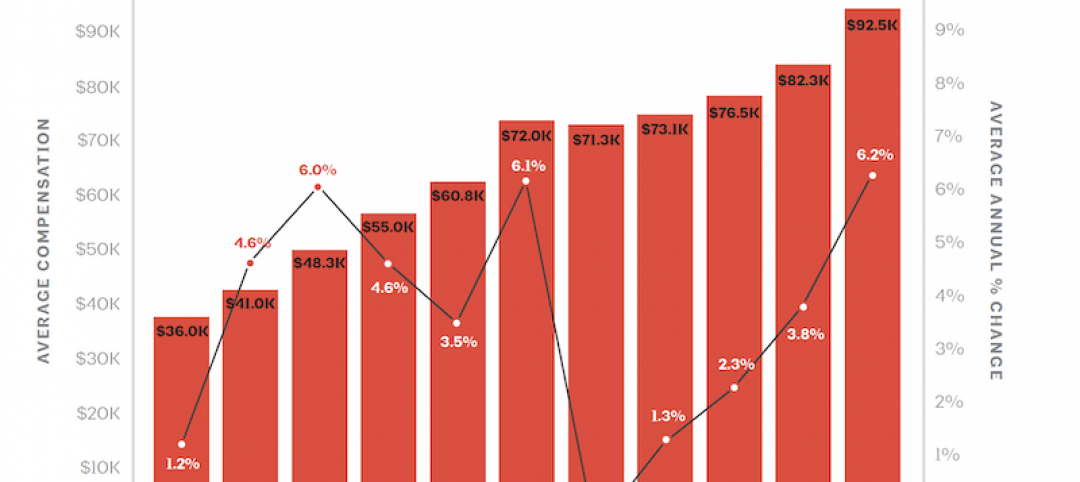

Buoyed by construction activity, architect compensation continues to see healthy gains

The latest AIA report breaks down its survey data by 44 positions and 28 metros.

Market Data | Sep 11, 2019

New 2030 Commitment report findings emphasize need for climate action

Profession must double down on efforts to meet 2030 targets.

Market Data | Sep 10, 2019

Apartment buildings and their residents contribute $3.4 trillion to the national economy

New data show how different aspects of the apartment industry positively impact national, state and local economies.

Market Data | Sep 3, 2019

Nonresidential construction spending slips in July 2019, but still surpasses $776 billion

Construction spending declined 0.3% in July, totaling $776 billion on a seasonally adjusted annualized basis.