U.S. architecture, engineering, and construction firms are being stymied by the shortage of experienced design and construction professionals and project managers, according to an exclusive Building Design+Construction survey of 133 C-suite executives and human resources directors at AEC firms.

“Finding good qualified people with experience in running projects is a challenge” is how one respondent summarized the AEC field’s shortage of so-called “seller-doers.”

Download a PDF of the survey findings (registration required)

Another industry executive worried about the AEC sector’s changing demographics, said: “There are not many young people entering the profession, and there is an extreme lack of talented people in the 10+ years’ level of experience,” said this respondent. “We have no problem hiring college graduates, but keeping them after five years is difficult, and then we start over with a new hire.”

KEY FINDINGS FROM THE SURVEY

- Four out of five respondents (81.7%) said they anticipate their firms will add at least 5% to their professional staffs over the next two years.

- “AEC professionals with 6–10 years’ experience” was cited by 24.2% of respondents as the staff category that is more than usually difficult to recruit or hire, followed by “AEC professionals with more than 10 years’ experience” (17.1%).

- Project managers were deemed the third most unusually difficult position to fill, at 16.3%.

- Bringing up the rear: “AEC professionals with 3–5 years’ experience,” at 13.3%.

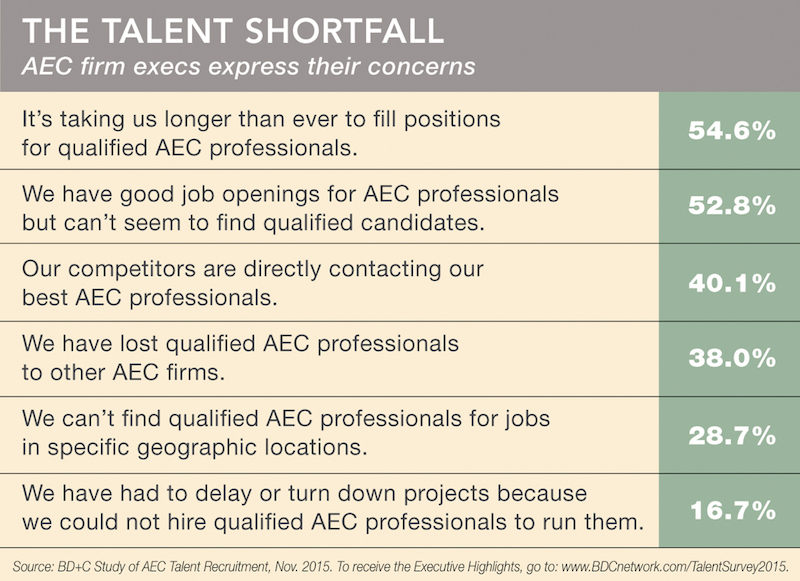

The majority of respondents said the hiring process for key professionals is taking longer than ever (54.6%). Less than one in five respondents (18.5%)

The majority of respondents said the hiring process for key professionals is taking longer than ever (54.6%). Less than one in five respondents (18.5%)

said their firms have not had serious problems hiring qualified professionals.

- “Specialty staff (IT, BIM/VDC, Revit, CAD, etc.)” were determined to be unusually difficult to recruit by 10.0% of respondents.

- Nearly six of 10 respondents (58.1%) said it has taken their firms four months or more to place their most difficult positions to fill.

- More than six in ten respondents (61.1%) said “flexible work hours” was offered as an incentive to attract qualified AEC professionals.

- Nearly seven in ten respondents (69.4%) stated that they used “word of mouth” (not specifically defined) as a recruiting tool. Nearly a quarter of respondents (23.2%) cited “word of mouth” as their firms’ most effective recruitment tool.

- The majority of respondents (54.6%) agreed with the statement, “It’s taking us longer than ever to fill positions for qualified AEC professionals.”

- More than four in five respondents (81.5%) reported one problem or other in their firms’ efforts to recruit and hire the right professionals.

Perhaps most startling of all was the finding that one in six respondents (16.7%) said their firms had delayed or turned down projects because they could not hire qualified AEC professionals to run them.

Respondents offered possible remedies for the talent shortfall. “Competition for talent is high,” said one respondent. “Focus by the entire team, including talent recruitment professionals, hiring managers, and company leadership, is key to success.”

“Firms need to realize that to attract and retain talent you cannot keep operating your company the same way they have been for the last few decades,” said another respondent. “You need to offer more vacation time, flexible hours, good insurance, a good salary. The firms that do this well do not seem to have issues with attraction and retention. Also, we have to be cognizant that these peak times will soon enough swing downward: they always do.”

Download a PDF of the survey findings (registration required).

Related Stories

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Market Data | Oct 23, 2023

New data finds that the majority of renters are cost-burdened

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic.

Giants 400 | Oct 23, 2023

Top 115 Multifamily Construction Firms for 2023

Clark Group, Suffolk Construction, Summit Contracting Group, Whiting-Turner Contracting, and McShane Companies top the ranking of the nation's largest multifamily housing sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 75 Multifamily Engineering Firms for 2023

Kimley-Horn, WSP, Tetra Tech, Olsson, and Langan head the ranking of the nation's largest multifamily housing sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 190 Multifamily Architecture Firms for 2023

Humphreys and Partners, Gensler, Solomon Cordwell Buenz, Niles Bolton Associates, and AO top the ranking of the nation's largest multifamily housing sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Senior Living Design | Oct 19, 2023

Senior living construction poised for steady recovery

Senior housing demand, as measured by the change in occupied units, continued to outpace new supply in the third quarter, according to NIC MAP Vision. It was the ninth consecutive quarter of growth with a net absorption gain. On the supply side, construction starts continued to be limited compared with pre-pandemic levels.

Warehouses | Oct 19, 2023

JLL report outlines 'tremendous potential' for multi-story warehouses

A new category of buildings, multi-story warehouses, is beginning to take hold in the U.S. and their potential is strong. A handful of such facilities, also called “urban logistics buildings” have been built over the past five years, notes a new report by JLL.

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.

Office Buildings | Oct 19, 2023

Proportion of workforce based at home drops to lowest level since pandemic began

The proportion of the U.S. workforce working remotely has dropped considerably since the start of the Covid 19 pandemic, but office vacancy rates continue to rise. Fewer than 26% of households have someone who worked remotely at least one day a week, down sharply from 39% in early 2021, according to the latest Census Bureau Household Pulse Surveys.

Contractors | Oct 19, 2023

Poor productivity cost U.S contractors as much as $40 billion last year

U.S. contractors lost between $30 billion and $40 billion in 2022 due to poor labor productivity, according to a new report from FMI Corp. The survey focused on self-performing contractors, those typically engaged as a trade partner to a general contractor.