The new Trump Administration’s aggressive policies, particularly on international trade and immigration reform, could, if executed as planned, “greatly affect” how America’s construction industry does business this year and beyond.

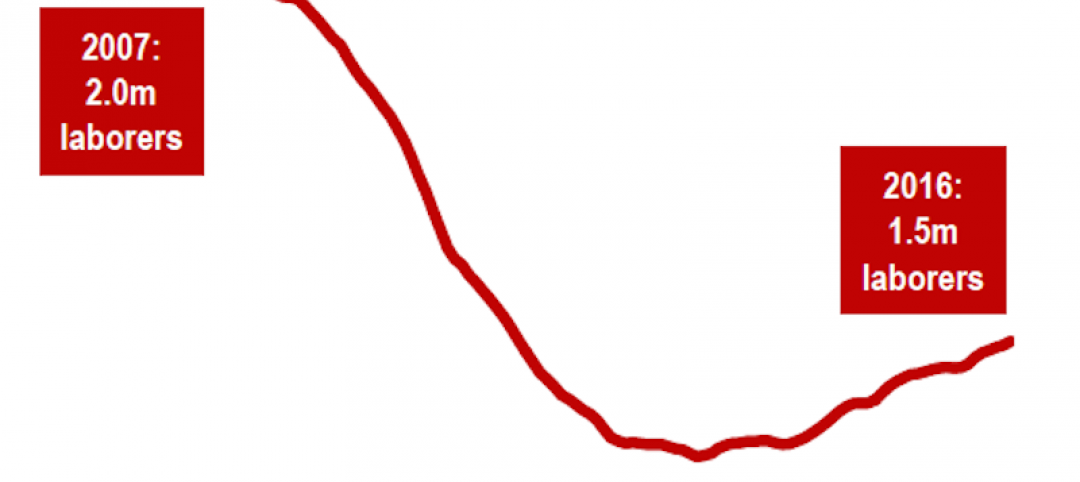

In its Q4 2016 Construction Outlook, which it released earlier this week, JLL also continued to see construction labor as a “pain point” for the industry that will cause wages to rise and impact project timelines and budgets. And materials costs, which for the most part stabilized in the latter months of 2016, should hold steady if, as expected, construction activity slows this year.

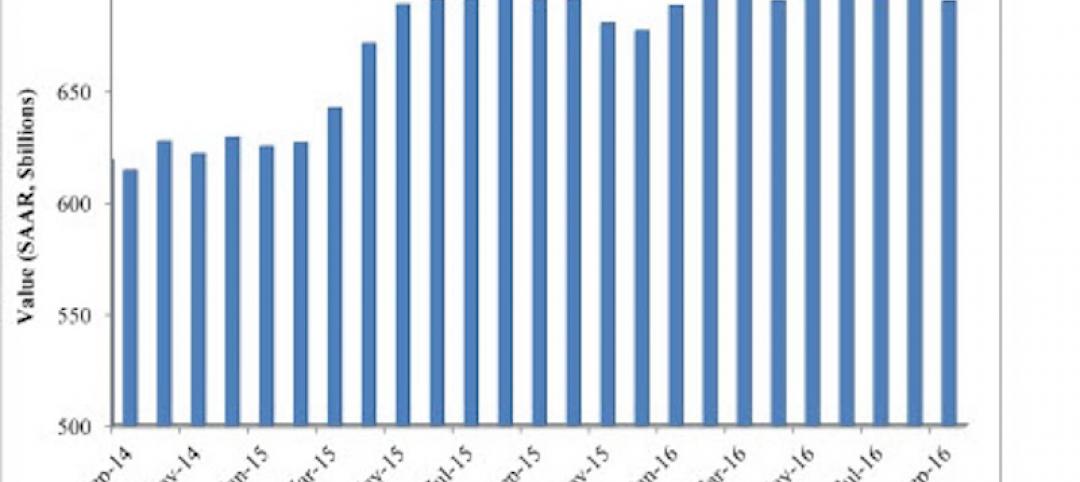

Twenty-sixteen was a banner year for construction spending. Led by the hotel and office sectors, spending increased over the previous year by 4.5% to $1.2 trillion. That rate of growth was nearly triple the GDP inflation rate.

Nationally, the construction and contractor backlog in Q4 2016 stood at 8.7 months of future work across all sectors, up 2.2 percent from the fourth quarter 2015 and tracking closely with national trends. The Midwest in particular enjoyed sizable year-over-year growth that quarter, while work in the South remains steady. The Northeast and West regions continued to slip, each well below 2015 levels.

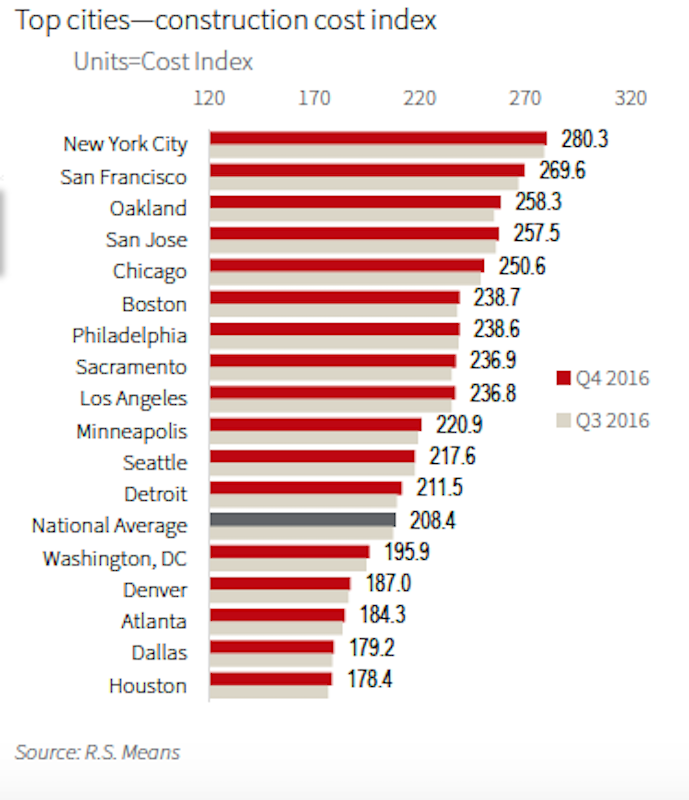

Not surprisingly, construction costs are rising faster in metros where construction activity has been robust, but also where labor is in shorter supply. Image: JLL Research

Building costs rose nationally by a modest 2.7%, with nearly half of that increase occurring in the fourth quarter, spurred by strong residential construction that drove demand, and uncertainly surrounding the effects of the Trump presidency.

JLL doesn’t expect the manifestations of policy decisions coming out of Washington to intervene on the construction industry until later this year. But JLL’s forecast strikes a cautionary pose about the prospects of “voided international trade deals and new import tariffs [that] could drive up materials costs faster.”

And at a time when construction unemployment continues to fall—last week, AGC America reported that from January 2016 to January 2017 construction employment rose in 39 states and in 216 of 358 metro areas—immigration reform “could shrink the skilled labor supply and spur further wage increases,” says JLL’s report. Large-scale infrastructure projects will create a premium on materials and workforce in specific markets such as Oakland and San Francisco, Chicago, and New York.

Inflation in materials costs is harder to gauge when trade agreements are in flux. The largest price swings in 4Q 2016 were seen on the cement and lumber fronts: cement costs were down 4.7% compared to the same time last year, while lumber was priced 9%-plus higher. Steel, on the other hand, maintained negligible price changes, not even breaking one-tenth of a percentage point over third-quarter prices.

One barometer worth keeping an eye on is the IHS Markit PEG Engineering and Construction Cost Index, which tracks procurement activity among engineering and construction firms. In March, that Index registered its fifth consecutive month of rising prices.

Eight of 12 materials/equipment categories tracked showed rising prices in March. And the six-month expectation index stayed positive, although materials and equipment prices are projected to rise at a slower pace than subcontractor labor.

Related Stories

Market Data | Nov 30, 2016

Marcum Commercial Construction Index reports industry outlook has shifted; more change expected

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier.

Industry Research | Nov 30, 2016

Multifamily millennials: Here is what millennial renters want in 2017

It’s all about technology and convenience when it comes to the things millennial renters value most in a multifamily facility.

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Multifamily Housing | Nov 28, 2016

Axiometrics predicts apartment deliveries will peak by mid 2017

New York is projected to lead the nation next year, thanks to construction delays in 2016

Market Data | Nov 22, 2016

Construction activity will slow next year: JLL

Risk, labor, and technology are impacting what gets built.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Nov 11, 2016

Brand marketing: Why the B2B world needs to embrace consumers

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.

Market Data | Nov 2, 2016

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.