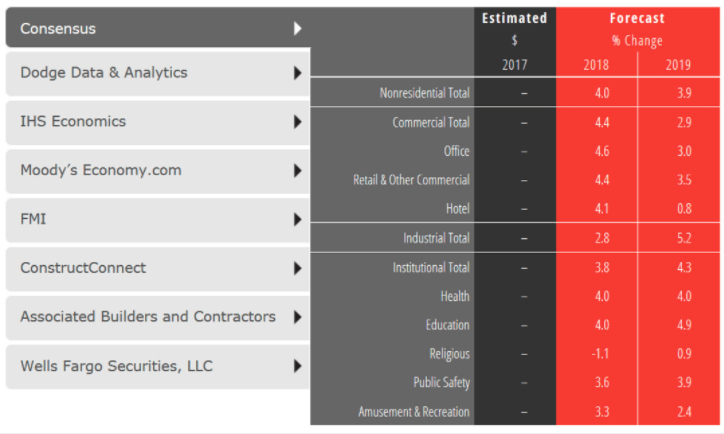

Despite labor shortages and rising material costs that continue to impact the construction sector, construction spending for nonresidential buildings is projected to increase 4.0% this year and continue at a 3.9% pace of growth through 2019.

The American Institute of Architects (AIA) semi-annual Consensus Construction Forecast indicates the commercial construction sectors will generate much of the expected gains this year, and by 2019 the industrial and institutional sectors will dominate the projected construction growth.

“Rebuilding after the record-breaking losses from natural disasters last year, the recently enacted tax reform bill, and the prospects of an infrastructure package are expected to provide opportunities for even more robust levels of activity within the industry,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “The Architecture Billings Index (ABI) and other major leading indicators for the industry also point to an upturn in construction activity over the coming year.”

CLICK TO VIEW INTERACTIVE CHART

CLICK TO VIEW INTERACTIVE CHART

Even eight and a half years into this current national economic cycle, the US economy remains on solid footings. Given the strong levels of business investment, economic growth is estimated to have been 2.2% to 2.3% range last year, easily topping the 1.5% growth from 2016. Over two million new payroll positions on net were added to the economy last year, the seventh straight year that payroll growth exceeded that level.

The national unemployment rate ended the year at 4.1%, its lowest level since 2000. And while low interest rates have helped to fuel this growth, rising stock prices have ensured that public companies have had access to capital to expand their operations. The Dow Jones industrial average increased almost 25% during the year.

However, in the face of a supportive economy, construction spending on nonresidential buildings disappointed last year. Overall spending on these facilities grew by only about 2.5%, with spending on manufacturing facilities seeing a steep double-digit decline.

The only sector achieving healthy growth was retail and other commercial facilities, an odd result given the numerous reports of failing shopping centers due to strong growth in e-commerce sales. However, much of the spending reported in the retail and other commercial facilities category was for distribution facilities and related logistic operations to support a more efficient e-commerce system.

Still, the slowdown in spending last year was sharper than expected. Annual 2015 increases were almost 16% across the entire nonresidential building category, with the office and lodging categories realizing strong gains, and the institutional categories posting increases of almost 8% overall.

Growth in activity eased in 2016, with overall spending on nonresidential buildings increasing by only 6% even though the office and lodging categories posted gains of nearly 25%. Spending on institutional facilities was disappointing, with increases totaling less than 2% in this category.

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.