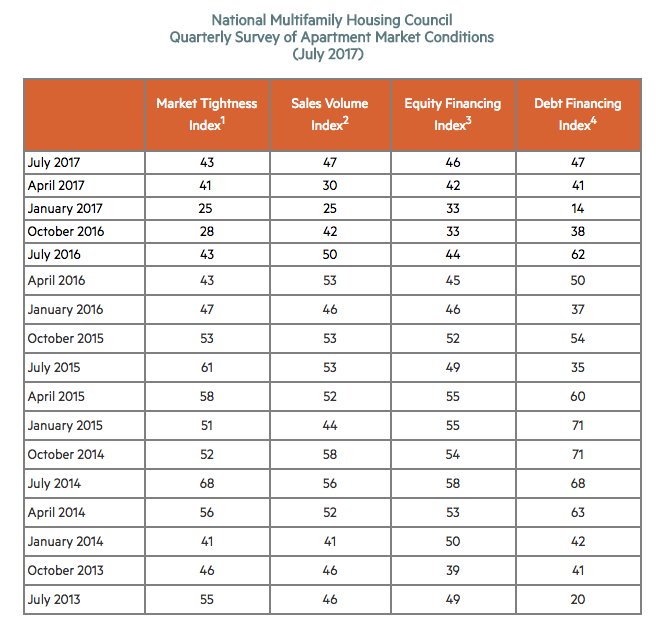

All four indexes of the National Multifamily Housing Council’s (NMHC) July Quarterly Survey of Apartment Market Conditions remained slightly below the breakeven level of 50, the fourth consecutive quarter indicating softening conditions. The Market Tightness (43), Sales Volume (47), Equity Financing (46), and Debt Financing (47) Indexes all improved from April, but still hovered just below 50.

“All four indexes are below 50 but rising, suggesting that the softening is less wide-spread than in previous quarters,” said Mark Obrinsky, NMHC’s SVP of Research and Chief Economist. “Despite some softness at the high end of the apartment market—due to construction having finally ramped up to the level needed—demand for apartments will continue to be substantial for years to come.”

The Market Tightness Index edged up from 41 to 43, as almost half of respondents (48 percent) reported unchanged conditions. One-third (33 percent) of respondents saw conditions as looser than three months ago, while the remaining 19 percent reported tighter conditions. This marks the seventh consecutive quarter of overall declining conditions.

The Sales Volume Index increased from 30 to 47, just shy of the breakeven level of 50. Twenty-seven percent of respondents reported higher sales volume than three months prior, compared to 33 percent that reported lower volume.

The Equity Financing Index increased four points to 46, with almost a quarter (24 percent) of respondents believing that equity financing was less available than three months prior. Sixteen percent thought that equity financing was more available compared to three months ago.

The Debt Financing Index increased from 41 to 47, showing a similar trend to the equity market. While a quarter of respondents (25 percent) reported worse conditions for debt financing compared to three months prior, another 19 percent disagreed, believing conditions had become more favorable.

About the Survey:

The July 2017 Quarterly Survey of Apartment Market Conditions was conducted July 10-July 17, 2017; 123 CEOs and other senior executives of apartment-related firms nationwide responded.

Related Stories

Multifamily Housing | Sep 22, 2021

11 notable multifamily projects to debut in 2021

A residence for older LGBTQ+ persons, a P3 student housing building, and a converted masonic lodge highlight the multifamily developments to debut this year.

Multifamily Housing | Sep 1, 2021

Top 10 outdoor amenities at multifamily housing developments for 2021

Fire pits, lounge areas, and covered parking are the most common outdoor amenities at multifamily housing developments, according to new research from Multifamily Design+Construction.

Giants 400 | Aug 30, 2021

2021 Giants 400 Report: Ranking the largest architecture, engineering, and construction firms in the U.S.

The 2021 Giants 400 Report includes more than 130 rankings across 25 building sectors and specialty categories.

Multifamily Housing | Aug 30, 2021

366-unit multifamily community breaks ground San Jose

KTGY designed the project.

Multifamily Housing | Aug 27, 2021

ODA completes West Half, its first D.C. project

The project is located in Washington, D.C.’s Navy Yard.

Multifamily Housing | Aug 26, 2021

Luxury residential tower breaks ground in Downtown Phoenix

The tower will rise 26 stories.

Multifamily Housing | Aug 19, 2021

Multifamily emerges strong from the pandemic, with Yardi Matrix's Doug Ressler

Yardi Matrix's Doug Ressler discusses his firm's latest assessment of multifamily sales and rent growth for 2021.

Resiliency | Aug 19, 2021

White paper outlines cost-effective flood protection approaches for building owners

A new white paper from Walter P Moore offers an in-depth review of the flood protection process and proven approaches.

Senior Living Design | Aug 13, 2021

Designing with dignity for senior living, with Mike Rodebaugh, LEO A DALY

In this exclusive interview for HorizonTV, Mike Rodebaugh, AIA, Senior Living Sector Leader with LEO A DALY, describes how his firm applies "hospitality magic tricks" in its senior living communities, using design to lend dignity to residents, staff, and residents' families and social circles.