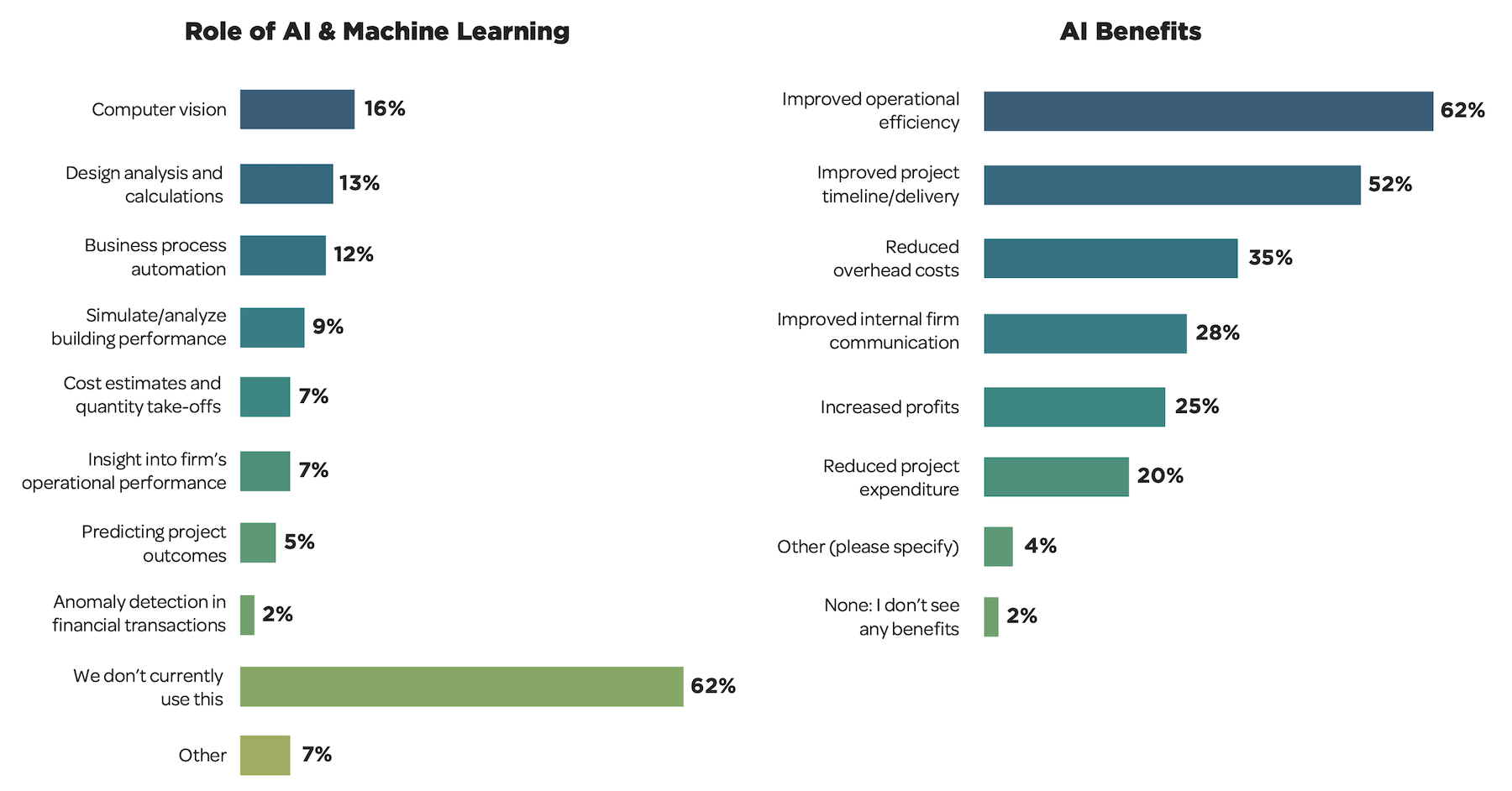

There is growing curiosity about how artificial intelligence and machine learning fit into architecture, engineering, and construction. A new survey of A/E firms found that more than three-fifths of 652 respondents expect AI to improve their operational efficiency.

That survey, though, also found that the same portion of respondents wasn’t using AI yet, and two-thirds admitted they were struggling with where and how to apply AI.

These findings are part of the 45th annual Clarity Architecture & Engineering Study, a comprehensive report conducted by the enterprise software provider Deltek, and sponsored by AIA, the American Council of Engineering Companies, the Association of Consulting Engineering Companies|Canada, and the Society of Marketing Professional Services. The survey was taken between January and March of this year.

The report is organized to explore trends in Technology, Business Development, Human Capital Management, and Financial Management.

It found key financial metrics had held steady in 2023, reflecting an equilibrium following general economic volatility, inflationary pressures, and talent shortages observed in recent years. The survey’s respondents were generating, on average, 18.7% operating profit on net revenue that they forecast would grow that year by 10.9%.

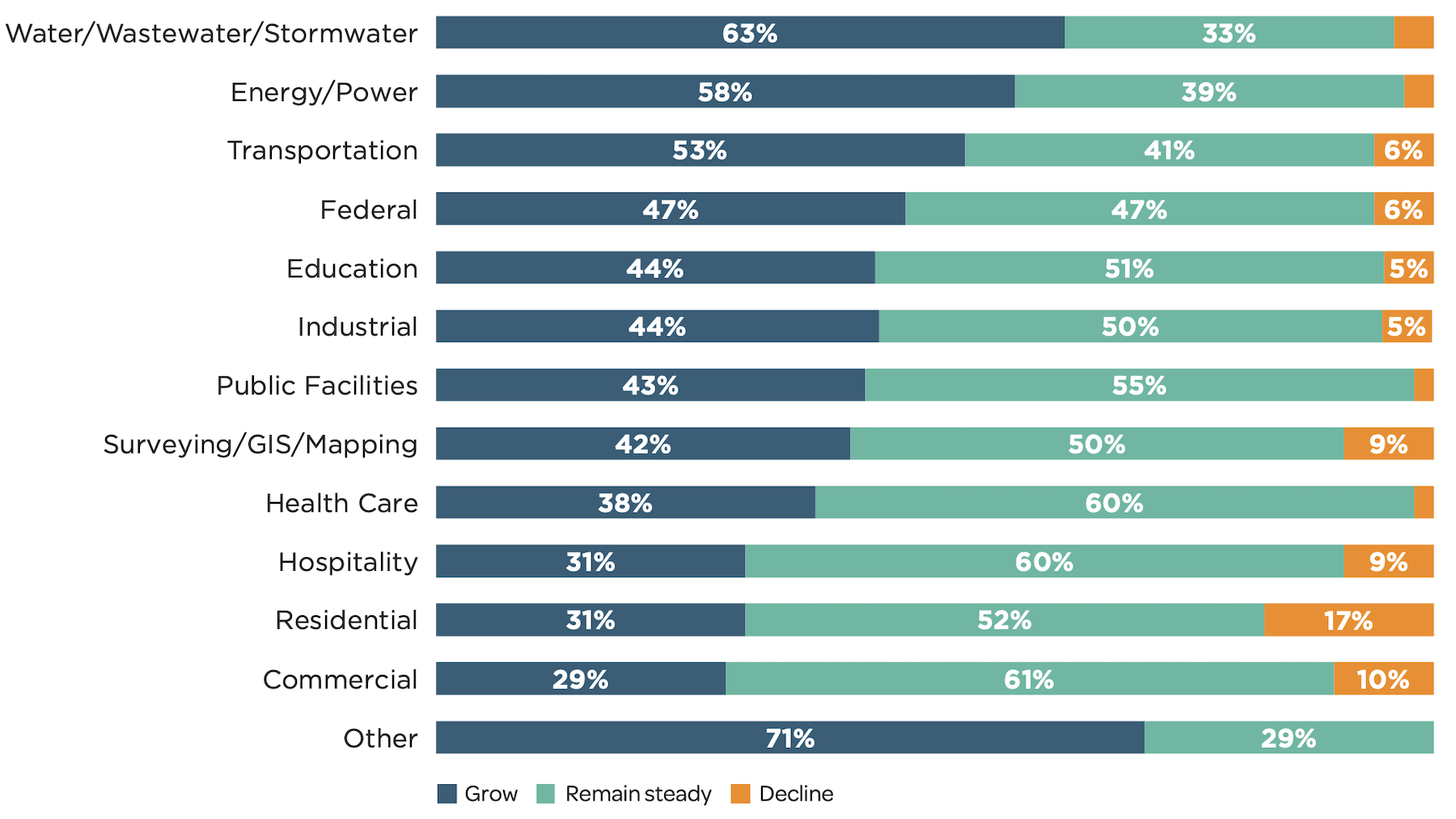

The volume of proposal submissions and contracts awarded increased in 2023, yet the overall value of those contracts receded compared to the previous year. Work on existing buildings continued to be a strong opportunity area, notably in reconstruction, renovation and interiors versus new builds. Indeed, business has been so robust that firms have had the luxury of being more selective about the projects they accept.

But challenges remain: while high talent turnover has waned, worker shortages persist and many firms continue to make do with less, requiring the best-performing A/E firms to seek operational efficiencies and to cross-train talent.

Expanding tech use continues to be a strategic priority

The report observes that, more than ever, A/E leaders are making technology a primary strategic focus. In doing so, Deltek urges those firms to turn to their own staffs for guidance, tap outside expertise, and consider client needs above all. Once A/E firms establish strategic priorities for technology, perceived cost will transition to an investment with long-term payoffs. Until then, “firms that allow costs to prevent them from advancing their business will fall behind. Firms must see past individual competing interests and expenses,” the report states.

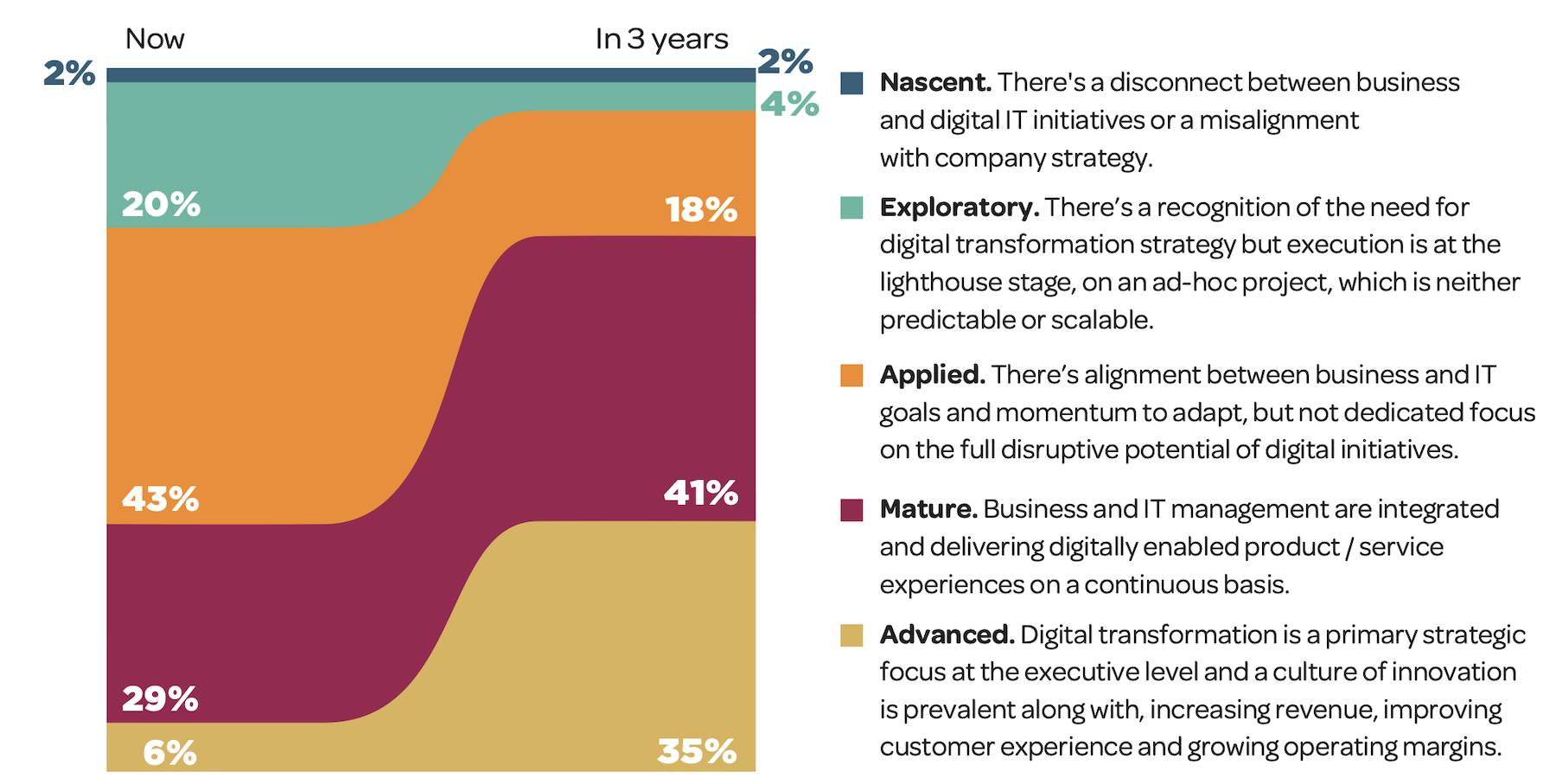

When it comes to technological sophistication, A/E firms hold a relatively high opinion of themselves, with 35% self-classifying as “advanced” and “mature” on a digital transformation spectrum. Another 43% identify their firms as in the “applied” stage, which is in the center of the spectrum.

(The irony of these responses is that A/E firms are still reliant on manual data entry, especially for operations, administrative, and accounting. It’s not surprising, then, that 64% of respondents prioritized the creation of strategic technology implementation plans and 56% indicated the need to educate staff on critical technology trends.)

Looking ahead, 76% of firms are more than twice as likely to envision themselves as “advanced” and “mature” in just a few years. Another 18% expect to reach the “applied” stage, leaving only six percentage points in the immature “exploratory” and “nascent” stages.

Despite their relatively modest usage rate so far, firms largely expect AI to help most with improving operational efficiency (62%), improving project timeline/delivery (52%) and reducing overhead costs (35%). These priorities spotlight the urgent need to refine internal processes to yield cost savings and operational improvements.

On the other hand, concerns about data and cybersecurity have not abated for A/E firms, as more than 60% of respondents ranked it in their top three challenges for their IT operations two years in a row, with 29% identifying it as their No. 1 challenge.

Almost half of firms report they leverage cloud solutions for more than 60% of their firm’s infrastructure, systems, workstations and storage. Significantly, even firms with historically few cloud solutions (0% to 19% leverage) have started their digital transformation journeys, jumping from 18% to 23% in one year.

Nearly one in four firms—16%—now offers technology services to clients as a revenue generator, or has one under consideration (7%). These services include technology consulting, application development, smart buildings/smart infrastructure and digital twins, among other services.

Career development programs being added

The report’s other revealing findings include:

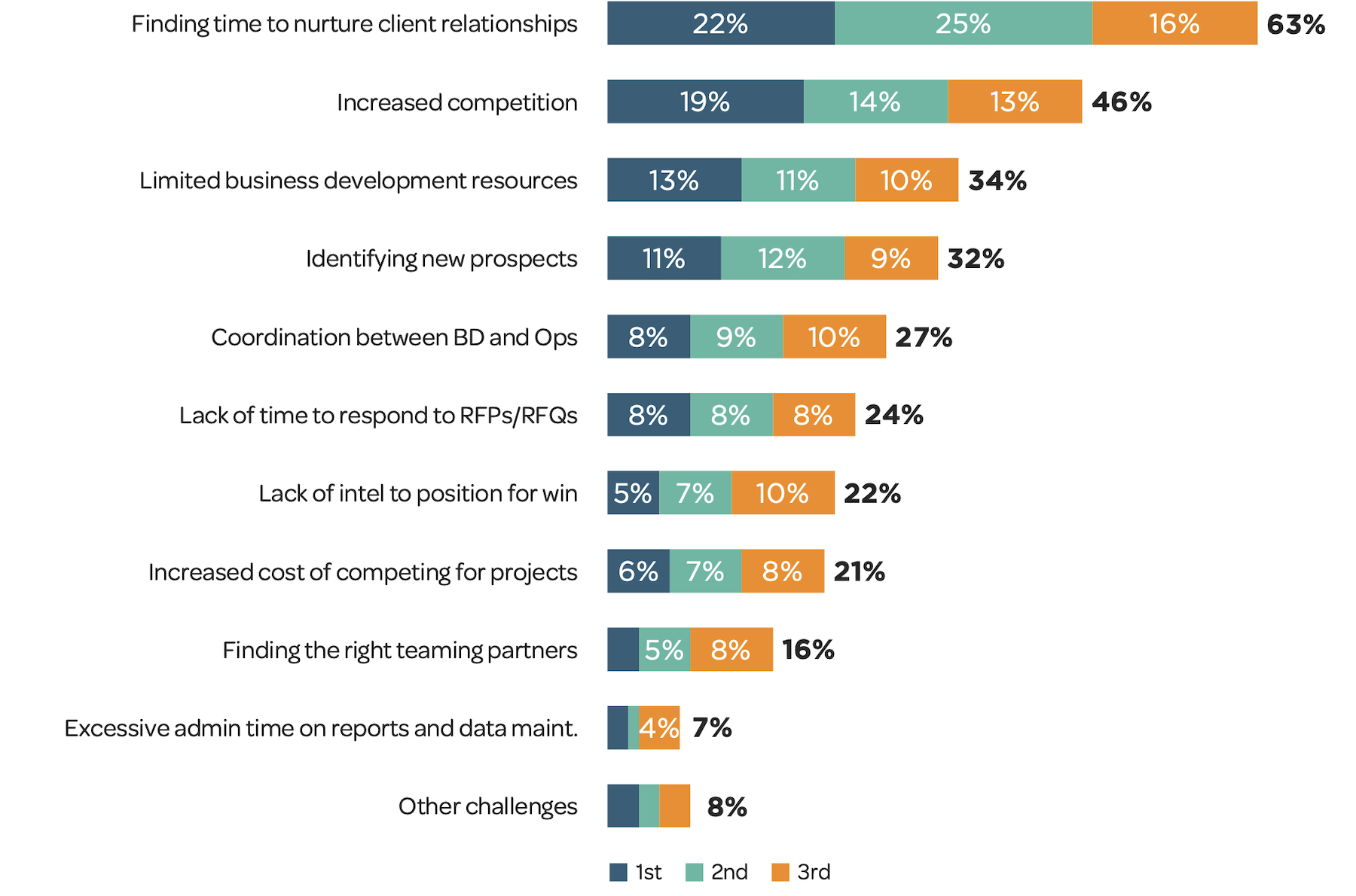

•Firms with formal business development processes increased slightly to 46%. The report states that diversification is “strategically important,” as is finding the right teaming partners to identify and pursue opportunities outside of traditional offerings;

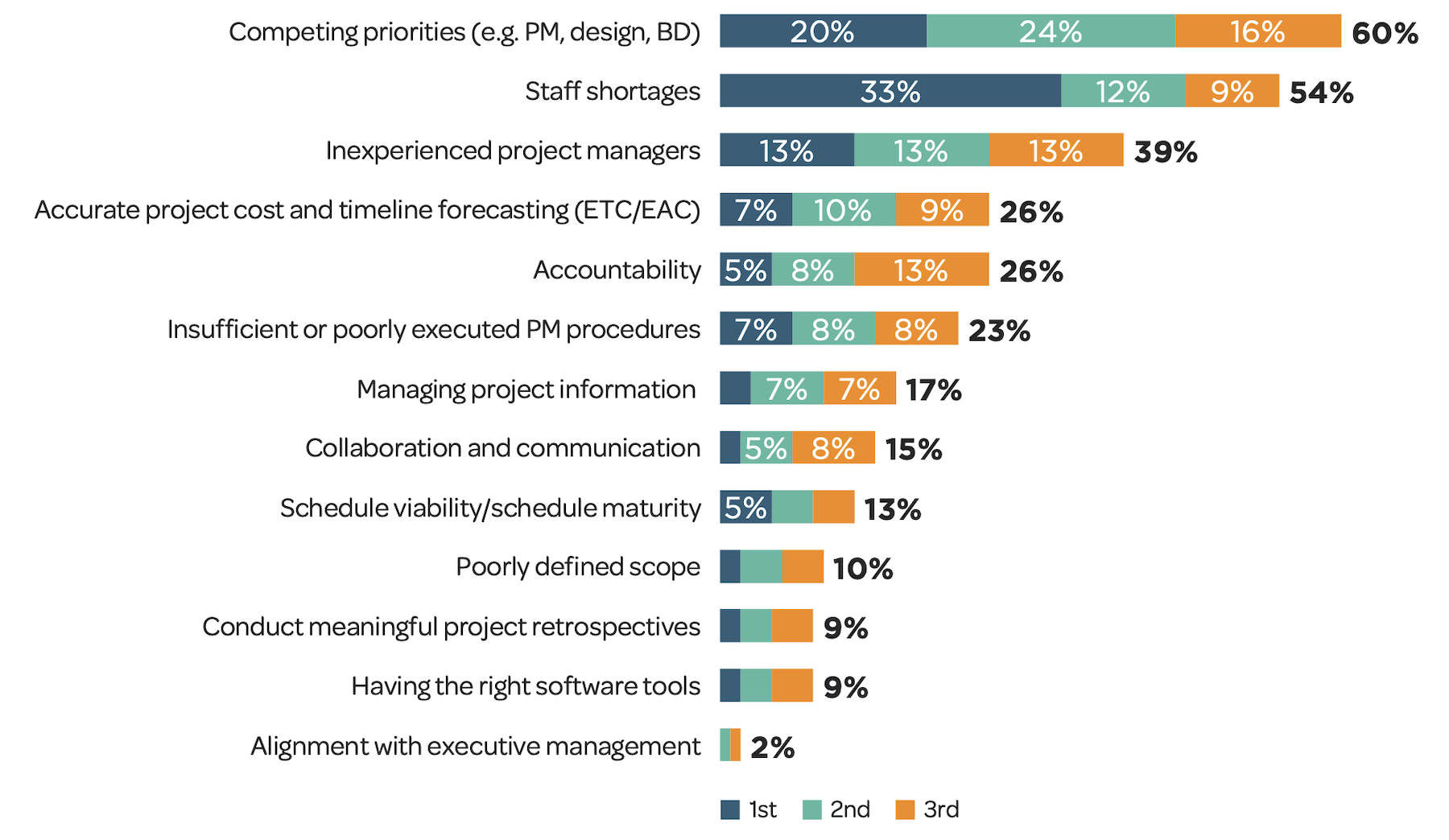

•Competing priorities (60%) and staff shortages (54%) ranked as the top two project management challenges, indicating that project managers currently feel like they’re getting stretched too thin and without sufficient support. Firms reported that 58% of projects were on or ahead of schedule, the lowest rate in seven years (it was 75% in 2017). Consequently, more firms are investing in project management training;

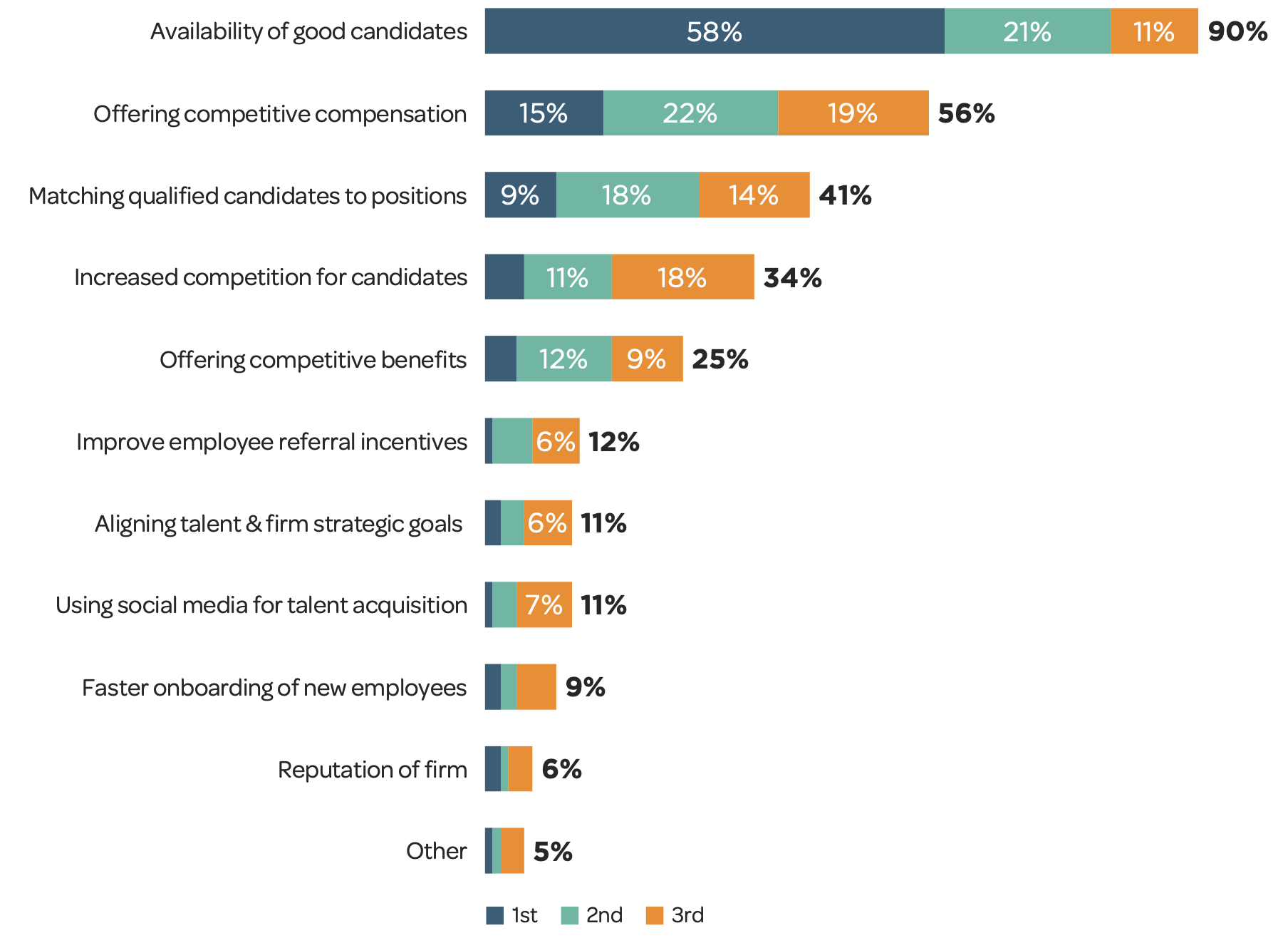

•Given the ongoing shortages in skilled labor—turnover still hovers around 14%—a growing number of firms are introducing and adopting structured career development programs. Overall, firms with career development plans grew to just under 40%, a 13-percentage-point increase year over year. Medium-sized and large firms demonstrated the most substantial growth in this area with medium-sized firms growing from 37% to 48%, and large firms climbing from 32% to 56%.

More firms are also turning toward providing better benefits to attract talent. More than a quarter of firms now utilize competitive benefits, up four percentage points year over year.

Related Stories

AEC Tech | Jan 27, 2023

Key takeaways from Autodesk University 2022

Autodesk laid out its long-term vision to drive digital collaboration through cloud-based solutions and emphasized the importance of connecting people, processes and data.

AEC Tech Innovation | Jan 24, 2023

ConTech investment weathered last year’s shaky economy

Investment in construction technology (ConTech) hit $5.38 billion last year (less than a 1% falloff compared to 2021) from 228 deals, according to CEMEX Ventures’ estimates. The firm announced its top 50 construction technology startups of 2023.

AEC Tech | Jan 19, 2023

Data-informed design, with Josh Fritz of LEO A DALY

Joshua Fritz, Leo A Daly's first Data Scientist, discusses how information analysis can improve building project outcomes.

AEC Tech Innovation | Jan 14, 2023

CES recognizes a Dutch firm’s wearable technology for construction management

The firm’s TokenMe product offers construction managers a real-time crowd- and asset-tracking solution via low-power, location-aware radio and RFID tags and multiple sensors through which data are processed with cloud-based artificial intelligence.

Digital Twin | Nov 21, 2022

An inside look at the airport industry's plan to develop a digital twin guidebook

Zoë Fisher, AIA explores how design strategies are changing the way we deliver and design projects in the post-pandemic world.

Giants 400 | Nov 14, 2022

4 emerging trends from BD+C's 2022 Giants 400 Report

Regenerative design, cognitive health, and jobsite robotics highlight the top trends from the 519 design and construction firms that participated in BD+C's 2022 Giants 400 Report.

Contractors | Nov 14, 2022

U.S. construction firms lean on technology to manage growth and weather the pandemic

In 2021, Gilbane Building Company and Nextera Robotics partnered in a joint venture to develop an artificial intelligence platform utilizing a fleet of autonomous mobile robots. The platform, dubbed Didge, is designed to automate construction management, maximize reliability and safety, and minimize operational costs. This was just one of myriad examples over the past 18 months of contractor giants turning to construction technology (ConTech) to gather jobsite data, manage workers and equipment, and smooth the construction process.

BAS and Security | Oct 19, 2022

The biggest cybersecurity threats in commercial real estate, and how to mitigate them

Coleman Wolf, Senior Security Systems Consultant with global engineering firm ESD, outlines the top-three cybersecurity threats to commercial and institutional building owners and property managers, and offers advice on how to deter and defend against hackers.

Webinar | Oct 6, 2022

Register today! Live webinar: The future of 3D + 360° construction progress management

Learn about the value of digital site documentation and progress monitoring, how reality capture is used for site documentation, and the value of both 3D scans and 360 photos. This live webinar will take place Thursday, October 20 at 2 ET/ 1 CT.

AEC Tech | Sep 23, 2022

Register today! Live webinar: 10 KPIs your AE firm needs to track for maximum project profitability

Join us for an engaging, live webinar presented by Steven Burns, FAIA, Chief Creative Officer at BQE Software as he explores 10 project performance KPIs that, when tracked properly, will transform the way your business operates, and subsequently how profitable each project is.