In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

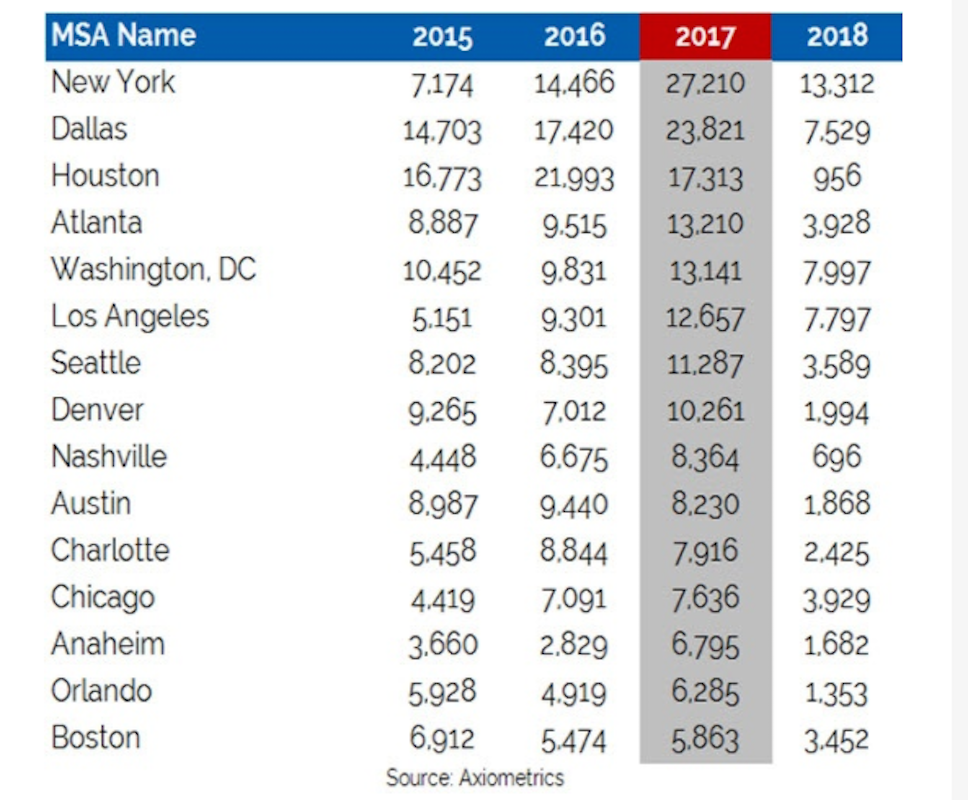

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Giants 400 | Aug 29, 2022

Top 70 Student Housing Facility Architecture + AE Firms for 2022

Niles Bolton Associates, Mithun, Gensler, and Perkins and Will top the ranking of the nation's largest student housing facility architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 29, 2022

Top 110 Multifamily Sector Contractors + CM Firms for 2022

Suffolk Construction, Clark Group, AECOM, and Whiting-Turner top the ranking of the nation's largest multifamily housing sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes all multifamily sector work, including apartments, condos, student housing, and senior living facilities.

Giants 400 | Aug 29, 2022

Top 75 Multifamily Sector Engineering + EA Firms for 2022

Kimley-Horn, WSP, Langan, and Olsson head the ranking of the nation's largest multifamily housing sector engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes all multifamily sector work, including apartments, condos, student housing, and senior living facilities.

Giants 400 | Aug 29, 2022

Top 175 Multifamily Sector Architecture + AE Firms for 2022

Perkins Eastman, Solomon Cordwell Buenz, KTGY, and Gensler top the ranking of the nation's largest multifamily sector architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes all multifamily sector work, including apartments, condos, student housing, and senior living facilities.

Multifamily Housing | Aug 25, 2022

7 things to know about designing for Chinese multifamily developers

Seven tips for designing successful apartment and condominium projects for Chinese clients.

Giants 400 | Aug 25, 2022

Top 155 Apartment and Condominium Architecture Firms for 2022

Solomon Cordwell Buenz, KTGY, Gensler, and AO top the ranking of the nation's largest apartment and condominium architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 25, 2022

Top 65 Apartment and Condominium Engineering Firms for 2022

Kimley-Horn, Langan, Thornton Tomasetti, and WSP head the ranking of the nation's largest apartment and condominium engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 25, 2022

Top 100 Apartment and Condominium Contractors for 2022

Clark Group, Suffolk Construction, AECOM, and Lendlease top the ranking of the nation's largest apartment and condominium contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 90 Construction Management Firms for 2022

CBRE, Alfa Tech, Jacobs, and Hill International head the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 200 Contractors for 2022

Turner Construction, STO Building Group, Whiting-Turner, and DPR Construction top the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.