In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

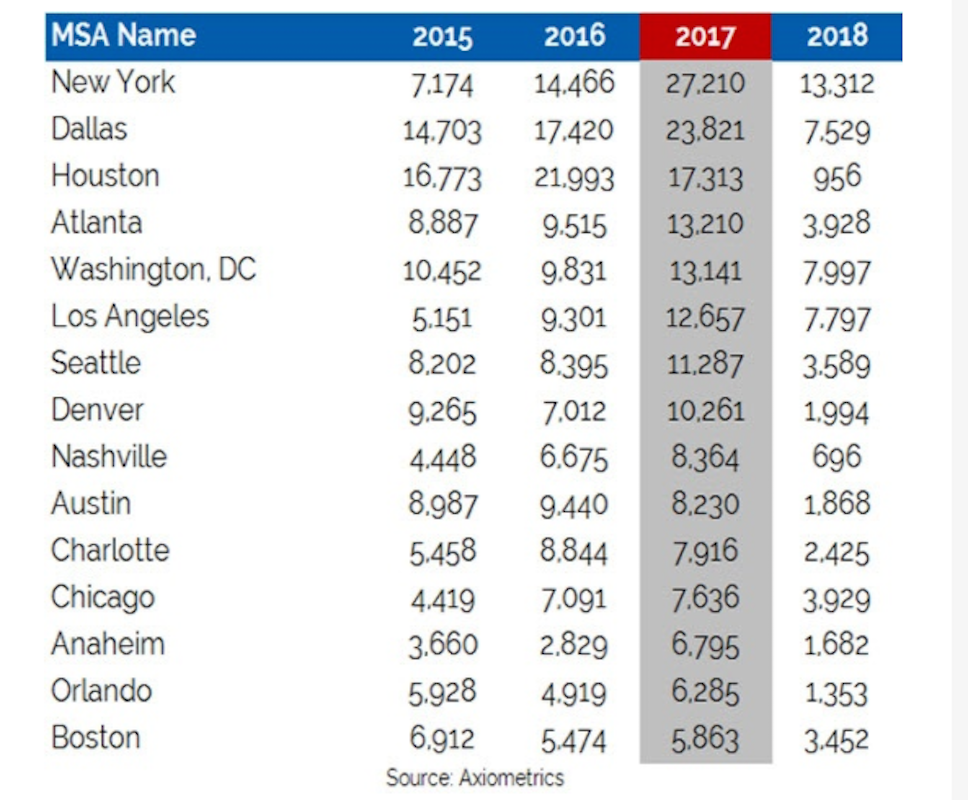

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Multifamily Housing | Apr 22, 2021

The Weekly Show, Apr 22, 2021: COVID-19's impact on multifamily amenities

This week on The Weekly show, BD+C's Robert Cassidy speaks with three multifamily design experts about the impact of COVID-19 on apartment and condo amenities, based on the 2021 Multifamily Amenities Survey.

Multifamily Housing | Apr 20, 2021

Two new residential towers set to rise in Nashville

Goettsch Partners is designing the buildings.

Multifamily Housing | Apr 14, 2021

Miami's Adela at MiMo Bay combines a residential building with an American Legion facility

The five-story residential building features 236 units and a new American Legions Facility for military veterans.

Multifamily Housing | Apr 12, 2021

103 income-restricted residential units under construction in Downtown Denver

KTGY is designing the project.

Multifamily Housing | Apr 2, 2021

250-unit rental building opens in Brooklyn

CetraRuddy designed the project.

Multifamily Housing | Mar 30, 2021

Bipartisan ‘YIMBY’ bill would provide $1.5B in grants to spur new housing

Resources for local leaders to overcome obstacles such as density-unfriendly or discriminatory zoning.

Multifamily Housing | Mar 30, 2021

ProCONNECT Multifamily, ProCONNECT Single-Family open for Developers, Builders, Architects

Sponsors and Attendees can still sign up for ProCONNECT Multifamily April 21-22, ProCONNECT Single-Family for May 18-19

Multifamily Housing | Mar 28, 2021

Smart home technology 101 for multifamily housing communities

Bulk-services Wi-Fi leads to better connectivity, products, and services to help multifamily developers create greater value for residents–and their own bottom line.

Multifamily Housing | Mar 27, 2021

Designing multifamily housing today for the post-Covid world of tomorrow

The multifamily market has changed dramatically due to the Covid pandemic. Here's how one architecture firm has accommodate their designs to what tenants are now demanding.