In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

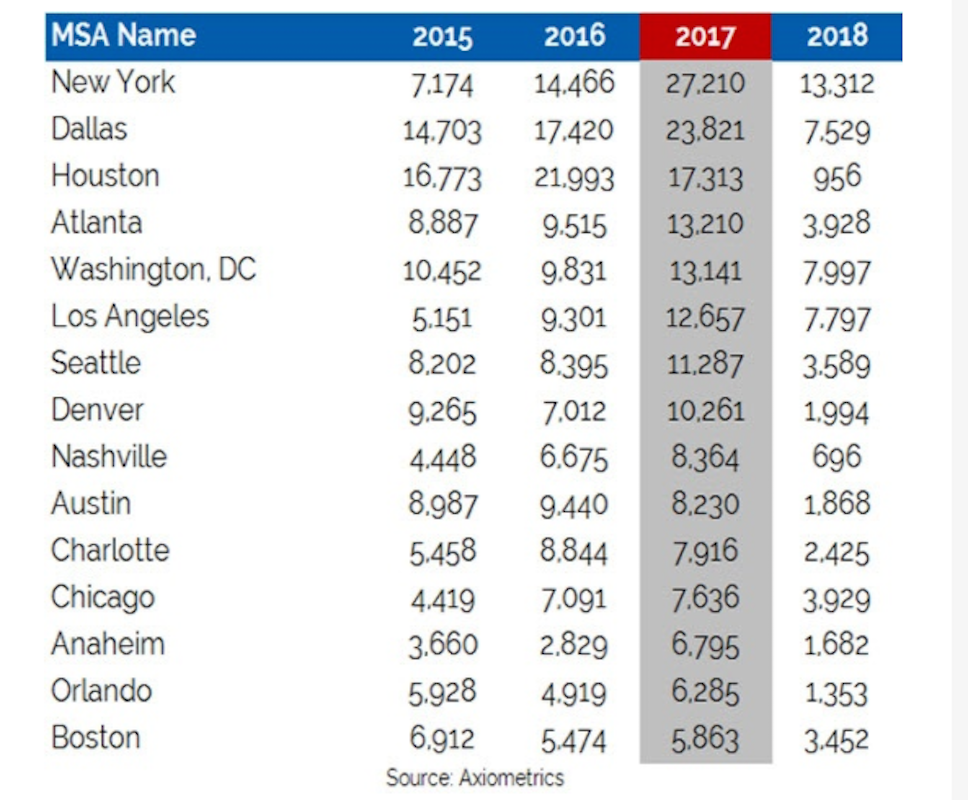

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Multifamily Housing | Sep 16, 2020

8 (more) noteworthy multifamily projects to debut in 2020

An office-to-apartment conversion in Clearwater, Fla., and a modular affordable housing community in Portland, Ore., highlight the latest multifamily developments to open this year.

Multifamily Housing | Sep 14, 2020

McShane Construction begins work on Gilbert, Ariz., multifamily development

Continental Properties is the project owner.

Multifamily Housing | Sep 10, 2020

COVID-19: How are you doing?

Multifamily seems to be one sector in the construction industry that’s holding its own during the pandemic.

Multifamily Housing | Sep 10, 2020

EV charging webinar to feature experts from Bozzuto, Irvine Company, and RCLCO - Wed., 9-16

EV charging webinar (9/16) to feature Bozzuto Development, The Irvine Company, RCLCO, and ChargePoint

Multifamily Housing | Sep 2, 2020

8 noteworthy multifamily projects to debut in 2020

Brooklyn's latest mega-development, Denizen Bushwick, and Related California’s apartment tower in San Francisco are among the notable multifamily projects to debut in the first half of 2020.

Multifamily Housing | Sep 2, 2020

New affordable housing in the Bronx is designed for both seniors and teens

Body Lawson Associates designed the project.

Giants 400 | Aug 28, 2020

2020 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

The 2020 Giants 400 Report features more than 130 rankings across 25 building sectors and specialty categories.

Sponsored | | Aug 26, 2020

Healthy air systems have become the new “standard equipment.”

As home buyers demand healthy air systems, builders look to differentiate themselves with a “Healthy Home Builder” designation.

Coronavirus | Aug 25, 2020

Video: 5 building sectors to watch amid COVID-19

RCLCO's Brad Hunter reveals the winners and non-winners of the U.S. real estate market during the coronavirus pandemic.

Multifamily Housing | Aug 24, 2020

Portland’s zoning reform looks to boost the ‘missing middle’ of housing

The city council in Portland, Ore., recently approved the “Residential Infill Project” (RIP), a package of amendments to the city’s zoning code that legalizes up to four homes on nearly any residential lot and sharply limits building sizes.