In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

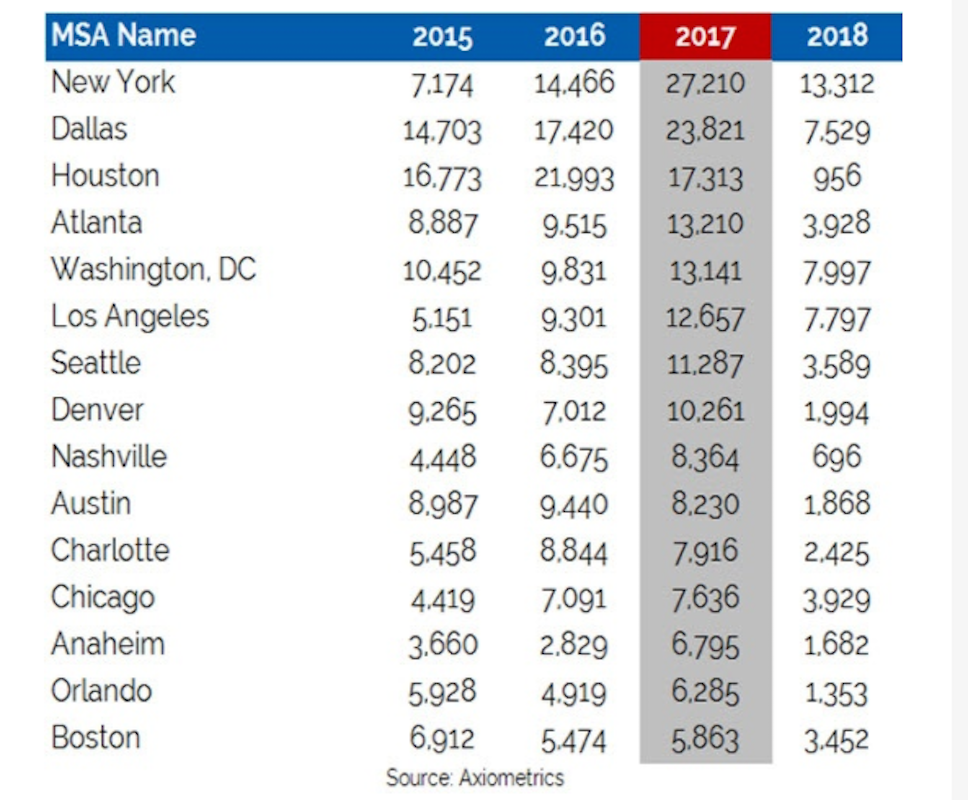

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Multifamily Housing | Sep 10, 2019

Carbon-neutral apartment building sets the pace for scalable affordable housing

Project Open has no carbon footprint, but the six-story, solar-powered building is already leaving its imprint on Salt Lake City’s multifamily landscape.

Multifamily Housing | Sep 4, 2019

Peloton to multifamily communities: Drop dead

Peloton will no longer sell its bikes to apartment communities.

| Sep 3, 2019

Top 10 indoor amenities in multifamily developments for 2019

In-unit washer/dryer heads our ranking of the top indoor amenities in multifamily housing developments.

AEC Innovators | Aug 27, 2019

7 AEC industry disruptors and their groundbreaking achievements

From building prefab factories in the sky to incubating the next generation of AEC tech startups, our 2019 class of AEC Innovators demonstrates that the industry is poised for a shakeup. Meet BD+C’s 2019 AEC Innovators.

AEC Tech | Aug 25, 2019

Deluxe parking: A condo building in Philadelphia offers its owners a completely automated parking service

This is the first “palletless” system that Westfalia Technologies has installed.

Multifamily Housing | Aug 22, 2019

40-story residential tower to rise near Seattle’s Pike Place Market

Hewitt architects is designing the project.

Multifamily Housing | Aug 19, 2019

Affordable, senior development rises in the Bronx

RKTB Architects is designing the project.

Multifamily Housing | Aug 19, 2019

Top 10 outdoor amenities in multifamily housing for 2019

Top 10 results in the “Outdoor Amenities” category in our Multifamily Design+Construction Amenities Survey 2019.

Market Data | Aug 19, 2019

Multifamily market sustains positive cycle

Year-over-year growth tops 3% for 13th month. Will the economy stifle momentum?

Giants 400 | Aug 15, 2019

Top 140 Multifamily Sector Architecture Firms for 2019

Humphreys & Partners, KTGY, SCB, CallisonRTKL, and Perkins Eastman top the rankings of the nation's largest multifamily sector architecture and architecture engineering (AE) firms, as reported in Building Design+Construction's 2019 Giants 300 Report.