In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

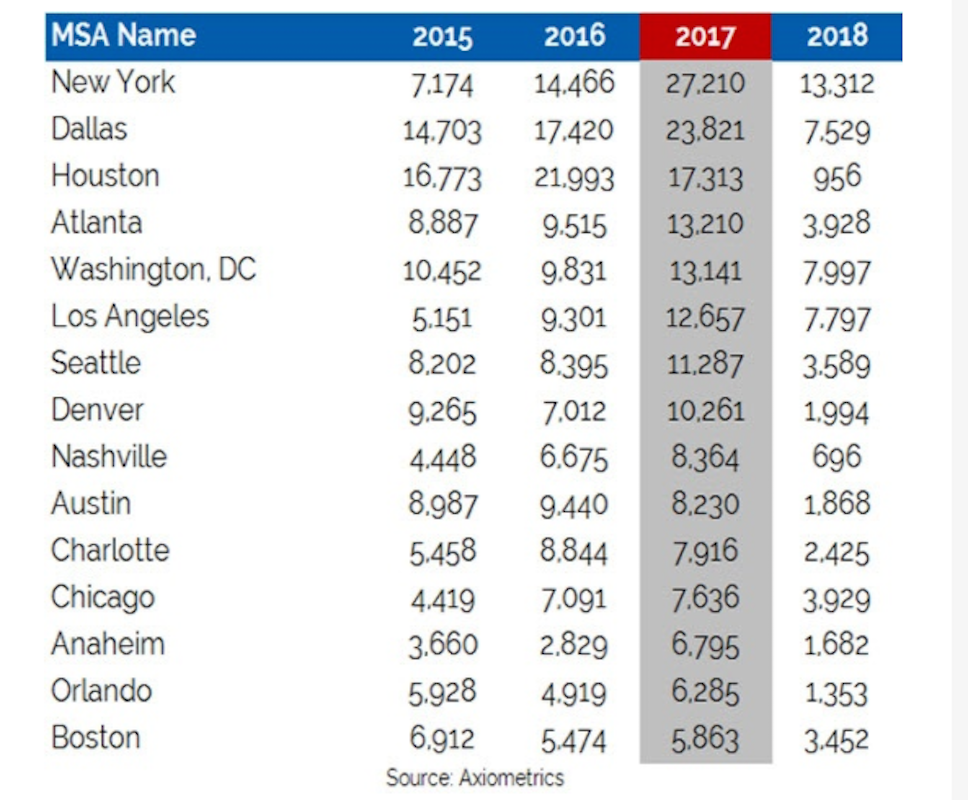

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Multifamily Housing | Jun 25, 2019

Historic New York hospital becomes multifamily development

CetraRuddy designed the project and Delshah Capital is the developer.

Multifamily Housing | Jun 25, 2019

New Joint Center housing report foresees steady rental demand over the next decade

However, supply shortages, especially on the affordable end, are likely to push rents even higher.

Multifamily Housing | Jun 17, 2019

Boston multifamily development combines a historic warehouse with a new, modern addition

The Architectural Team designed the project.

Multifamily Housing | Jun 4, 2019

New Silver Spring apartment community includes over 5,000 sf of amenity space

Design Collective is the project’s architect.

Multifamily Housing | Jun 3, 2019

11 trends in senior living

Style, flexibility, and fun highlight the latest design trends for the 55+ market.

Multifamily Housing | May 29, 2019

Grilled to order: The art of outdoor kitchens

Seven tips for ensuring outdoor kitchens deliver safe, memorable experiences for residents and guests.

Multifamily Housing | May 17, 2019

At last, downtown Dallas tower to get $450 million redo

The landmark tower has been vacant for a decade.

Multifamily Housing | May 8, 2019

Multifamily visionary: AvalonBay’s relentless attention to detail

The nation's fourth-largest owner of apartments holds more than 85,000 apartments in 291 communities.

| Apr 28, 2019

New York Is NOT Most Expensive City for Apartment Sales Transactions

Data from Marcus & Millichap 2019 U.S. Multifamily Investment Forecast on Average Price/Dwelling Unit in apartment transactions.