In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

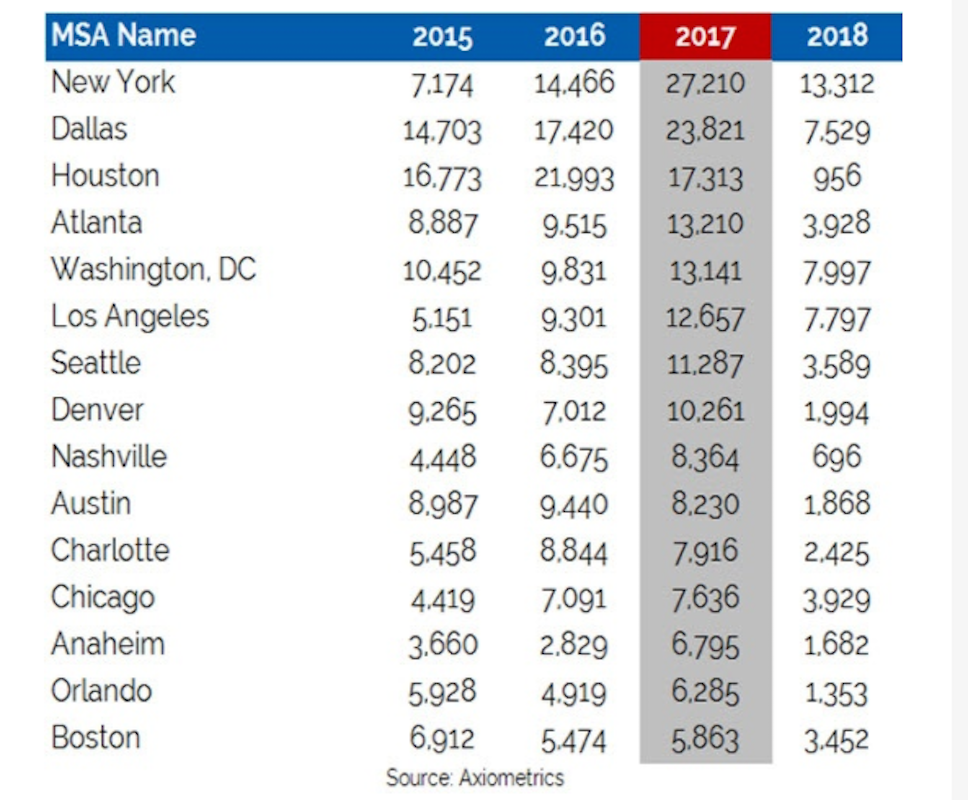

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

High-rise Construction | Mar 22, 2017

Porsche Design Tower is, unsurprisingly, a car lover’s dream

The idea behind the residential tower was to provide residents with a full single family home in the sky, complete with a private garage and pool.

Multifamily Housing | Mar 15, 2017

Amenity-packed residential building is Zaha Hadid’s only NYC project

The building sits adjacent to New York’s popular High Line park and includes a $50 million penthouse.

Sponsored | Multifamily Housing | Mar 10, 2017

Bathroom ergonomics and design for a shifting demographic

Multifamily Housing | Feb 24, 2017

121 East 22nd Street will be the first OMA-designed residential building in NYC

The building will offer 133 units across its 18 stories.

Multifamily Housing | Jan 15, 2017

Multifamily sector expected to stay strong in 2017

Market watchers expect some moderation from record highs, but not much.

Game Changers | Jan 13, 2017

Building from the neighborhood up

EcoDistricts is helping cities visualize a bigger picture that connects their communities.

Multifamily Housing | Jan 11, 2017

Istanbul’s Valens Archway could be rejuvenated with “floating” housing concept

Superspace’s proposal would create a natural promenade atop the ancient stone structure.

University Buildings | Jan 9, 2017

Massive student housing project in Texas will be ready this Fall

Developers hope the early opening of some units sets the tone for the community and future rentals.

Multifamily Housing | Dec 22, 2016

Multifamily green financing programs grew rapidly in 2016

Multifamily green financing programs boomed in 2016, and are likely to continue to grow in 2017, according to the president of Partner Energy.