Only 34% of the nation’s metro areas—just over one-third—added construction jobs from November 2019 to November 2020, according to an analysis of new government data that the Associated General Contractors of America released today. Association officials said large numbers of contractors are having to lay off workers once they complete projects begun before the pandemic because private owners and public agencies are hesitant to commit to new construction.

“Canceled and postponed projects appear to be more common than new starts for far too many contractors,” said Ken Simonson, the association’s chief economist. “Our association’s 2021 Construction Hiring and Business Outlook Survey found three times more contractors have experienced postponements and cancellations than new or expanded projects.”

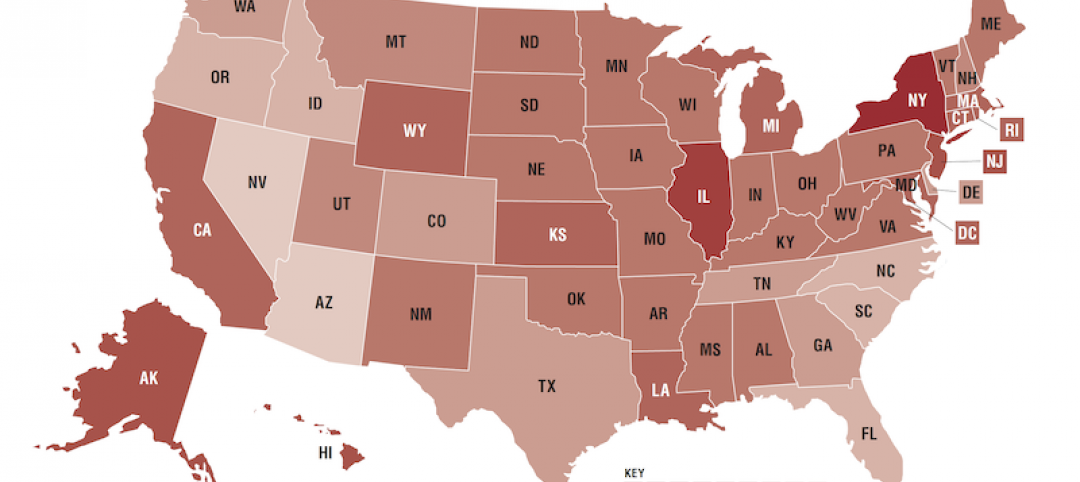

Construction employment fell in 203, or 57%, of 358 metro areas between November 2019 and November 2020. Construction employment was stagnant in 33 additional metro areas, while only 122 metro areas—34%—added construction jobs during the past year.

Houston-The Woodlands-Sugar Land, Texas lost the most construction jobs over that span (-22,500 jobs, -9%), followed by New York City (-16,700 jobs, -11%); Midland, Texas (-9,800 jobs, -25%); Montgomery-Bucks-Chester counties, Pa. (-8,800 jobs, -16%); and Oakland-Hayward-Berkeley, Calif. (-8,400 jobs, -11%). Brockton-Bridgewater-Easton, Mass. had the largest percentage decline (-40%, -2,200 jobs), followed by Altoona, Pa. (-35%, -1,100 jobs); Bloomsburg-Berwick, Pa. (-31%, -400 jobs); Johnstown, Pa. (-31%, -800 jobs); and East Stroudsburg, Pa. (-30%, -600 jobs).

Phoenix-Mesa-Scottsdale, Ariz. added the most construction jobs over the year (4,700 jobs, 3%), followed by Baltimore-Columbia-Towson, Md. (4,500 jobs, 5%); Boise, Idaho (4,300 jobs, 16%); Dallas-Plano-Irving, Texas (3,700 jobs, 2%); and Seattle-Bellevue-Everett, Wash. (3,600 jobs, 3%). Walla Walla, Wash. had the highest percentage increase (17%, 200 jobs), followed by Boise; Oshkosh-Neenah, Wisc. (16%, 900 jobs); and Springfield, Mo. (16%, 1,500 jobs).

Association officials said many metro areas were likely to lose more construction jobs amid declining demand and continued project cancellations and delays. They added that a clearer picture of what is in store for the industry will emerge on Thursday, January 7, when the association releases the 2021 Construction Hiring and Business Outlook it prepared with Sage.

“Construction employment is likely to fall further in many parts of the country as the coronavirus continues to weigh on demand for nonresidential projects,” said Stephen E. Sandherr, the association’s chief executive officer. “Unless market conditions change rapidly, this year is likely to prove very challenging for many construction employers.”

View the metro employment 12-month data, rankings, top 10, new highs and lows, map.

Related Stories

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.

Market Data | Oct 9, 2019

Two ULI reports foresee a solid real estate market through 2021

Market watchers, though, caution about a “surfeit” of investment creating a bubble.

Market Data | Oct 4, 2019

Global construction output growth will decline to 2.7% in 2019

It will be the slowest pace of growth in a decade, according to GlobalData.