Only 34% of the nation’s metro areas—just over one-third—added construction jobs from November 2019 to November 2020, according to an analysis of new government data that the Associated General Contractors of America released today. Association officials said large numbers of contractors are having to lay off workers once they complete projects begun before the pandemic because private owners and public agencies are hesitant to commit to new construction.

“Canceled and postponed projects appear to be more common than new starts for far too many contractors,” said Ken Simonson, the association’s chief economist. “Our association’s 2021 Construction Hiring and Business Outlook Survey found three times more contractors have experienced postponements and cancellations than new or expanded projects.”

Construction employment fell in 203, or 57%, of 358 metro areas between November 2019 and November 2020. Construction employment was stagnant in 33 additional metro areas, while only 122 metro areas—34%—added construction jobs during the past year.

Houston-The Woodlands-Sugar Land, Texas lost the most construction jobs over that span (-22,500 jobs, -9%), followed by New York City (-16,700 jobs, -11%); Midland, Texas (-9,800 jobs, -25%); Montgomery-Bucks-Chester counties, Pa. (-8,800 jobs, -16%); and Oakland-Hayward-Berkeley, Calif. (-8,400 jobs, -11%). Brockton-Bridgewater-Easton, Mass. had the largest percentage decline (-40%, -2,200 jobs), followed by Altoona, Pa. (-35%, -1,100 jobs); Bloomsburg-Berwick, Pa. (-31%, -400 jobs); Johnstown, Pa. (-31%, -800 jobs); and East Stroudsburg, Pa. (-30%, -600 jobs).

Phoenix-Mesa-Scottsdale, Ariz. added the most construction jobs over the year (4,700 jobs, 3%), followed by Baltimore-Columbia-Towson, Md. (4,500 jobs, 5%); Boise, Idaho (4,300 jobs, 16%); Dallas-Plano-Irving, Texas (3,700 jobs, 2%); and Seattle-Bellevue-Everett, Wash. (3,600 jobs, 3%). Walla Walla, Wash. had the highest percentage increase (17%, 200 jobs), followed by Boise; Oshkosh-Neenah, Wisc. (16%, 900 jobs); and Springfield, Mo. (16%, 1,500 jobs).

Association officials said many metro areas were likely to lose more construction jobs amid declining demand and continued project cancellations and delays. They added that a clearer picture of what is in store for the industry will emerge on Thursday, January 7, when the association releases the 2021 Construction Hiring and Business Outlook it prepared with Sage.

“Construction employment is likely to fall further in many parts of the country as the coronavirus continues to weigh on demand for nonresidential projects,” said Stephen E. Sandherr, the association’s chief executive officer. “Unless market conditions change rapidly, this year is likely to prove very challenging for many construction employers.”

View the metro employment 12-month data, rankings, top 10, new highs and lows, map.

Related Stories

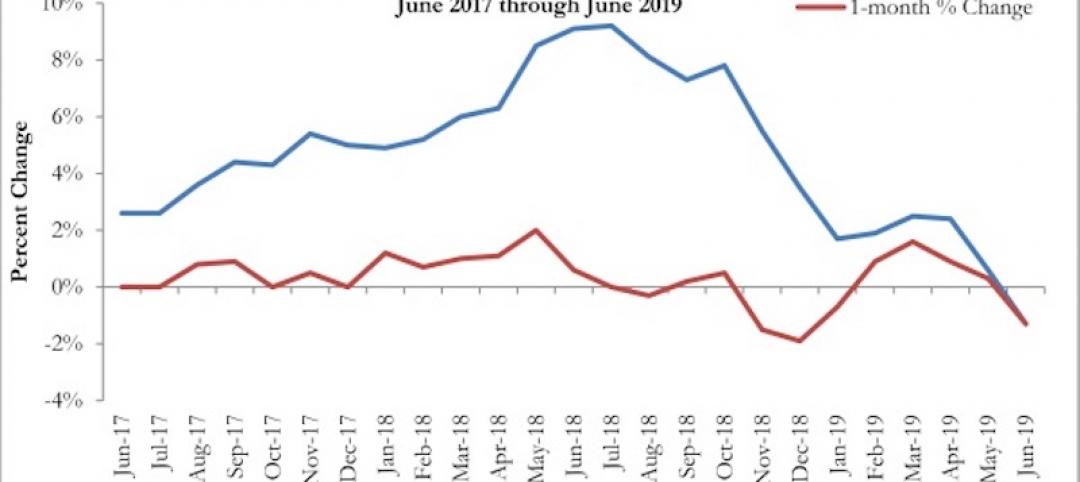

Market Data | Jul 18, 2019

Construction contractors remain confident as summer begins

Contractors were slightly less upbeat regarding profit margins and staffing levels compared to April.

Market Data | Jul 17, 2019

Design services demand stalled in June

Project inquiry gains hit a 10-year low.

Market Data | Jul 16, 2019

ABC’s Construction Backlog Indicator increases modestly in May

The Construction Backlog Indicator expanded to 8.9 months in May 2019.

K-12 Schools | Jul 15, 2019

Summer assignments: 2019 K-12 school construction costs

Using RSMeans data from Gordian, here are the most recent costs per square foot for K-12 school buildings in 10 cities across the U.S.

Market Data | Jul 12, 2019

Construction input prices plummet in June

This is the first time in nearly three years that input prices have fallen on a year-over-year basis.

Market Data | Jul 1, 2019

Nonresidential construction spending slips modestly in May

Among the 16 nonresidential construction spending categories tracked by the Census Bureau, five experienced increases in monthly spending.

Market Data | Jul 1, 2019

Almost 60% of the U.S. construction project pipeline value is concentrated in 10 major states

With a total of 1,302 projects worth $524.6 billion, California has both the largest number and value of projects in the U.S. construction project pipeline.

Market Data | Jun 21, 2019

Architecture billings remain flat

AIA’s Architecture Billings Index (ABI) score for May showed a small increase in design services at 50.2.

Market Data | Jun 19, 2019

Number of U.S. architects continues to rise

New data from NCARB reveals that the number of architects continues to increase.

Market Data | Jun 12, 2019

Construction input prices see slight increase in May

Among the 11 subcategories, six saw prices fall last month, with the largest decreases in natural gas.