The use of third parties to develop and own new medical real estate projects is increasingly viewed as an attractive option for health systems seeking ways to preserve and generate precious capital resources to fund acute care programs and market share growth. The right third-party developer can help health systems create medical facilities with market-competitive rental rates as well as provide several benefits, such as future flexibility for the hospital, avoidance of the legal exposure that may come with serving as a landlord to referring physicians, and a potential investment vehicle for physician-tenants.

However, the selection of a developer for a new project can create challenges for health system executives. To obtain the most competitive terms, hospitals usually issue a request for proposal (RFP) as part of the selection process. In addition to the time and effort dedicated to developing and managing the RFP, hospitals also may face challenges in keeping pace with the changing economics of the real estate development industry.

One of the biggest challenges health systems face when issuing a RFP is in maintaining maximum negotiating leverage for as long as possible when selecting a developer for a new project. Three critical steps can enhance the negotiating leverage of health systems when managing the developer selection process: understanding the risk-return profile of the equity backing the developer, establishing confidence in the developer's ability to achieve target value design, and diligently vetting all legal documentation associated with the project.

UNDERSTANDING THE EQUITY

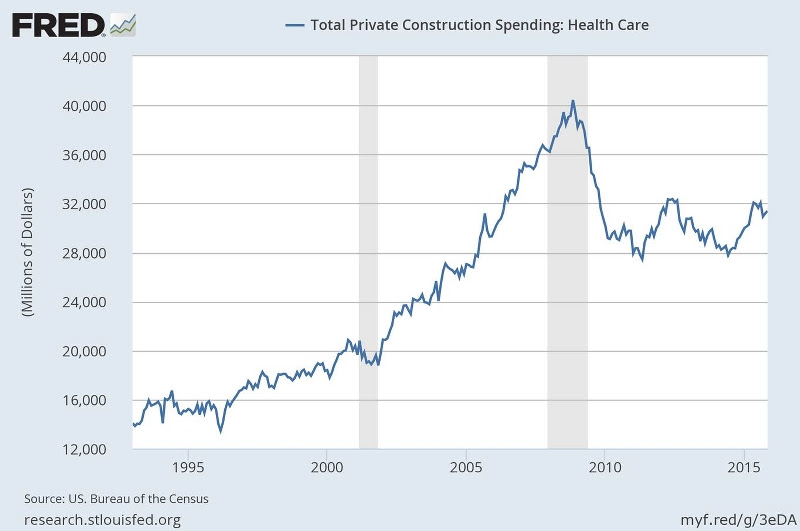

A health system increases its likelihood of negotiating the best terms for a new project by understanding the dynamic of the equity source behind a developer. Although the demand for healthcare development projects among equity sources has significantly increased in recent years, the number of opportunities to place the equity remains below prerecession levels. The healthcare development market peaked in 2008 with $40.4 billion in private U.S. healthcare construction spending, and it remains 23 percent below that, at $31 billion, as of November 2015.

Total Private Construction Spending: Health Care

Total Private Construction Spending: Health Care

In a market with limited opportunities to place capital, low interest rates, and an abundance of debt and equity that is pursuing healthcare real estate, developer yields continue to compress for the most competitive projects, to the point that healthcare developers are much less likely to fund new projects through investment from "friends and family." Instead, developers looking to compete are seeking the most aggressive sources of capital, which typically take the form of equity from pension funds and publicly traded real estate investment trusts (REITs).

Although pension funds have the lowest cost of capital in today's market, their commitments to new projects are closely tied to the geographic location of the project and the credit of the health system. The most active state pension funds with allocations to healthcare real estate, usually advised through investment managers, include those in Alaska, Arizona, Kentucky, Massachusetts, Michigan, New Jersey, Wisconsin and

Texas. As public pensions shift their asset allocation toward the "endowment model," which historically has had higher allocations in alternative assets, we expect this capital source to correspondingly increase allocations to commercial real estate. Pension funds are primarily seeking real estate development opportunities, including through health systems that are in primary and secondary markets with backing by investment-grade credit. Although pension funds may have very specific criteria, they typically are able to offer greater flexibility regarding forward equity commitments, ground lease structuring, and purchase options by the hospital sponsor, and ownership models for physician tenants.

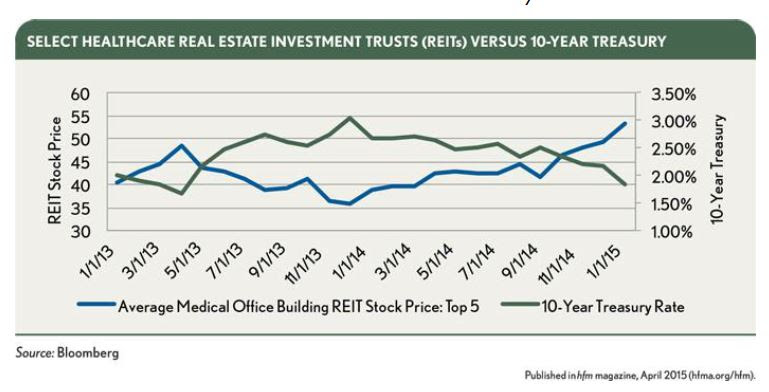

Although public REITs have less flexibility than pension fund equity, they typically offer longer term stability. REITs, as an asset class, generally do not sell their owned facilities because each asset in their portfolio provides rental income that supports the payout of dividends to their shareholders. As a potentially infinite holder of real estate, REITs historically have served as a preferred equity source for health systems. However, REITs are more interest-rate sensitive than any other equity source for developers, and generally are unable to offer a fixed forward equity commitment more than 12 months in advance for any project. REIT stock prices tend to move counter to fixed-income interest rates, such as the 10-year Treasury note. As interest rates decrease, stock prices for REITs tend to increase because they pay investor dividends, which typically float between 4 and 5 percent. Investors faced with rising interest rates tend to move away from dividend-generating stocks and toward options with higher yields.

Select Healthcare REITs Versus 10-Year Treasury

Select Healthcare REITs Versus 10-Year Treasury

BALANCING COSTS WITH DESIGN

During the developer proposal selection process, health systems should beware that the lowest yield does not always produce the lowest lease rate. Health systems typically emphasize the lease constant or developer yield, but pay less attention to the other variables in the equation, such as the cost of construction or miscellaneous fees.

A key question health systems should ask is whether the developer is experienced in achieving target value design (TVD) while delivering a state-of-the art facility. TVD delivers value to the health system through the design process while recognizing the importance of constraints such as construction costs. TVD was a target-costing practice popularized in Japan during the economically turbulent 1990s to create high-quality, cost-efficient facilities. The process aims to push the developer, architect, and general contractor to excel and innovate through the exclusion of standard approaches to design and construction. The use of financial targets and consideration of the expected value to the health system can drive creativity and problem solving. Developers often do not select their architect or general contractor before submitting their proposal to ensure that the hospital helps in the selection process for those positions and supports them. Hospitals can enhance their standard role in the selection process by reviewing a short list of the developer's proposed architects and general contractors to help gauge their historical success in achieving TVD.

As part of the selection process, health systems can go beyond simply analyzing the developer's fee by comparing miscellaneous fees, such as those for feasibility studies, project management, leasing, and financing. When miscellaneous fees surface after the developer is selected, the overall budget is increased, leaving the health system to ultimately grapple with a higher rental rate.

INVOLVING LEGAL EXPERTISE EARLY

Before beginning the developer selection process, health systems should determine their priorities. A memorandum of understanding should clearly state preferences regarding issues such as future options to purchase the facility, rights of first refusal to lease the space, specific ground-lease control provisions, and physician ownership models. The health system should share this document with the short list of developers in the final round of the selection process, and should request redline comments from the developer's legal counsel. At this point in the selection process, the involved parties generally are provided with key legal documents, such as the developer agreement, ground lease (if applicable), and space lease, to make a final selection. Although the developer may formally present the proposal, the legal documents often are provided for comment to the equity source backing the developer. A critical step is for the health system to review redline comments while it still has leverage, to bolster its negotiating position if the equity source responds with any comments that conflict with the health system's goals.

CONCLUSION

By running a detailed and competitive process from the beginning while in a position of leverage, a health system can benefit from a more streamlined process and from minimized risk after selecting a developer for a new project.

Footnote

a. Lease Constant: The developer and tenant agree on a factor (called a lease constant or developer yield) to be multiplied by the total development cost of the project to determine the initial annual rent. For example, if the lease constant/developer yield is 9 percent and the project cost for a 75,000-square-foot medical office building is $20 million, then the initial rent would be $1.8 million, or $24 per square foot.

About the Author: Chris Bodnar joined CBRE in 2003 and is an Executive Vice President of the Investment Properties division and co-leads the CBRE Healthcare Capital Markets Group with his business partner Lee Asher. Disciplined in the specialty of Investment Sales, Mr. Bodnar has been involved in the disposition of over 10 million square feet of commercial assets, exceeding a total value of $3 billion dollars on behalf of his clients since 2010.

Related Stories

| Nov 19, 2013

Pediatric design in an adult hospital setting

Freestanding pediatric facilities have operational and physical characteristics that differ from those of adult facilities.

| Nov 19, 2013

Top 10 green building products for 2014

Assa Abloy's power-over-ethernet access-control locks and Schüco's retrofit façade system are among the products to make BuildingGreen Inc.'s annual Top-10 Green Building Products list.

| Nov 18, 2013

6 checkpoints when designing a pediatric healthcare unit

As more time and money is devoted to neonatal and pediatric research, evidence-based design is playing an increasingly crucial role in the development of healthcare facilities for children. Here are six important factors AEC firms should consider when designing pediatric healthcare facilities.

| Nov 15, 2013

Greenbuild 2013 Report - BD+C Exclusive

The BD+C editorial team brings you this special report on the latest green building trends across nine key market sectors.

| Nov 15, 2013

Pedia-Pod: A state-of-the-art pediatric building module

This demonstration pediatric treatment building module is “kid-friendly,” offering a unique and cheerful environment where a child can feel most comfortable.

| Nov 14, 2013

Behind the build: BD+C's 'Pedia-Pod' modular pediatric patient unit at Greenbuild 2013 [slideshow]

Next week at Greenbuild, BD+C will unveil its demonstration pediatric patient unit, called Pedia-Pod. Here's a behind-the-scenes look at the construction of this unique modular structure.

| Nov 13, 2013

Installed capacity of geothermal heat pumps to grow by 150% by 2020, says study

The worldwide installed capacity of GHP systems will reach 127.4 gigawatts-thermal over the next seven years, growth of nearly 150%, according to a recent report from Navigant Research.

| Nov 8, 2013

Oversized healthcare: How did we get here and how do we right-size?

Healthcare facilities, especially our nation's hospitals, have steadily become larger over the past couple of decades. The growth has occurred despite stabilization, and in some markets, a decline in inpatient utilization.

| Nov 1, 2013

CBRE Group enhances healthcare platform with acquisition of KLMK Group

CBRE Group, Inc. (NYSE:CBG) today announced that it has acquired KLMK Group, a leading provider of facility consulting, project advisory and facility activation solutions to the healthcare industry.

| Oct 30, 2013

15 stellar historic preservation, adaptive reuse, and renovation projects

The winners of the 2013 Reconstruction Awards showcase the best work of distinguished Building Teams, encompassing historic preservation, adaptive reuse, and renovations and additions.