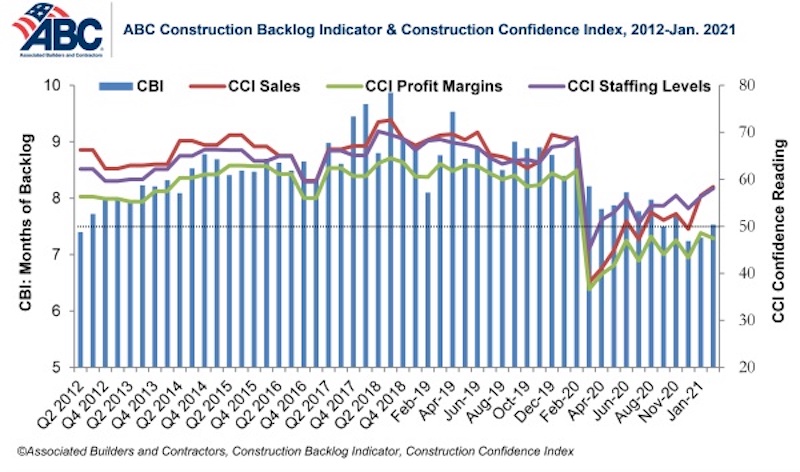

Associated Builders and Contractors reported today that its Construction Backlog Indicator rose to 7.5 months in January 2021, an increase of 0.2 months from its December 2020 reading, according to an ABC member survey conducted from Jan. 20 to Feb. 2. Despite the monthly uptick, backlog is 0.9 months lower than in January 2020.

ABC’s Construction Confidence Index readings for sales and staffing levels increased in January and remain above the threshold of 50, indicating expectations of growth over the next six months. The index reading for profit margins remained below that threshold, slipping to 47.5 in January.

“Though nonresidential construction spending has continued to recede for the better part of a year, the growing consensus is that the next six months will be a period of improvement,” said ABC Chief Economist Anirban Basu. “While backlog is down substantially from its January 2020 level and profit margins remain under pressure, more than half of contractors expect sales to rise over the next six months and nearly half expect to increase staffing levels.

“The anticipation is that the second half of the year will be spectacular for the U.S. economy from a growth perspective, which will help lift industry fortunes as 2022 approaches,” said Basu. “But that is not the entire story. There are also public health and supply chain considerations. During the COVID-19 pandemic, many contractors experienced repeated interruptions in project work. Acquiring key materials and equipment has also become more difficult, with occasional price shocks for certain commodities. With vaccinations proceeding apace, many contractors will benefit from fewer interruptions going forward and the restart of many postponed projects.”

Related Stories

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.

Market Data | Oct 9, 2019

Two ULI reports foresee a solid real estate market through 2021

Market watchers, though, caution about a “surfeit” of investment creating a bubble.

Market Data | Oct 4, 2019

Global construction output growth will decline to 2.7% in 2019

It will be the slowest pace of growth in a decade, according to GlobalData.