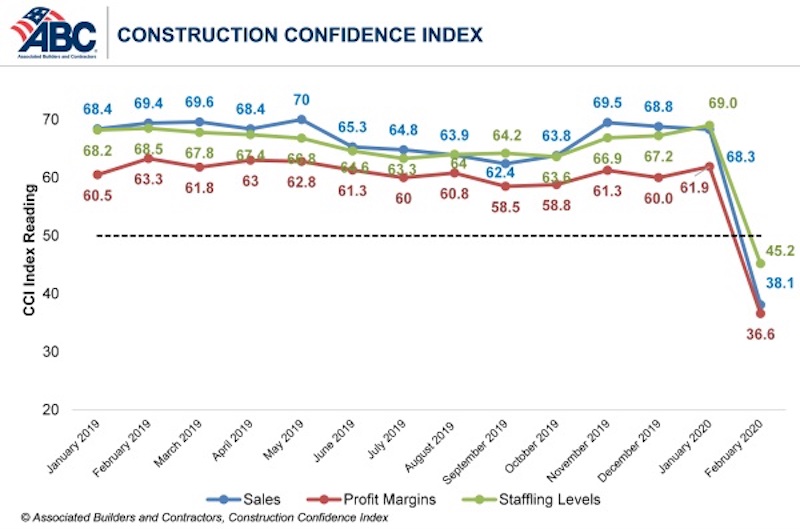

Confidence among U.S. construction industry leaders plummeted in February due to expectations of the economic fallout associated with COVID-19, according to the Associated Builders and Contractors Construction Confidence Index released today. Readings for sales, profit margins and staffing levels expectations fell below the threshold of 50 for the first time in the history of the series, signaling expected contraction along all three dimensions.

As of February 2020, fewer than 30% of contractors expected their sales to increase over the next six months, while less than 20% of contractors expected their profit margins to increase. More than one in five contractors expect a significant decrease in profit margins, while one in four expect a significant decline in sales volumes.

- The CCI for sales expectations decreased from 68.3 to 38.1 in February.

- The CCI for profit margin expectations decreased from 61.9 to 36.6.

- The CCI for staffing levels decreased from 69 to 45.2.

“In the course of a month, construction industry confidence has shifted from ecstatic to utterly dismayed,” said ABC Chief Economist Anirban Basu. “If anything, confidence is likely to decline further as construction industry leaders come to terms with the full extent of the COVID-19 crisis. The finances of key sources of demand for construction services, including commercial real estate investment trusts, state and local governments, retailers and hoteliers, have been savaged by the crisis, translating into fewer funds available to finance construction.

“Normally, construction activity is partially shielded from the initial stages of downturn due to the presence of backlog, which stood at 8.2 months as of February 2020,” said Basu. “But this time is at least somewhat different, with certain construction activities halted in California, Pennsylvania, Massachusetts and elsewhere. While construction will hold up better in the near-term than retail, restaurants, airlines, auto manufacturing, lodging and a number of other key industries, its recovery is also likely to be less profound than in these other segments absent a federal infrastructure-oriented stimulus package.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

Related Stories

Market Data | Jan 5, 2021

Barely one-third of metros add construction jobs in latest 12 months

Dwindling list of project starts forces contractors to lay off workers.

Market Data | Jan 4, 2021

Nonresidential construction spending shrinks further in November

Many commercial projects languish, even while homebuilding soars.

Market Data | Dec 29, 2020

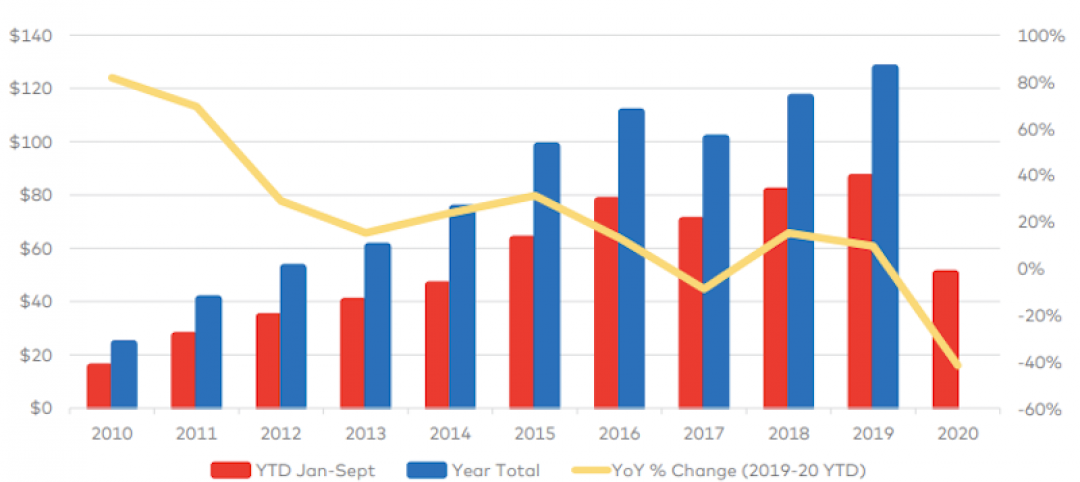

Multifamily transactions drop sharply in 2020, according to special report from Yardi Matrix

Sales completions at end of Q3 were down over 41 percent from the same period a year ago.

Market Data | Dec 28, 2020

New coronavirus recovery measure will provide some needed relief for contractors coping with project cancellations, falling demand

Measure’s modest amount of funding for infrastructure projects and clarification that PPP loans may not be taxed will help offset some of the challenges facing the construction industry.

Market Data | Dec 28, 2020

Construction employment trails pre-pandemic levels in 35 states despite gains in industry jobs from October to November in 31 states

New York and Vermont record worst February-November losses, Virginia has largest pickup.

Market Data | Dec 16, 2020

Architecture billings lose ground in November

The pace of decline during November accelerated from October, posting an Architecture Billings Index (ABI) score of 46.3 from 47.5.

AEC Tech | Dec 8, 2020

COVID-19 affects the industry’s adoption of ConTech in different ways

A new JLL report assesses which tech options got a pandemic “boost.”

Market Data | Dec 7, 2020

Construction sector adds 27,000 jobs in November

Project cancellations, looming PPP tax bill will undercut future job gains.

Market Data | Dec 3, 2020

Only 30% of metro areas add construction jobs in latest 12 months

Widespread project postponements and cancellations force layoffs.

Market Data | Dec 2, 2020

New Passive House standards offers prescriptive path that reduces costs

Eliminates requirement for a Passive House consultant and attendant modeling.