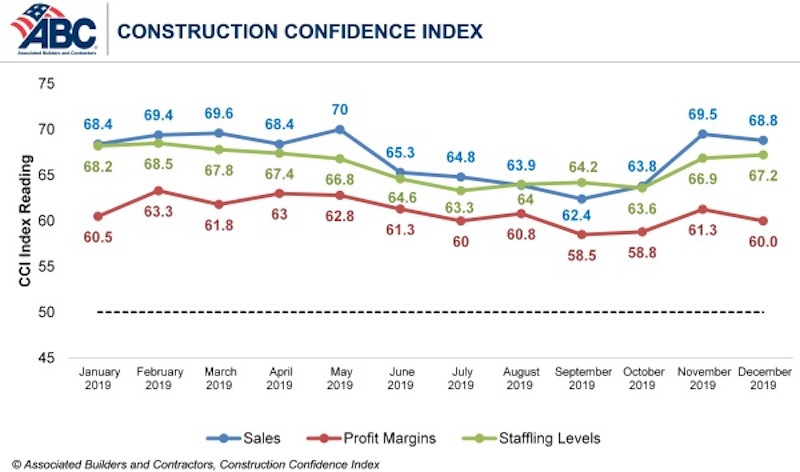

Confidence among U.S. construction industry leaders held steady in December 2019 after surging in November, according to the Associated Builders and Contractors Construction Confidence Index released today. The average American contractor entered 2020 with confidence: Sales expectations, profit margins and staffing levels all remained above the growth expectations threshold, indicating a strong start to 2020.

70% of contractors expect their sales to increase over the first half of 2020, while nearly the same percentage of contractors expect to increase their staffing levels. Nearly half of contractors expect their profit margins to increase, while just 12% expect them to decline over the next two quarters.

- The CCI for sales expectations decreased from 69.5 to 68.8 in December.

- The CCI for profit margin expectations decreased from 61.3 to 60.

- The CCI for staffing levels increased from 66.9 to 67.2

“The U.S. economy is humming, and among the principal beneficiaries of that performance are nonresidential contractors,” said ABC Chief Economist Anirban Basu. “Sales expectations, despite inching a bit lower in December, remain especially robust, with seven in 10 survey respondents expecting sales increases and fewer than one in 10 expecting their sales to decline during the first half of 2020. Recently released data regarding construction spending and hiring in the U.S. strongly suggest that this confidence is justified. ABC’s Construction Backlog Indicator dipped in December but still indicates that contractors remain busy.

“Despite broad optimism regarding sales prospects, contractors’ expectations are somewhat more subdued regarding profit margins,” said Basu. “Though materials prices have been generally stable and energy prices have declined recently, workers are becoming more expensive, both in terms of wages and benefits. Shortfalls in the skilled trades are apparent throughout the nation, especially in the booming markets of the South and West. With U.S. unemployment hovering near a 50-year low, many construction workers may find opportunities in other segments, including logistics, and retirement rates remain elevated. All of this translates into ongoing increases in compensation costs and a squeeze on margins.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

Related Stories

Market Data | Mar 24, 2021

Architecture billings climb into positive territory after a year of monthly declines

AIA’s ABI score for February was 53.3 compared to 44.9 in January.

Market Data | Mar 22, 2021

Construction employment slips in 225 metros from January 2020 to January 2021

Rampant cancellations augur further declines ahead.

Market Data | Mar 18, 2021

Commercial Construction Contractors’ Outlook lifts on rising revenue expectations

Concerns about finding skilled workers, material costs, and steel tariffs linger.

Market Data | Mar 16, 2021

Construction employment in January lags pre-pandemic mark in 42 states

Canceled projects, supply-chain woes threaten future jobs.

Market Data | Mar 15, 2021

Rising materials prices and supply chain disruptions are hurting many construction firms

The same firms are already struggling to cope with pandemic impacts.

Market Data | Mar 11, 2021

Soaring materials costs, supply-chain problems, and project cancellations continue to impact construction industry

Costs and delayed deliveries of materials, parts, and supplies are vexing many contractors.

Market Data | Mar 8, 2021

Construction employment declines by 61,000 in February

Association officials urge congress and Biden administration to focus on new infrastructure funding.

Market Data | Mar 2, 2021

Construction spending rises in January as private nonresidential sector stages rare gain

Private nonresidential market shrinks 10% since January 2020 with declines in all 11 segments.

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.

Market Data | Feb 23, 2021

Architectural billings continue to contract in 2021

AIA’s Architecture Billings Index (ABI) score for January was 44.9 compared to 42.3 in December.