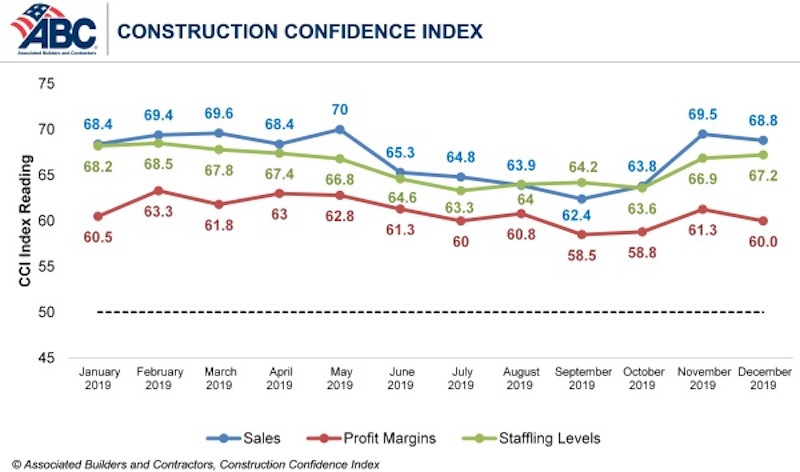

Confidence among U.S. construction industry leaders held steady in December 2019 after surging in November, according to the Associated Builders and Contractors Construction Confidence Index released today. The average American contractor entered 2020 with confidence: Sales expectations, profit margins and staffing levels all remained above the growth expectations threshold, indicating a strong start to 2020.

70% of contractors expect their sales to increase over the first half of 2020, while nearly the same percentage of contractors expect to increase their staffing levels. Nearly half of contractors expect their profit margins to increase, while just 12% expect them to decline over the next two quarters.

- The CCI for sales expectations decreased from 69.5 to 68.8 in December.

- The CCI for profit margin expectations decreased from 61.3 to 60.

- The CCI for staffing levels increased from 66.9 to 67.2

“The U.S. economy is humming, and among the principal beneficiaries of that performance are nonresidential contractors,” said ABC Chief Economist Anirban Basu. “Sales expectations, despite inching a bit lower in December, remain especially robust, with seven in 10 survey respondents expecting sales increases and fewer than one in 10 expecting their sales to decline during the first half of 2020. Recently released data regarding construction spending and hiring in the U.S. strongly suggest that this confidence is justified. ABC’s Construction Backlog Indicator dipped in December but still indicates that contractors remain busy.

“Despite broad optimism regarding sales prospects, contractors’ expectations are somewhat more subdued regarding profit margins,” said Basu. “Though materials prices have been generally stable and energy prices have declined recently, workers are becoming more expensive, both in terms of wages and benefits. Shortfalls in the skilled trades are apparent throughout the nation, especially in the booming markets of the South and West. With U.S. unemployment hovering near a 50-year low, many construction workers may find opportunities in other segments, including logistics, and retirement rates remain elevated. All of this translates into ongoing increases in compensation costs and a squeeze on margins.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

Related Stories

Market Data | Jun 22, 2018

Multifamily market remains healthy – Can it be sustained?

New report says strong economic fundamentals outweigh headwinds.

Market Data | Jun 21, 2018

Architecture firm billings strengthen in May

Architecture Billings Index enters eighth straight month of solid growth.

Market Data | Jun 20, 2018

7% year-over-year growth in the global construction pipeline

There are 5,952 projects/1,115,288 rooms under construction, up 8% by projects YOY.

Market Data | Jun 19, 2018

ABC’s Construction Backlog Indicator remains elevated in first quarter of 2018

The CBI shows highlights by region, industry, and company size.

Market Data | Jun 19, 2018

America’s housing market still falls short of providing affordable shelter to many

The latest report from the Joint Center for Housing Studies laments the paucity of subsidies to relieve cost burdens of ownership and renting.

Market Data | Jun 18, 2018

AI is the path to maximum profitability for retail and FMCG firms

Leading retailers including Amazon, Alibaba, Lowe’s and Tesco are developing their own AI solutions for automation, analytics and robotics use cases.

Market Data | Jun 12, 2018

Yardi Matrix report details industrial sector's strength

E-commerce and biopharmaceutical companies seeking space stoke record performances across key indicators.

Market Data | Jun 8, 2018

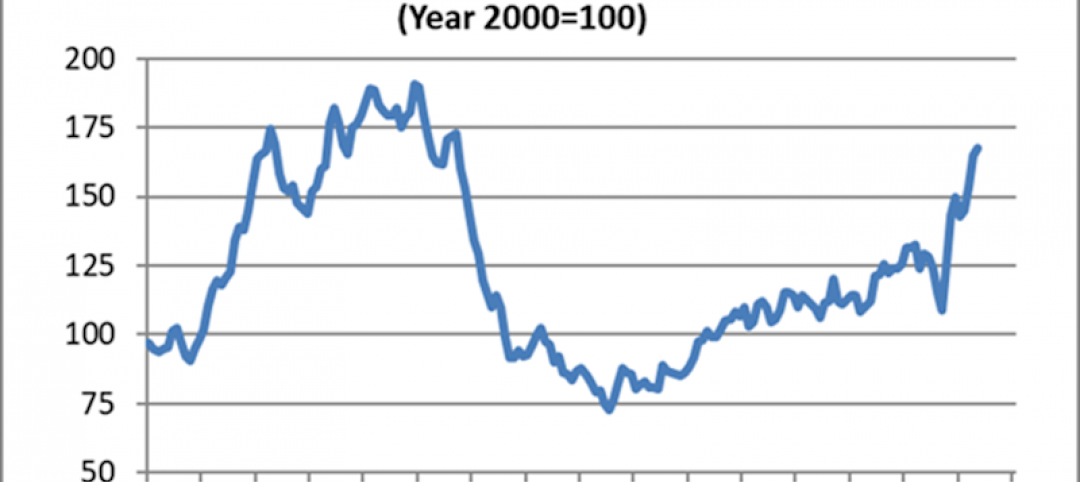

Dodge Momentum Index inches up in May

May’s gain was the result of a 4.7% increase by the commercial component of the Momentum Index.

Market Data | Jun 4, 2018

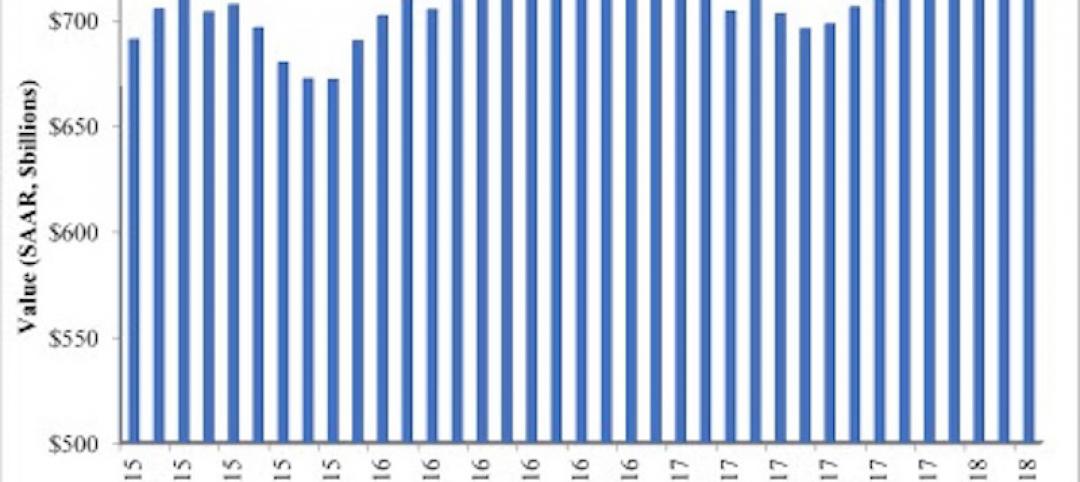

Nonresidential construction remains unchanged in April

Private sector spending increased 0.8% on a monthly basis and is up 5.3% from a year ago.

Market Data | May 30, 2018

Construction employment increases in 256 metro areas between April 2017 & 2018

Dallas-Plano-Irving and Midland, Texas experience largest year-over-year gains; St. Louis, Mo.-Ill. and Bloomington, Ill. have biggest annual declines in construction employment amid continuing demand.