Overcapacity in global iron ore production was a major factor in keeping construction costs low through the first four months of 2015. And for the first time in years, subcontractor labor costs showed signs of softening.

Those are two key findings in the latest assessment of current and future pricing from IHS, the Englewood, Colo.-based market analysis firm.

IHS derives its monthly Cost Index from information it receives from member procurement executives working for several of the world’s largest construction and engineering companies, including AECOM and Bechtel. It breaks down those data into current pricing trends and projections for six months forward.

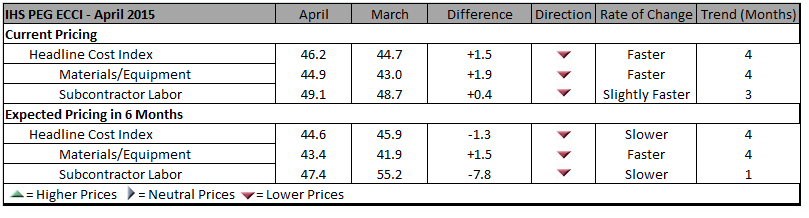

In April, its Cost Index was 46.2, a bit higher than 44.7 in March, but still below what IHS would consider a “neutral” reading. Its sub index for Materials/Equipment costs in April was 44.9 compared to 43.0 in March. And the April sub index for Subcontractor Labor costs stood at 49.1, compared to 48.7 in March.

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

IHS notes that eight of 12 construction components it tracks registered falling prices in April, led by carbon steel pipe and fabricated structural steel. Both are victims of “bloated capacity, weak profit growth, and lackluster demand,” explains John Anton, IHS’s Director of Steel Services. Iron ore companies that, in response to demand from China’s steel industry, have initiated massive projects whose capacity, so far, “is far ahead of demand,” and is holding prices down.

Anton adds that while the iron ore market may have some ostensible similarities to the recent decline of crude oil prices, what’s different is that iron ore producers have shown no inclinations toward cutting production to match demand. (IHS points out that three quarters of China’s mines are losing money.)

IHS also notes that several global construction and engineering firms, particularly those in the oil and gas sectors, have been taking a “wait and see” approach to investing in larger capital projects. “The capex environment has yet to thaw,” asserts Mark Eisinger, IHS’s senior economist.

While some markets, like the U.S. South, are still experiencing shortages in skilled subcontractor labor, manpower costs have been receding. For the third consecutive month, the U.S. did not register higher month-to-month labor costs in April. And for the first time in this survey’s history, projections about labor costs over the next six months are below the neutral mark. The six-month cost index for subcontractor labor fell to 47.4 in April, compared to 55.2 in March.

The forward-looking index for materials and equipment, at 43.4 April, rose from March’s record low of 41.9, even as 10 of 12 components showed falling price expectations.

Related Stories

AEC Tech | May 1, 2023

Utilizing computer vision, AI technology for visual jobsite tasks

Burns & McDonnell breaks down three ways computer vision can effectively assist workers on the job site, from project progress to safety measures.

| Apr 28, 2023

$1 billion mixed-use multifamily development will add 1,200 units to South Florida market

A giant $1 billion residential project, The District in Davie, will bring 1.6 million sf of new Class A residential apartments to the hot South Florida market. Located near Ft. Lauderdale and greater Miami, the development will include 36,000 sf of restaurants and retail space. The development will also provide 1.1 million sf of access controlled onsite parking with 2,650 parking spaces.

Design Innovation Report | Apr 27, 2023

BD+C's 2023 Design Innovation Report

Building Design+Construction’s Design Innovation Report presents projects, spaces, and initiatives—and the AEC professionals behind them—that push the boundaries of building design. This year, we feature four novel projects and one building science innovation.

Mixed-Use | Apr 27, 2023

New Jersey turns a brownfield site into Steel Tech, a 3.3-acre mixed-use development

In Jersey City, N.J., a 3.3-acre redevelopment project called Steel Tech will turn a brownfield site into a mixed-use residential high-rise building, a community center, two public plazas, and a business incubator facility. Steel Tech received site plan approval in recent weeks.

Multifamily Housing | Apr 27, 2023

Watch: Specifying materials in multifamily housing projects

A trio of multifamily housing experts discusses trends in materials in their latest developments. Topics include the need to balance aesthetics and durability, the advantages of textured materials, and the benefits of biophilia.

AEC Tech Innovation | Apr 27, 2023

Does your firm use ChatGPT?

Is your firm having success utilizing ChatGPT (or other AI chat tools) on your building projects or as part of your business operations? If so, we want to hear from you.

Concrete Technology | Apr 24, 2023

A housing complex outside Paris is touted as the world’s first fully recycled concrete building

Outside Paris, Holcim, a Swiss-based provider of innovative and sustainable building solutions, and Seqens, a social housing provider in France, are partnering to build Recygénie—a 220-unit housing complex, including 70 social housing units. Holcim is calling the project the world’s first fully recycled concrete building.

Multifamily Housing | Apr 21, 2023

Arlington County, Va., eliminates single-family-only zoning

Arlington County, a Washington, D.C., community that took shape in the 1950s, when single-family homes were the rule in suburbia, recently became one of the first locations on the East Coast to eliminate single-family-only zoning.

Green | Apr 21, 2023

Top 10 green building projects for 2023

The Harvard University Science and Engineering Complex in Boston and the Westwood Hills Nature Center in St. Louis are among the AIA COTE Top Ten Awards honorees for 2023.

Multifamily Housing | Apr 19, 2023

Austin’s historic Rainey Street welcomes a new neighbor: a 48-story mixed-used residential tower

Austin’s historic Rainey Street is welcoming a new neighbor. The Paseo, a 48-story mixed-used residential tower, will bring 557 apartments and two levels of retail to the popular Austin entertainment district, known for houses that have been converted into bungalow bars and restaurants.