Overcapacity in global iron ore production was a major factor in keeping construction costs low through the first four months of 2015. And for the first time in years, subcontractor labor costs showed signs of softening.

Those are two key findings in the latest assessment of current and future pricing from IHS, the Englewood, Colo.-based market analysis firm.

IHS derives its monthly Cost Index from information it receives from member procurement executives working for several of the world’s largest construction and engineering companies, including AECOM and Bechtel. It breaks down those data into current pricing trends and projections for six months forward.

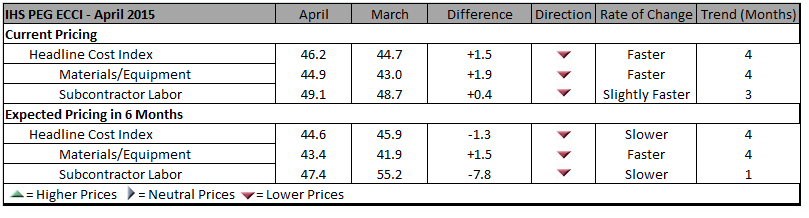

In April, its Cost Index was 46.2, a bit higher than 44.7 in March, but still below what IHS would consider a “neutral” reading. Its sub index for Materials/Equipment costs in April was 44.9 compared to 43.0 in March. And the April sub index for Subcontractor Labor costs stood at 49.1, compared to 48.7 in March.

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

IHS notes that eight of 12 construction components it tracks registered falling prices in April, led by carbon steel pipe and fabricated structural steel. Both are victims of “bloated capacity, weak profit growth, and lackluster demand,” explains John Anton, IHS’s Director of Steel Services. Iron ore companies that, in response to demand from China’s steel industry, have initiated massive projects whose capacity, so far, “is far ahead of demand,” and is holding prices down.

Anton adds that while the iron ore market may have some ostensible similarities to the recent decline of crude oil prices, what’s different is that iron ore producers have shown no inclinations toward cutting production to match demand. (IHS points out that three quarters of China’s mines are losing money.)

IHS also notes that several global construction and engineering firms, particularly those in the oil and gas sectors, have been taking a “wait and see” approach to investing in larger capital projects. “The capex environment has yet to thaw,” asserts Mark Eisinger, IHS’s senior economist.

While some markets, like the U.S. South, are still experiencing shortages in skilled subcontractor labor, manpower costs have been receding. For the third consecutive month, the U.S. did not register higher month-to-month labor costs in April. And for the first time in this survey’s history, projections about labor costs over the next six months are below the neutral mark. The six-month cost index for subcontractor labor fell to 47.4 in April, compared to 55.2 in March.

The forward-looking index for materials and equipment, at 43.4 April, rose from March’s record low of 41.9, even as 10 of 12 components showed falling price expectations.

Related Stories

| Aug 11, 2022

Report examines supposed conflict between good design and effective cost management

A report by the American Institute of Architects and the Associated General Contractors of America takes a look at the supposed conflict between good design and effective cost management, and why it causes friction between architects and contractors.

Energy Efficiency | Aug 11, 2022

Commercial Energy Efficiency: Finally “In-the-Money!”

By now, many business leaders are out in front of policymakers on prioritizing the energy transition.

High-rise Construction | Aug 11, 2022

Saudi Arabia unveils plans for a one-building city stretching over 100 miles long

Saudi Arabia recently announced plans for an ambitious urban project called The Line—a one-building city in the desert that will stretch 170 kilometers (106 miles) long and only 200 meters (656 feet) wide.

| Aug 10, 2022

U.S. needs more than four million new apartments by 2035

Roughly 4.3 million new apartments will be necessary by 2035 to meet rising demand, according to research from the National Multifamily Housing Council (NMHC) and National Apartment Association.

| Aug 10, 2022

Gresham Smith Founder, Batey M. Gresham Jr., passes at Age 88

It is with deep sadness that Gresham Smith announces the passing of Batey M. Gresham Jr., AIA—one of the firm’s founders.

| Aug 9, 2022

Work-from-home trend could result in $500 billion of lost value in office real estate

Researchers find major changes in lease revenues, office occupancy, lease renewal rates.

| Aug 9, 2022

5 Lean principles of design-build

Simply put, lean is the practice of creating more value with fewer resources.

| Aug 9, 2022

Designing healthy learning environments

Studies confirm healthy environments can improve learning outcomes and student success.

Legislation | Aug 8, 2022

Inflation Reduction Act includes over $5 billion for low carbon procurement

The Inflation Reduction Act of 2022, recently passed by the U.S. Senate, sets aside over $5 billion for low carbon procurement in the built environment.

| Aug 8, 2022

Mass timber and net zero design for higher education and lab buildings

When sourced from sustainably managed forests, the use of wood as a replacement for concrete and steel on larger scale construction projects has myriad economic and environmental benefits that have been thoroughly outlined in everything from academic journals to the pages of Newsweek.