Overcapacity in global iron ore production was a major factor in keeping construction costs low through the first four months of 2015. And for the first time in years, subcontractor labor costs showed signs of softening.

Those are two key findings in the latest assessment of current and future pricing from IHS, the Englewood, Colo.-based market analysis firm.

IHS derives its monthly Cost Index from information it receives from member procurement executives working for several of the world’s largest construction and engineering companies, including AECOM and Bechtel. It breaks down those data into current pricing trends and projections for six months forward.

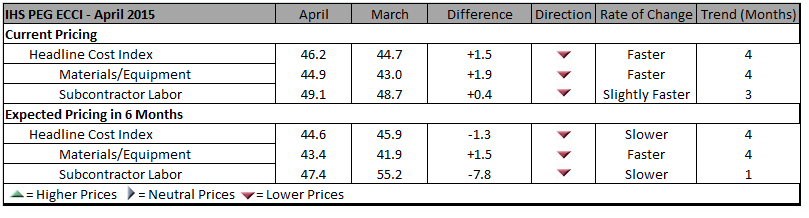

In April, its Cost Index was 46.2, a bit higher than 44.7 in March, but still below what IHS would consider a “neutral” reading. Its sub index for Materials/Equipment costs in April was 44.9 compared to 43.0 in March. And the April sub index for Subcontractor Labor costs stood at 49.1, compared to 48.7 in March.

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

IHS notes that eight of 12 construction components it tracks registered falling prices in April, led by carbon steel pipe and fabricated structural steel. Both are victims of “bloated capacity, weak profit growth, and lackluster demand,” explains John Anton, IHS’s Director of Steel Services. Iron ore companies that, in response to demand from China’s steel industry, have initiated massive projects whose capacity, so far, “is far ahead of demand,” and is holding prices down.

Anton adds that while the iron ore market may have some ostensible similarities to the recent decline of crude oil prices, what’s different is that iron ore producers have shown no inclinations toward cutting production to match demand. (IHS points out that three quarters of China’s mines are losing money.)

IHS also notes that several global construction and engineering firms, particularly those in the oil and gas sectors, have been taking a “wait and see” approach to investing in larger capital projects. “The capex environment has yet to thaw,” asserts Mark Eisinger, IHS’s senior economist.

While some markets, like the U.S. South, are still experiencing shortages in skilled subcontractor labor, manpower costs have been receding. For the third consecutive month, the U.S. did not register higher month-to-month labor costs in April. And for the first time in this survey’s history, projections about labor costs over the next six months are below the neutral mark. The six-month cost index for subcontractor labor fell to 47.4 in April, compared to 55.2 in March.

The forward-looking index for materials and equipment, at 43.4 April, rose from March’s record low of 41.9, even as 10 of 12 components showed falling price expectations.

Related Stories

Urban Planning | Jul 28, 2022

A former military base becomes a substation with public amenities

On the site of a former military base in the Hunters Point neighborhood of San Francisco, a new three-story substation will house critical electrical infrastructure to replace an existing substation across the street.

Hotel Facilities | Jul 28, 2022

As travel returns, U.S. hotel construction pipeline growth follows

According to the recently released United States Construction Pipeline Trend Report from Lodging Econometrics (LE), the total U.S. construction pipeline stands at 5,220 projects/621,268 rooms at the close of 2022’s second quarter, up 9% Year-Over-Year (YOY) by projects and 4% YOY by rooms.

Codes and Standards | Jul 27, 2022

Biden administration proposes drastic flood insurance reform

The Biden administration’s proposed major overhaul to the National Flood Insurance Program, or NFIP, would drastically alter how Americans protect homes and businesses against flooding.

Concrete | Jul 26, 2022

Consortium to set standards and create markets for low-carbon concrete

A consortium of construction firms, property developers, and building engineers have pledged to drive down the carbon emissions of concrete.

Green | Jul 26, 2022

Climate tech startup BlocPower looks to electrify, decarbonize the nation's buildings

The New York-based climate technology company electrifies and decarbonizes buildings—more than 1,200 of them so far.

Education Facilities | Jul 26, 2022

Malibu High School gets a new building that balances environment with education

In Malibu, Calif., a city known for beaches, surf, and sun, HMC Architects wanted to give Malibu High School a new building that harmonizes environment and education.

| Jul 26, 2022

Better design with a “brain break”

During the design process, there aren’t necessarily opportunities to implement “brain breaks,” brief moments to take a purposeful pause from the task at hand and refocus before returning to work.

Building Team | Jul 25, 2022

First Ismaili Center in the U.S. combines Islamic design with Texas influences

Construction has begun on the first Ismaili Center in the U.S. in Houston.

Codes and Standards | Jul 22, 2022

Office developers aim for zero carbon without offsets

As companies reassess their office needs in the wake of the pandemic, a new arms race to deliver net zero carbon space without the need for offsets is taking place in London, according to a recent Bloomberg report.

Codes and Standards | Jul 22, 2022

Hurricane-resistant construction may be greatly undervalued

New research led by an MIT graduate student at the school’s Concrete Sustainability Hub suggests that the value of buildings constructed to resist wind damage in hurricanes may be significantly underestimated.