Building revenue and demand for new commercial construction may be rising fast—but so are costs. Profitability for new commercial building projects will be tricky in 2015, as soaring demand may not lead to soaring profits.

“Leasing momentum is boosting construction demand across multiple commercial property sectors—but raw material and labor costs are making it more expensive to get out of the ground than ever before,” said Todd Burns, President, JLL Project and Development Services, Americas. “Demand is exploding, but demand isn’t everything. You have to consider the bottom line of every project to make sure it makes economic sense short- and long-term.”

Affirming rising demand, the American Institute of Architects’ Consensus Construction Forecast projects that spending on non-residential construction is expected to rise 7.7% in every commercial property sector this year. Likewise, the Construction Backlog Indicator, which tracks non-residential construction, hit a post-downturn high of 8.8 months in the third quarter of 2014.

A new JLL report on U.S. non-residential construction activity highlights several trends to watch in 2015:

- The construction industry remains 22% below peak (2007) levels. According to Gilbane, it may take seven to eight more years to retain previous levels.

- Recovery Continues, Backlog Builds. The overall value of buildings constructed has continued to grow since bottoming-out in 2010. The Construction Backlog Index has grown in all but the Southeast Region, indicating that 2015 will be a big year for construction. Office vacancy rates across the country have declined from 14.1% in 2012 to 10.9% in the fourth quarter of 2014, further strengthening demand. That said, cities with high labor costs and limited land, like New York and New Jersey, may see construction activity slow.

- Costs Climbing Higher. Although raw material costs are expected to stabilize in 2015, rising labor costs will force construction costs continue to grow. Cities such as New York and Chicago will feel the pain of cost hikes and so will Minneapolis where a massive downtown refurbishment is underway. Even Atlanta, one of the lowest-cost markets, saw a bump up in overall prices for the first time since 2008. This could be troublesome for the education sector, which reported the highest level of spending on construction in 2014 at $78.7 billion.

- The Construction Unemployment Paradox. Construction unemployment rates remain high, indicating a large potential employment pool for new construction. However, overall unemployment will drop quickly as building continues to grow. Though unemployment will drop, costs will continue to rise due to productivity issues; there is a lack of construction workers with the right skills and training, frustrating employers and driving up overall labor costs. Costs are also growing more quickly in union-centric markets. According to the U.S. Bureau of Labor Statistics, the lack of available workers with the right training will worsen even as 1.1 million construction jobs are added to the market by 2020. The construction industry has grown every month of 2014, gaining 48,000 jobs in December to reach 290,000 total in 2014. However, overall construction employment is still 1.5 million lower than its peak in 2007.

- Cheaper to Build Than to Lease. With more demand for new construction in some markets like Chicago, West L.A. and Seattle, replacement costs have become lower than purchase prices so constructing new space is more cost-effective than leasing existing space.

While the overall market is recovering, it’s not an even recovery. Construction of distribution facilities supporting e-commerce and retail supply chains will continue to expand, particularly in markets like Dallas and Miami, where new facilities are needed to support sophisticated logistics strategies. Conversely, due to a high volume of office projects started in 2014, more than 16 million sf of new office development is under construction in Houston; 44% of that space remains unleased, which may cause vacancy issues for the city down the road, especially if oil prices remain low.

“Vacancy rates for industrial properties have dropped in the last two years, and competition for big distribution centers has increased dramatically,” said Dana Westgren, research analyst with JLL. “Particularly in locations near ports and other key supply chain locations, new construction can replace older, now-obsolete facilities.”

Download a copy of the JLL U.S. Construction Perspective for Q4 2014 report here.

Related Stories

Giants 400 | Dec 5, 2023

Top 70 Federal Government Building Architecture Firms for 2023

Page Southerland Page, HOK, Gensler, LEO A DALY, and Stantec top BD+C's ranking of the nation's largest federal government building architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

University Buildings | Dec 5, 2023

The University of Cincinnati builds its largest classroom building to serve its largest college

The University of Cincinnati’s recently completed Clifton Court Hall unifies the school’s social science programs into a multidisciplinary research and education facility. The 185,400-sf structure is the university’s largest classroom building, serving its largest college, the College of Arts and Sciences.

MFPRO+ News | Dec 5, 2023

DOE's Zero Energy Ready Home Multifamily Version 2 released

The U.S. Department of Energy has released Zero Energy Ready Home Multifamily Version 2. The latest version of the certification program increases energy efficiency and performance levels, adds electric readiness, and makes compliance pathways and the certification process more consistent with the ENERGY STAR Multifamily New Construction (ESMFNC) program.

Giants 400 | Nov 28, 2023

Top 55 Laboratory Construction Firms for 2023

Whiting-Turner, DPR Construction, STO Building Group, Skanska, and Hensel Phelps top BD+C's ranking of the nation's largest laboratory general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Contractors | Nov 28, 2023

Swinerton’s special projects units allow the national GC to operate like a local boutique firm

Swinerton’s Carolinas Division has been particularly successful in attracting jobs that require a nimble touch.

Engineers | Nov 27, 2023

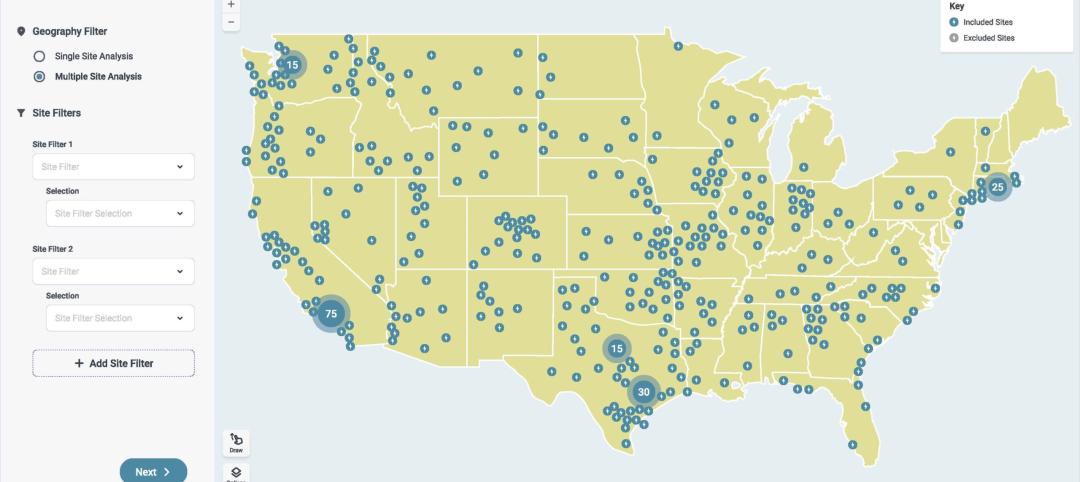

Kimley-Horn eliminates the guesswork of electric vehicle charger site selection

Private businesses and governments can now choose their new electric vehicle (EV) charger locations with data-driven precision. Kimley-Horn, the national engineering, planning, and design consulting firm, today launched TREDLite EV, a cloud-based tool that helps organizations develop and optimize their EV charger deployment strategies based on the organization’s unique priorities.

Market Data | Nov 27, 2023

Number of employees returning to the office varies significantly by city

While the return-to-the-office trend is felt across the country, the percentage of employees moving back to their offices varies significantly according to geography, according to Eptura’s Q3 Workplace Index.

Resiliency | Nov 27, 2023

All levels of government need to act to cope with climate-driven flooding and sea level rise

The latest National Climate Assessment highlights the need for local, state, and federal governments to adopt policies to mitigate the effects of climate-driven flooding and sea level rise, according to a policy expert with the National Resources Defense Council.

Contractors | Nov 27, 2023

A Minnesota GC offers workers Wellness Pods as a mental health option

A maternal need sparked this idea for Gardner Builders.

Cultural Facilities | Nov 21, 2023

Arizona’s Water Education Center will teach visitors about water conservation and reuse strategies

Phoenix-based architecture firm Jones Studio will design the Water Education Center for Central Arizona Project (CAP)—a 336-mile aqueduct system that delivers Colorado River water to almost 6 million people, more than 80% of the state’s population. The Center will allow the public to explore CAP’s history, operations, and impact on Arizona.