Building revenue and demand for new commercial construction may be rising fast—but so are costs. Profitability for new commercial building projects will be tricky in 2015, as soaring demand may not lead to soaring profits.

“Leasing momentum is boosting construction demand across multiple commercial property sectors—but raw material and labor costs are making it more expensive to get out of the ground than ever before,” said Todd Burns, President, JLL Project and Development Services, Americas. “Demand is exploding, but demand isn’t everything. You have to consider the bottom line of every project to make sure it makes economic sense short- and long-term.”

Affirming rising demand, the American Institute of Architects’ Consensus Construction Forecast projects that spending on non-residential construction is expected to rise 7.7% in every commercial property sector this year. Likewise, the Construction Backlog Indicator, which tracks non-residential construction, hit a post-downturn high of 8.8 months in the third quarter of 2014.

A new JLL report on U.S. non-residential construction activity highlights several trends to watch in 2015:

- The construction industry remains 22% below peak (2007) levels. According to Gilbane, it may take seven to eight more years to retain previous levels.

- Recovery Continues, Backlog Builds. The overall value of buildings constructed has continued to grow since bottoming-out in 2010. The Construction Backlog Index has grown in all but the Southeast Region, indicating that 2015 will be a big year for construction. Office vacancy rates across the country have declined from 14.1% in 2012 to 10.9% in the fourth quarter of 2014, further strengthening demand. That said, cities with high labor costs and limited land, like New York and New Jersey, may see construction activity slow.

- Costs Climbing Higher. Although raw material costs are expected to stabilize in 2015, rising labor costs will force construction costs continue to grow. Cities such as New York and Chicago will feel the pain of cost hikes and so will Minneapolis where a massive downtown refurbishment is underway. Even Atlanta, one of the lowest-cost markets, saw a bump up in overall prices for the first time since 2008. This could be troublesome for the education sector, which reported the highest level of spending on construction in 2014 at $78.7 billion.

- The Construction Unemployment Paradox. Construction unemployment rates remain high, indicating a large potential employment pool for new construction. However, overall unemployment will drop quickly as building continues to grow. Though unemployment will drop, costs will continue to rise due to productivity issues; there is a lack of construction workers with the right skills and training, frustrating employers and driving up overall labor costs. Costs are also growing more quickly in union-centric markets. According to the U.S. Bureau of Labor Statistics, the lack of available workers with the right training will worsen even as 1.1 million construction jobs are added to the market by 2020. The construction industry has grown every month of 2014, gaining 48,000 jobs in December to reach 290,000 total in 2014. However, overall construction employment is still 1.5 million lower than its peak in 2007.

- Cheaper to Build Than to Lease. With more demand for new construction in some markets like Chicago, West L.A. and Seattle, replacement costs have become lower than purchase prices so constructing new space is more cost-effective than leasing existing space.

While the overall market is recovering, it’s not an even recovery. Construction of distribution facilities supporting e-commerce and retail supply chains will continue to expand, particularly in markets like Dallas and Miami, where new facilities are needed to support sophisticated logistics strategies. Conversely, due to a high volume of office projects started in 2014, more than 16 million sf of new office development is under construction in Houston; 44% of that space remains unleased, which may cause vacancy issues for the city down the road, especially if oil prices remain low.

“Vacancy rates for industrial properties have dropped in the last two years, and competition for big distribution centers has increased dramatically,” said Dana Westgren, research analyst with JLL. “Particularly in locations near ports and other key supply chain locations, new construction can replace older, now-obsolete facilities.”

Download a copy of the JLL U.S. Construction Perspective for Q4 2014 report here.

Related Stories

AEC Innovators | Feb 28, 2023

Meet the 'urban miner' who is rethinking how we deconstruct and reuse buildings

New Horizon Urban Mining, a demolition firm in the Netherlands, has hitched its business model to construction materials recycling. It's plan: deconstruct buildings and infrastructure and sell the building products for reuse in new construction. New Horizon and its Founder Michel Baars have been named 2023 AEC Innovators by Building Design+Construction editors.

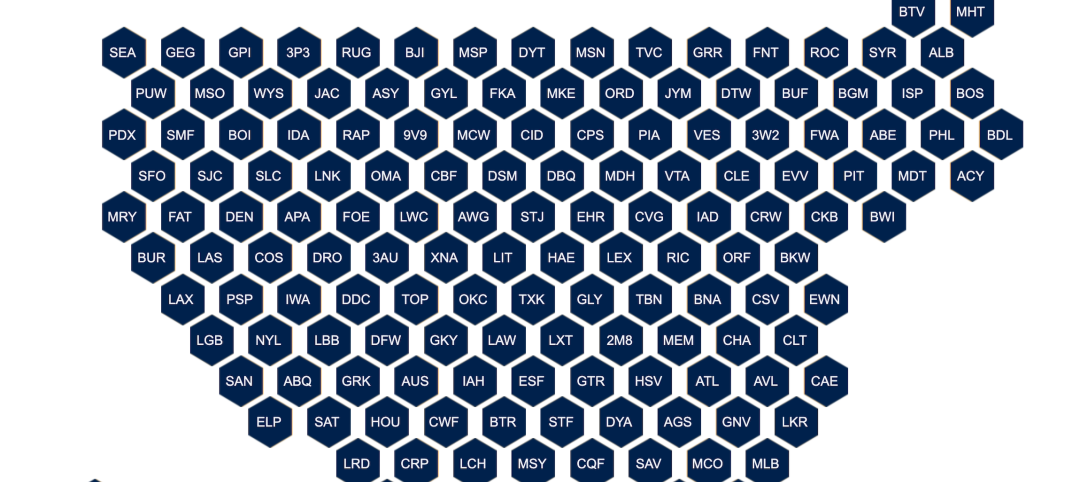

Airports | Feb 28, 2023

Data visualization: $1 billion earmarked for 2023 airport construction projects

Ninety-nine airports across 47 states and two territories are set to share nearly $1 billion in funding in 2023 from the Federal Aviation Administration. The funding is aimed at help airports of all sizes meet growing air travel demand, with upgrades like larger security checkpoints and more reliable and faster baggage systems.

Seismic Design | Feb 27, 2023

Turkey earthquakes provide lessons for California

Two recent deadly earthquakes in Turkey and Syria offer lessons regarding construction practices and codes for California. Lax building standards were blamed for much of the devastation, including well over 35,000 dead and countless building collapses.

Sports and Recreational Facilities | Feb 27, 2023

New 20,000-seat soccer stadium will anchor neighborhood development in Indianapolis

A new 20,000-seat soccer stadium for United Soccer League’s Indy Eleven will be the centerpiece of a major neighborhood development in Indianapolis. The development will transform the southwest quadrant of downtown Indianapolis by adding more than 600 apartments, 205,000 sf of office space, 197,000 sf for retail space and restaurants, parking garages, a hotel, and public plazas with green space.

Healthcare Facilities | Feb 21, 2023

Cleveland's Glick Center hospital anchors neighborhood revitalization

The newly opened MetroHealth Glick Center in Cleveland, a replacement acute care hospital for MetroHealth, is the centerpiece of a neighborhood revitalization. The eleven-story structure is located within a ‘hospital-in-a-park’ setting that will provide a bucolic space to the community where public green space is lacking. It will connect patients, visitors, and staff to the emotional and physical benefits of nature.

Multifamily Housing | Feb 21, 2023

Multifamily housing investors favoring properties in the Sun Belt

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix. Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever.

Multifamily Housing | Feb 21, 2023

New multifamily housing and mixed-use buildings in Portland, Ore., must be ready for electric vehicle charging

The Portland, Ore., City Council recently voted unanimously to require all new residential and mixed-use buildings to be ready for electric vehicle charging. The move amends Portland’s zoning laws to require all new multi-dwelling and mixed-use development of five or more units with onsite parking to provide electric vehicle charging infrastructure.

K-12 Schools | Feb 18, 2023

Atlanta suburb opens $85 million serpentine-shaped high school designed by Perkins&Will

In Ellenwood, Ga., a southeast suburb of Atlanta, Perkins and Will has partnered with Clayton County Public Schools and MEJA Construction to create a $85 million secondary school. Morrow High School, which opened in fall 2022, serves more than 2,200 students in Clayton County, a community with students from over 30 countries.

Museums | Feb 17, 2023

First Americans Museum uses design metaphors of natural elements to honor native worldview

First Americans Museum (FAM) in Oklahoma City honors the 39 tribes in Oklahoma today, reflecting their history through design metaphors of nature’s elements of earth, wind, water, and fire. The design concept includes multiple circles suggested by arcs, reflecting the native tradition of a circular worldview that encompasses the cycle of life, the seasons, and the rotation of the earth.

Multifamily Housing | Feb 16, 2023

Coastal Construction Group establishes an attainable multifamily housing division

Coastal Construction Group, one of the largest privately held construction companies in the Southeast, has announced a new division within their multifamily sector that will focus on the need for attainable housing in South Florida.