The resolution of global construction disputes remained steady in 2016, and the average time it took to resolve those disputes declined bit, according to the seventh annual Arcadis Global Construction Disputes Report 2017, which is subtitled “Avoiding the Same Pitfalls.”

This report reflects the construction disputes that Arcadis’ team handled around the world. The report infers that the roadblocks to expeditious and less cost dispute resolution often stem from the need for better contract administration, robust documentation, and a proactive approach to risk management.

“Our industry contains the best problem solvers in the world,” the report states. “But there often seems to be a lack of ability or willingness of the project participants to compromise and resolve disputes at the earliest and most inexpensive stage possible.” Roy Cooper, Senior Vice President of Arcadis Contract Solutions, attributes disputes to “human emotions that can impede settlements, as they do with physical factors such as differing site conditions and design errors.”

The world’s economic expansion generally is not seen as an impediment to resolving contract disputes. Global growth is projected at 3.5% in 2017, and 3.6% in 2018, according to the International Monetary Fund.

While the outlook is positive, the report sees risks in labor contraction, increasing commodities prices, and uncertain immigration policies. “A potential widening of global imbalances, coupled with sharp currency exchange rate movements, should those occur in response to major policy shifts, could further intensify protectionist pressures.”

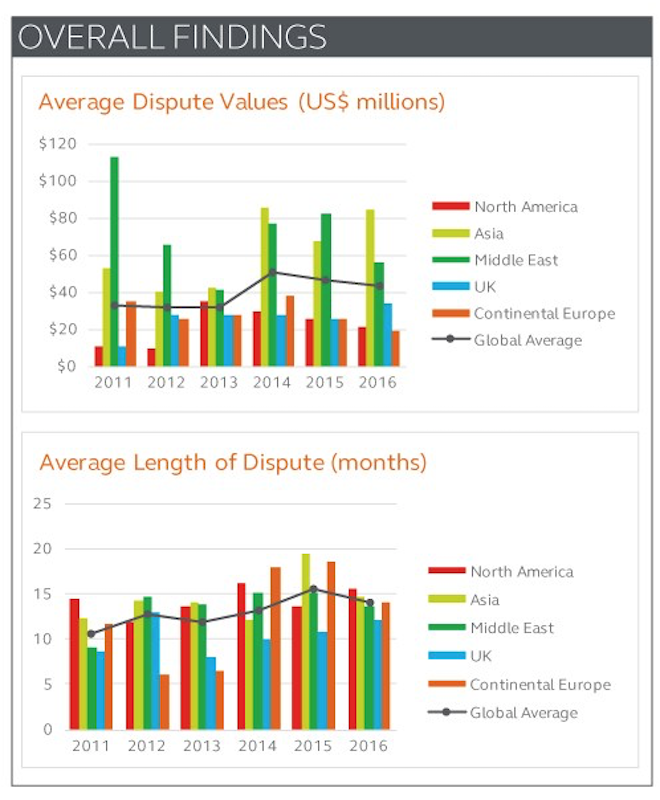

A summary of Arcadis' findings for 2016. Image: Arcadis US

That being said, the global average construction dispute value declined in 2016 by nearly 7% to US$42.8 million (and that includes one US$2 billion dispute Arcadis handled). Asia averaged the highest dispute value, at US$84 million, and the United Kingdom saw a double-digit increase in its average dispute value, to US$34 million.

The global average length of a dispute also fell slightly last year, to 14 months. North America’s dispute duration was the longest of all Arcadis’ regions, an average of 15.6 months. For the third consecutive year, the most common cause for disputes in North America in 2016 was errors and/or omissions in the contract documentation.

Asia had the highest average dispute value last year; North America the longest time it took to resolve a dispute. Image: Arcadis

Globally, Arcadis identifies failure to properly administer a contract among the five most common causes of disputes, along with poorly drafted or incomplete/unsubstantiated claims; the failure of an employer, contractor or subcontractor to understand or comply with its contractual obligations; errors and omissions in the contract; and incomplete design information or employer requires.

The most common methods to resolve construction disputes were, in order of preference, party-to-party negotiation, arbitration, and mediation.

And the most important activities to avoid disputes were led by proper contract administration, accurate documents, and fair and appropriate risk and balances in contracts.

Related Stories

Multifamily Housing | Jan 27, 2021

2021 multifamily housing outlook: Dallas, Miami, D.C., will lead apartment completions

In its latest outlook report for the multifamily rental market, Yardi Matrix outlined several reasons for hope for a solid recovery for the multifamily housing sector in 2021, especially during the second half of the year.

Market Data | Jan 26, 2021

Construction employment in December trails pre-pandemic levels in 34 states

Texas and Vermont have worst February-December losses while Virginia and Alabama add the most.

Market Data | Jan 19, 2021

Architecture Billings continue to lose ground

The pace of decline during December accelerated from November.

Market Data | Jan 19, 2021

2021 construction forecast: Nonresidential building spending will drop 5.7%, bounce back in 2022

Healthcare and public safety are the only nonresidential construction sectors that will see growth in spending in 2021, according to AIA's 2021 Consensus Construction Forecast.

Market Data | Jan 13, 2021

Atlanta, Dallas seen as most favorable U.S. markets for commercial development in 2021, CBRE analysis finds

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19.

Market Data | Jan 13, 2021

Nonres construction could be in for a long recovery period

Rider Levett Bucknall’s latest cost report singles out unemployment and infrastructure spending as barometers.

Market Data | Jan 13, 2021

Contractor optimism improves as ABC’s Construction Backlog inches up in December

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December.

Market Data | Jan 11, 2021

Turner Construction Company launches SourceBlue Brand

SourceBlue draws upon 20 years of supply chain management experience in the construction industry.

Market Data | Jan 8, 2021

Construction sector adds 51,000 jobs in December

Gains are likely temporary as new industry survey finds widespread pessimism for 2021.

Market Data | Jan 7, 2021

Few construction firms will add workers in 2021 as industry struggles with declining demand, growing number of project delays and cancellations

New industry outlook finds most contractors expect demand for many categories of construction to decline.