Construction employment increased by 61,000 jobs in February to the highest level since June 2008 as rising pay rates enabled the industry to attract more workers, according to an analysis of new government data by the Associated General Contractors of America. However, association officials cautioned that the Trump administration's newly imposed steel and aluminum tariffs have the potential to undermine future employment growth for the sector.

"Construction industry employment has accelerated over the past four months, and industry pay rates are now more than 10% higher than the private-sector average," said Ken Simonson, the association's Chief Economist. "However, steep tariffs on steel and aluminum will add to rapidly rising materials costs. The combination of higher materials and labor costs could push some contractors out of business and make many projects unaffordable."

Construction employment totaled 7,173,000 in February, a gain of 61,000 for the month and 254,000, or 3.7%, over 12 months. The economist pointed out that the year-over-year growth rate in industry jobs was more than double the 1.6% rise in total nonfarm payroll employment.

Residential construction—comprising residential building and specialty trade contractors—added 25,400 jobs in February and 107,500 jobs, or 4.0%, over the past 12 months. Nonresidential construction (building, specialty trades, and heavy and civil engineering construction) employment increased by 35,400 jobs in February and 147,200 positions, or 3.5%, over 12 months.

While the industry added over a quarter-million jobs during the past year, the number of unemployed job seekers with recent construction experience only fell by 49,000 between February 2017 and February 2018. The unemployment rate in construction dropped to 7.8% last month from 8.8% a year earlier. This suggests that most of the new hires at construction firms are from other sectors of the economy or new entrants to the labor force, Simonson said.

One reason so many people may be leaving other sectors for construction is that average hourly earnings in the industry climbed to $29.47, a rise of 3.3% from a year earlier. In contrast, the average for all nonfarm private-sector jobs rose just 2.6% in the past year, to $26.75. The construction rate is now 10.2% higher than the private-sector average, the economist said.

Construction officials said the new employment figures are an encouraging sign that demand for construction services remains robust. But they cautioned that the new tariffs will raise costs for firms, many of which are locked into fixed-price contracts with little ability to charge more for their services. This will leave many employers with less money to invest in equipment and personnel, they added.

"It is frustrating to see the potential benefits of the President's tax cuts and regulatory reforms being undermined by his short-sighted decision to impose tariffs," said Stephen E. Sandherr, the association's Chief Executive Officer. "The best way to help the U.S. steel and aluminum sector is to continue pushing measures, like regulatory reform and new infrastructure funding, that will boost demand for their products."

Related Stories

Market Data | Mar 29, 2017

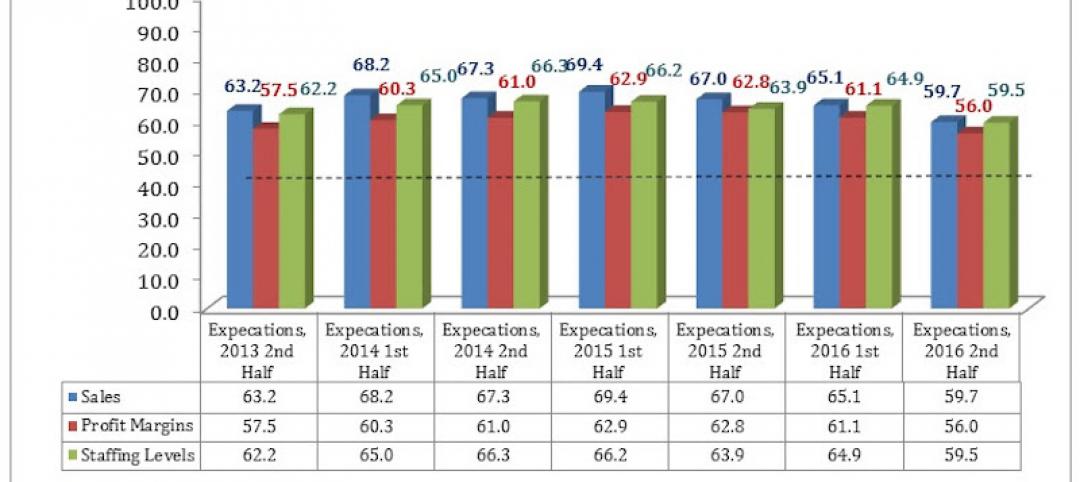

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

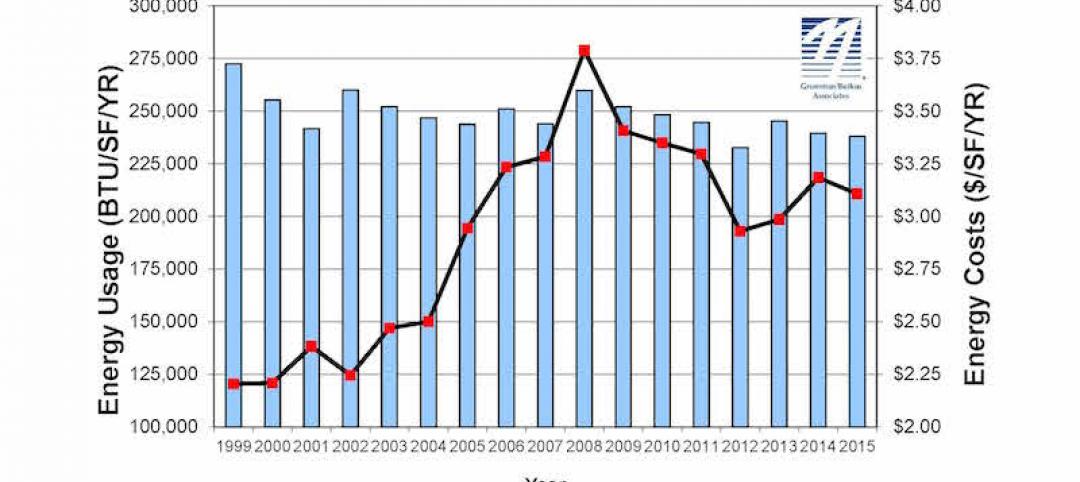

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

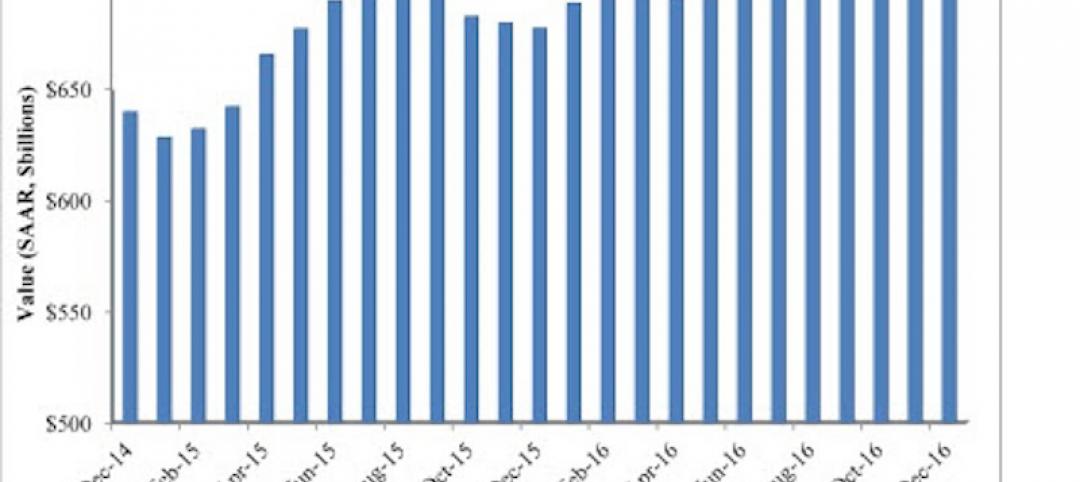

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.