Construction employment in May remained below the April level in 40 states and the District of Columbia, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials said skyrocketing materials prices and excessive delays in receiving key construction supplies were holding back the industry’s recovery.

“Today’s numbers show that impacts from the pandemic on demand for projects and on materials costs and the supply chain are weighing down construction in most parts of the country,” said Ken Simonson, the association’s chief economist. “In the few states where industry employment has topped the pre-pandemic levels of February 2020, most gains are likely attributable more to demand for homebuilding and remodeling than to most categories of nonresidential building and infrastructure projects.”

From April to May, construction employment decreased in 40 states and D.C., increased in only eight states, and held steady in Maryland and Utah. The largest decline over the month occurred in New York, which lost 5,900 construction jobs or 1.6%, followed by Illinois (-5,600 jobs, -2.5%) and Pennsylvania (-3,300 jobs, -1.3%). The steepest percentage declines since April occurred in Vermont (-3.9%, -600 jobs), followed by Maine (-3.5%, -1,100 jobs) and Delaware (-3.0%, -300 jobs).

Florida added the most construction jobs between April and May (3,700 jobs, 0.6%), followed by Michigan (1,600 jobs, 0.9%) and Minnesota (1,200 jobs, 0.9%). Oklahoma had the largest percentage gain for the month (1.3%, 1,000 jobs), followed by Minnesota and Michigan.

Employment declined from the pre-pandemic peak month of February 2020 in 42 states and D.C. Texas lost the most construction jobs over the period (-49,100 jobs or -6.3%), followed by New York (-45,200 jobs, -11.1%) and California (-30,800 jobs, -3.4%). Wyoming recorded the largest percentage loss (-15.3%, -3,500 jobs), followed by Louisiana (-15.1%, -20,700 jobs) and New York.

Among the eight states that added construction jobs since February 2020, the largest pickup occurred in Utah (5,000 jobs, 4.4%), followed by Idaho (3,400 jobs, 6.2%) and South Dakota (1,200 jobs, 5.0%). The largest percentage gain was in Idaho, followed by South Dakota and Utah.

Association officials noted that cost increases and extended lead times for producing many construction materials are exacerbating a slow recovery for construction. They urged the Biden administration to accelerate its timetable for reaching agreement with allies on removing tariffs on steel and aluminum, and to initiate talks to end tariffs on Canadian lumber.

“Federal officials can help get more construction workers employed by removing tariffs on essential construction materials such as lumber, steel and aluminum,” said Stephen E. Sandherr, the association’s chief executive officer. “These tariffs are causing unnecessary harm to construction workers and firms, as well as to the administration’s goals of building more affordable housing and infrastructure.”

View state February 2020-May 2021 data, 15-month rankings, 1-month rankings.

Related Stories

Market Data | Mar 29, 2017

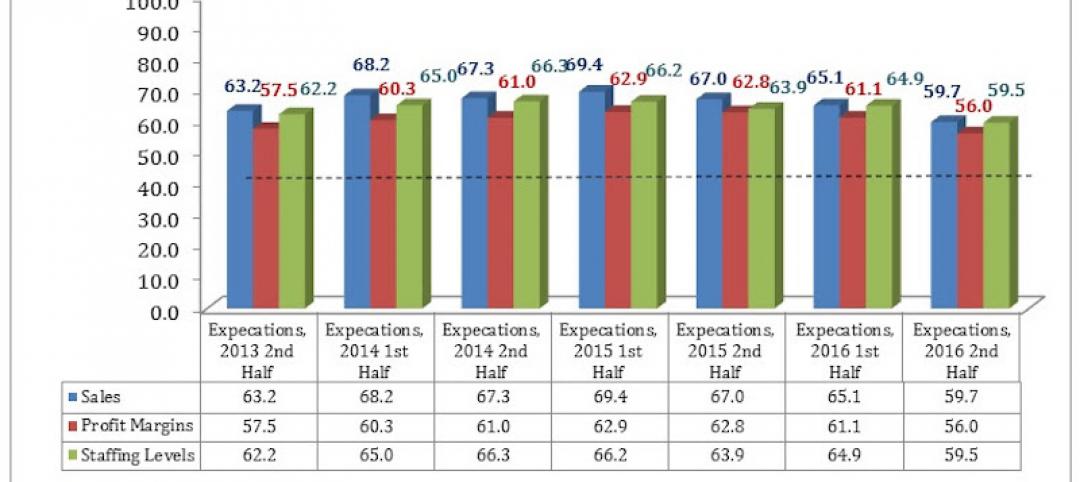

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

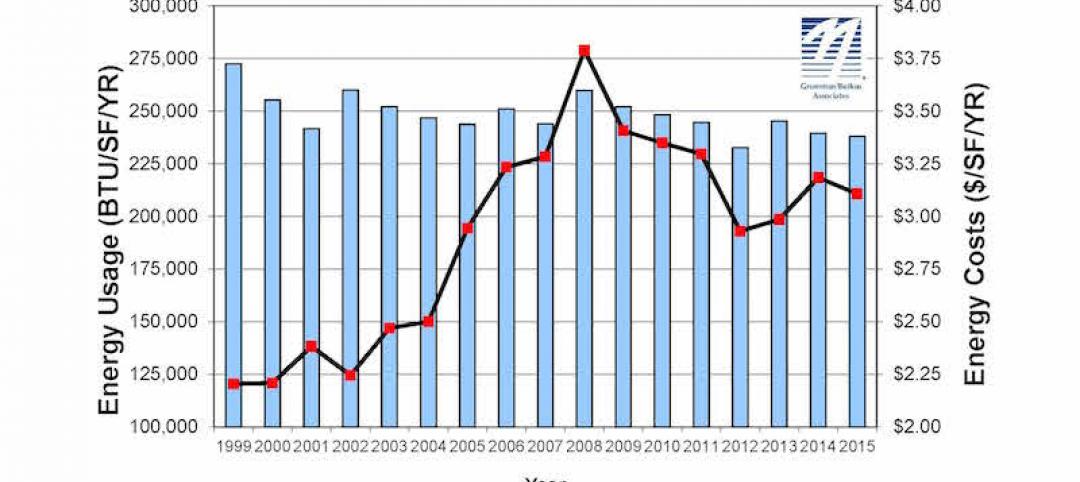

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

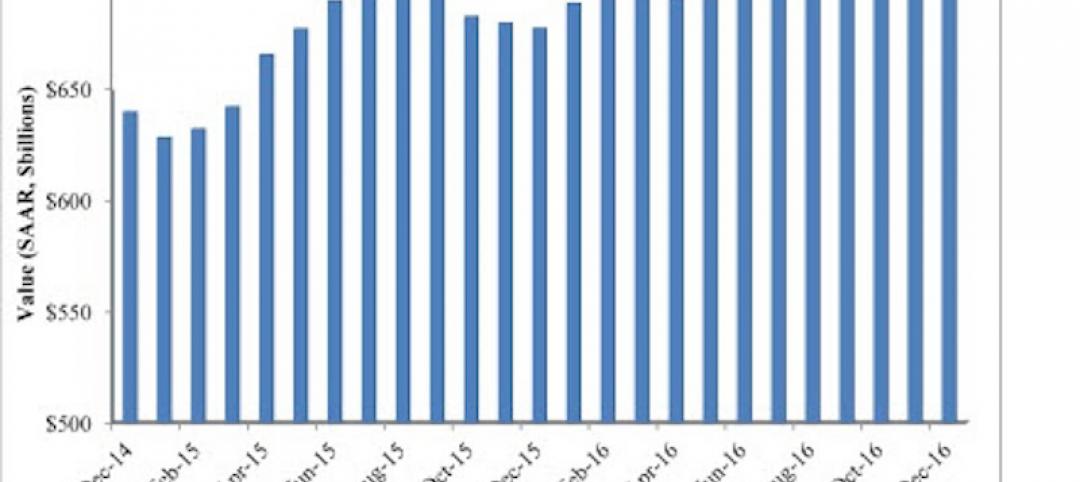

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.