Construction employment declined by 7,000 between May and June as the industry still employs 238,000 fewer people than before the pandemic, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said that job losses in the nonresidential construction sector offset modest monthly gains in residential construction as many firms struggle with worker shortages, supply chain disruptions and rising materials prices.

“It is hard for the industry to expand when it can’t find qualified workers, key building materials are scarce, and the prices for them keep climbing,” said Stephen E. Sandherr, the association’s chief executive officer. “June’s job declines seem less about a lack of demand for projects and a lot more about a lack of supplies to use and workers to employ.”

Construction employment in June totaled 7,410,000, dropping 7,000 from the revised May total. The total in June remained 238,000 or 3.1% below February 2020, the high point before the pandemic drove construction employment down. The number of former construction workers who were unemployed in June, 730,000, dropped a quarter from a year ago and the sector’s unemployment rate fell from 10.1% in June 2020 to 7.5% this June.

Residential and nonresidential construction sectors have differed sharply in their recovery since the pre-pandemic peak in February 2020. Residential construction firms—contractors working on new housing, additions, and remodeling—gained 15,200 employees during the month and have added 51,000 workers or 1.7% over 16 months. The nonresidential sector—comprising nonresidential building, specialty trades, and heavy and civil engineering contractors—shed 22,600 jobs in June and employed 289,000 fewer workers or 6.2% less than in February 2020.

Sandherr noted that many firms report key materials are backlogged or rationed, while also reporting frequent increases in the amount they pay for those materials. In addition, many firms report they are having a hard time finding workers to hire despite the relatively high number of people currently out of work. He added these factors are contributing to rising costs for many contractors, which are details in the association’s updated Construction Inflation Alert.

Association officials said they were taking steps to recruit more people into the construction industry. They noted the association launched its “Construction is Essential” recruiting campaign earlier this year. They said Washington officials could help the industry by taking steps to ease supply chain backups. They also continued to call on the President to remove tariffs on key construction materials, including steel.

“The good news is there are large numbers of qualified workers available to hire who are on the sidelines until schools reopen and the federal unemployment supplements expire,” said Stephen E. Sandherr, the association’s chief executive officer. “Our message to these workers is clear, there are high-paying construction careers available when they are ready.”

Related Stories

Senior Living Design | May 9, 2017

Designing for a future of limited mobility

There is an accessibility challenge facing the U.S. An estimated 1 in 5 people will be aged 65 or older by 2040.

Industry Research | May 4, 2017

How your AEC firm can go from the shortlist to winning new business

Here are four key lessons to help you close more business.

Engineers | May 3, 2017

At first buoyed by Trump election, U.S. engineers now less optimistic about markets, new survey shows

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0.

Market Data | May 2, 2017

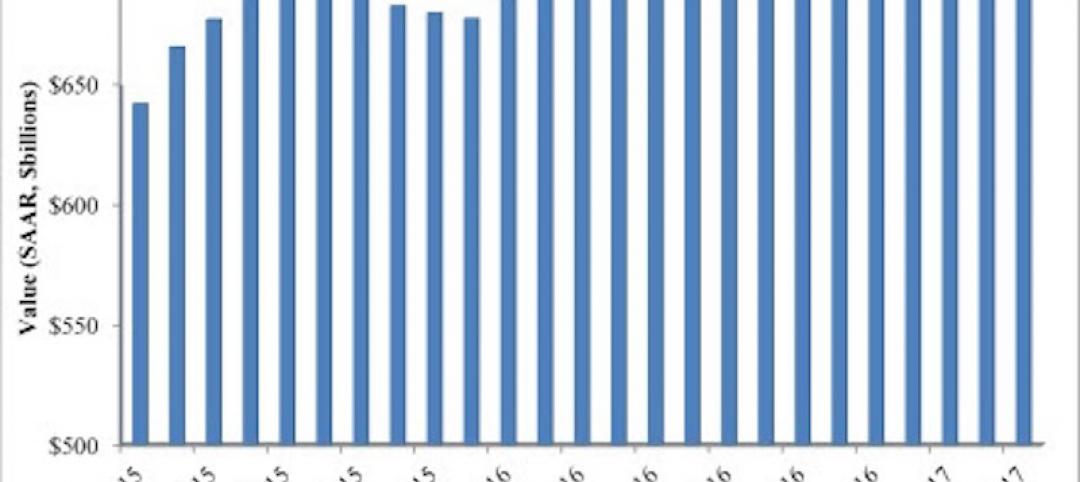

Nonresidential Spending loses steam after strong start to year

Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis.

Market Data | May 1, 2017

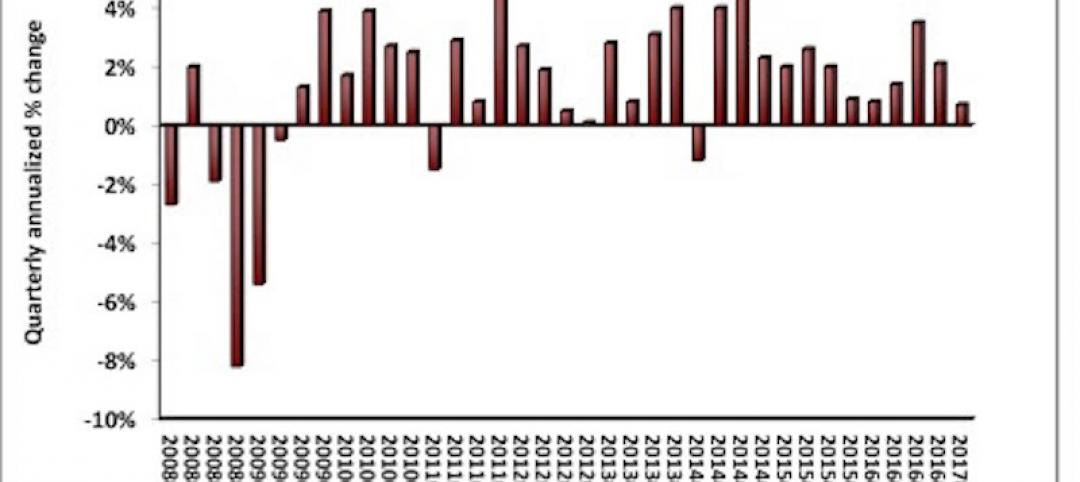

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Market Data | Apr 19, 2017

Architecture Billings Index continues to strengthen

Balanced growth results in billings gains in all regions.

Market Data | Apr 13, 2017

2016’s top 10 states for commercial development

Three new states creep into the top 10 while first and second place remain unchanged.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

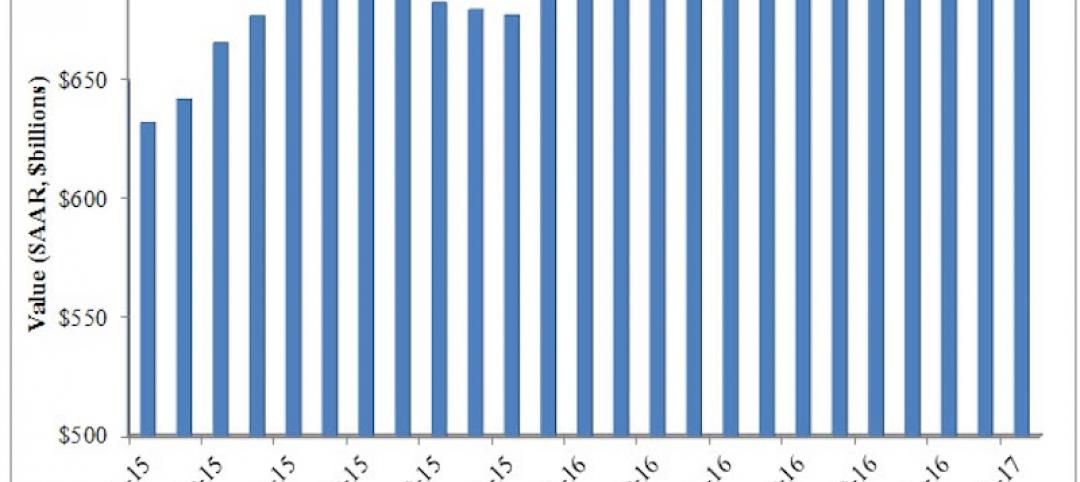

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.