Construction employment dipped by 5,000 jobs between December and January even though hourly pay rose at a record pace in the past year, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said future job gains are at risk from several factors that are slowing projects, as detailed in the Construction Inflation Alert that it will post on February 7.

“Contractors are struggling to fill positions as potential workers opt out of the labor market or choose other industries,” said Ken Simonson, the association’s chief economist. “In addition, soaring materials costs and unpredictable delivery times are delaying projects and holding back employment gains.”

Simonson noted that average hourly earnings in the construction industry increased 5.1% from January 2021 to last month--the steepest 12-month increase in the 15-year history of the series. The industry average of $33.80 per hour exceeded the private sector average by nearly 7%. However, competition for workers has intensified as other industries have hiked starting pay and offered working conditions that are not possible in construction, such as flexible hours or work from home.

Since January 2021 the industry has added 163,000 employees despite the decline last month. But the number of unemployed jobseekers among former construction workers shrank by 229,000 over that time, indicating workers are leaving the workforce altogether or taking jobs in other sectors, Simonson added.

Construction employment totaled 7,523,000 last month, which was 101,000 jobs or 1.3% less than in pre-pandemic peak month of February 2020. However, the totals mask large differences between residential and nonresidential segments of the industry, Simonson said.

Nonresidential construction firms--general building contractors, specialty trade contractors, and heavy and civil engineering construction firms--lost 9,000 employees in January. Nonresidential employment remains 213,000 below the pre-pandemic peak set in February 2020. In contrast, employment in residential construction--comprising homebuilding and remodeling firms--edged up by 4,400 jobs in January and topped the February 2020 level by 112,000.

Association officials said the Construction Hiring and Business Outlook survey that it released in January showed most contractors expect to add employees in 2022 but overwhelmingly find it difficult to find qualified workers. The association will shortly post an updated Construction Inflation Alert to inform owners, officials, and others about the challenges the industry is experiencing with employment, materials costs, and delays.

“Construction firms are struggling to find workers to hire even as they are being forced to cope with rising materials prices and ongoing supply chain disruptions,” said Stephen E. Sandherr, the association’s chief executive officer. “But instead of addressing those challenges, the Biden administration is adding to these problems with a new executive order that will inflate the cost of construction, discriminate against most workers and undermine the collective bargaining process.”

View the construction employment table. View the association’s Outlook survey.

Related Stories

Contractors | Jan 4, 2018

Construction spending in a ‘mature’ period of incremental growth

Labor shortages are spiking wages. Materials costs are rising, too.

Market Data | Dec 20, 2017

Architecture billings upturn shows broad strength

The American Institute of Architects (AIA) reported the November ABI score was 55.0, up from a score of 51.7 in the previous month.

Market Data | Dec 14, 2017

ABC chief economist predicts stable 2018 construction economy

There are risks to the 2018 outlook as a number of potential cost increases could come into play.

Market Data | Dec 13, 2017

Top world regions and markets in the global hotel construction pipeline

The top world region by project count is North America.

Market Data | Dec 11, 2017

Global hotel construction pipeline is growing

The Total Pipeline stands at 12,427 Projects/2,084,940 Rooms.

Market Data | Dec 11, 2017

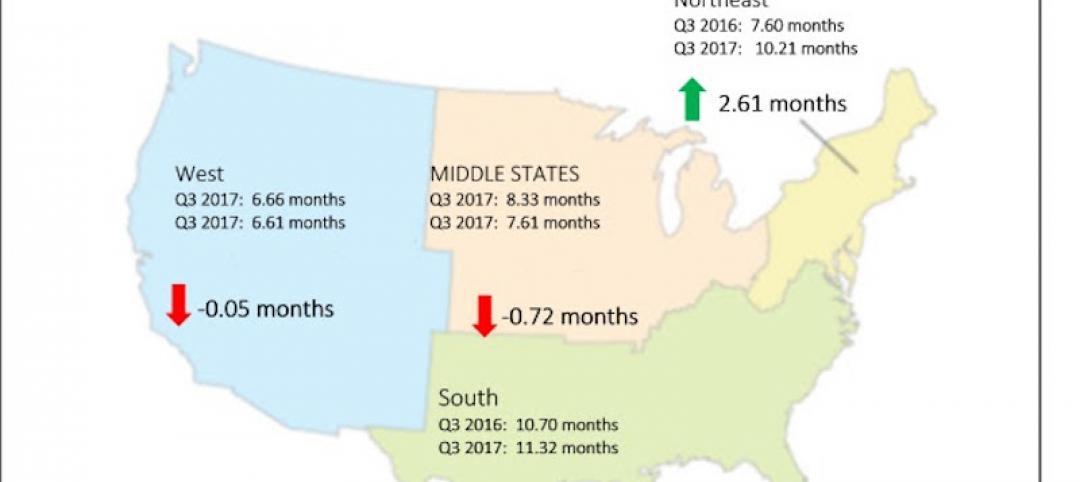

Construction backlog surges, sets record in third quarter

CBI is a leading economic indicator that reflects the amount of construction work under contract, but not yet completed.

Market Data | Dec 7, 2017

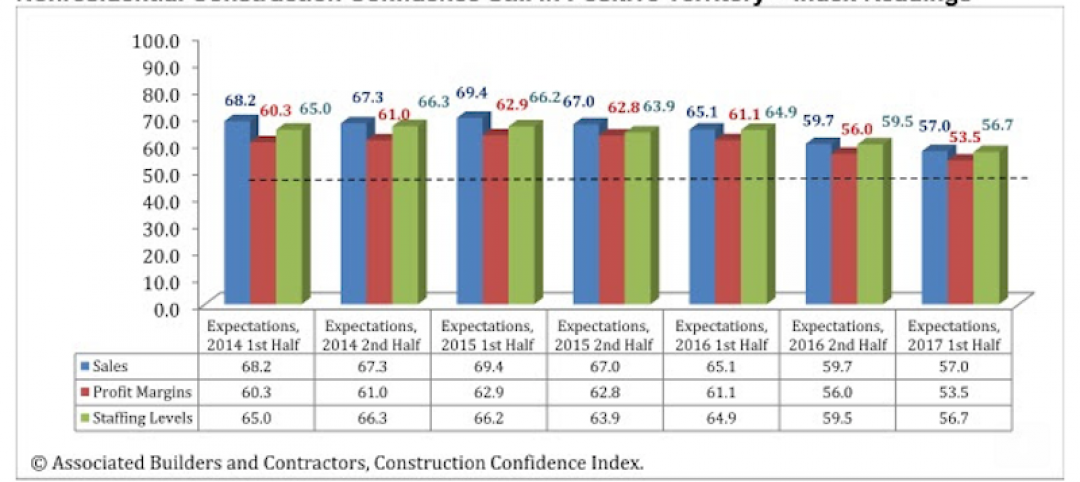

Buoyed by healthy economy, ABC Index finds contractors upbeat

Despite rising construction labor and materials costs, 55% of contractors expect their profit margins to expand in the first half of 2018.

Market Data | Dec 5, 2017

Top health systems engaged in $21 billion of U.S. construction projects

Largest active projects are by Sutter Health, New York Presbyterian, and Scripps Health.

Industry Research | Nov 28, 2017

2018 outlook: Economists point to slowdown, AEC professionals say ‘no way’

Multifamily housing and senior living developments head the list of the hottest sectors heading into 2018, according a survey of 356 AEC professionals.

Market Data | Nov 27, 2017

Construction's contribution to U.S. economy highest in seven years

Thirty-seven states benefited from the rise in construction activity in their state, while 13 states experienced a reduction in activity.