Construction employment increased by 42,000 jobs in February and by 223,000 or 3.0% over the past 12 months, as the industry’s unemployment rate hit a new February low, according to an analysis of new government data by the Associated General Contractors of America. Association officials said some of the gains were attributable to mild winter weather in many parts of the country last month but added that the main reason for the gains was strong demand for construction services.

“Contractors are off to a fast start in 2020, adding 91,000 jobs in the first two months—the most in nearly two years,” said Ken Simonson, the association’s chief economist. “Although some of the gains probably reflect unusually mild winter weather in much of the nation, there is no question that contractors have been upbeat about the volume of work available.”

Total construction employment climbed to 7,646,800, the highest level since July 2007, with gains in both residential and nonresidential employment. The 3.0% growth in construction employment between February 2019 and February 2020 was nearly double the 1.6% increase in total nonfarm payroll employment. Average hourly earnings in construction – a measure of all wages and salaries – increased 3.0% over the year to $31.35. That figure was 9.9% higher than the private-sector average of $28.52¬.

Simonson observed that both the number of unemployed workers with recent construction experience – 531,000 – and the unemployment rate for such workers – 5.5% – were the lowest ever for February in the 21-year history of those series. He said these figures are consistent with reports from contractors as part of the association’s annual outlook that experienced construction workers are hard to find.

The employment data were collected in mid-February. Since then, the novel coronavirus has begun to affect some industries, but there have been no reports of construction sites being affected or of projects being deferred or canceled, the economist noted.

Association officials said that it is hard to estimate whether the spreading coronavirus will have a significant impact on future demand for construction or the sector’s employment levels. They said the best way for Washington officials to address the economic uncertainty was to act quickly to pass measures to rebuild the nation’s airports, waterways, highways and transit systems. They added that the association was launching a new round of advertising via its Americans for Better Infrastructure Campaign to educate constituents and members of Congress on the economic benefits of investing in infrastructure.

“The industry clearly benefitted from strong demand in February, but it is unclear whether and how the coronavirus might impact construction employment,” said Stephen E. Sandherr, the association’s chief executive officer. “Passing new infrastructure measures will support needed fixes to our transportation network while adding a new level of stability in what are likely to be uncertain times.”

Related Stories

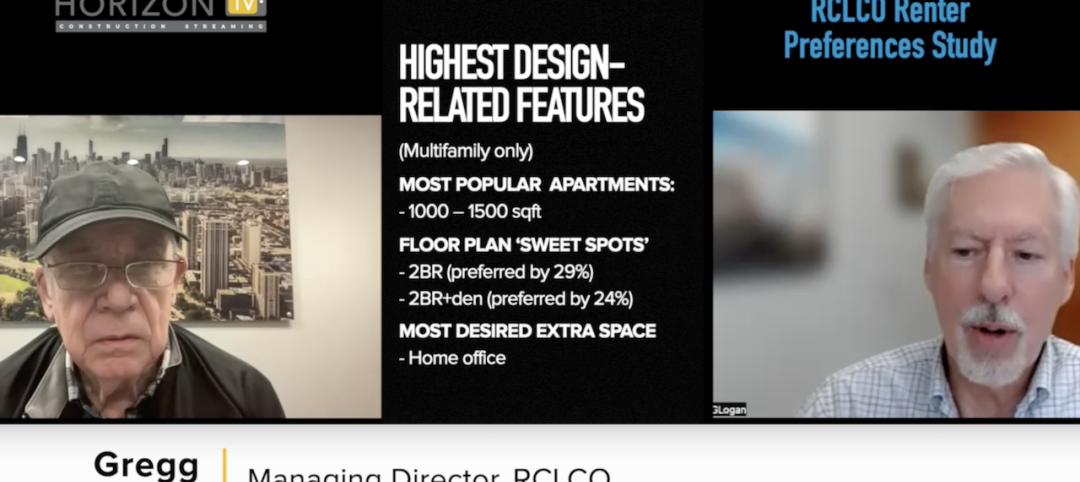

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

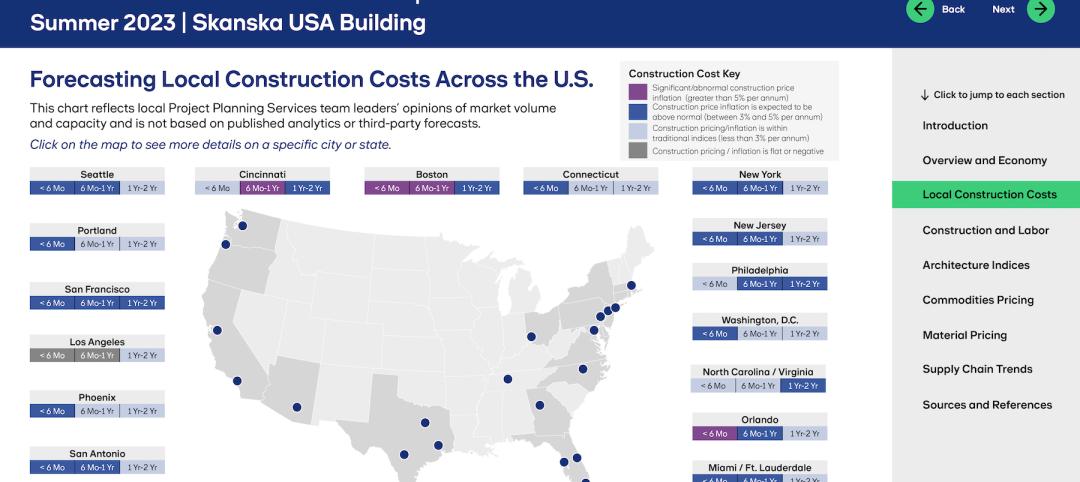

Market Data | Aug 18, 2023

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Hotel Facilities | Jul 27, 2023

U.S. hotel construction pipeline remains steady with 5,572 projects in the works

The hotel construction pipeline grew incrementally in Q2 2023 as developers and franchise companies push through short-term challenges while envisioning long-term prospects, according to Lodging Econometrics.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.