Construction employment rebounded from April to May in 45 states and the District of Columbia, following the loss of nearly one million construction jobs nationwide in April, but the gains may be short-lived, according to an analysis by the Associated General Contractors of America of government data released today and a survey the association released on Thursday. Association officials urged officials in Washington to promptly enact measures to fund infrastructure projects and plug looming state and local budget deficits to avoid a “second wave” of job losses.

“The widespread uptick in construction employment in May is welcome news following a month in which industry employment shrank in all but one state,” said Ken Simonson, the association’s chief economist. “Our association’s latest survey shows many firms have been recalling or adding employees in recent weeks, thanks in part to rapid receipt of Paycheck Protection Program loans. But only about one-fifth of firms report winning new or expanded projects, while almost one-third of firms say an upcoming project has been canceled.”

Simonson noted that the association’s latest survey found that nearly one-fourth of contractors reported a project that was scheduled to start in June or later had been canceled. He added that with most states and localities starting a new fiscal year on July 1, even more public construction is likely to be canceled unless the federal government makes up for some of their lost revenue and unbudgeted expenses.

Of the 45 states with construction job gains over the month, Pennsylvania had the largest increase (77,400 jobs or 48.9%). Michigan had the largest percentage increase (51.4%, 50,500 construction jobs). Construction employment declined from April to May in five states. Hawaii lost the largest number and highest percentage of construction jobs (-700 jobs, -1.9%).

From May 2019 to May 2020, 12 states added construction jobs while 38 states and D.C lost jobs. Utah added the most construction jobs over the year (8,200 jobs, 7.6%). South Dakota—the only state to add construction jobs in April—had the largest year-over-year percentage increase (10.3%, 2,400 jobs). Both states set new highs for construction employment, in a series dating to 1990. New York lost the most construction jobs over the year (105,300 jobs, -25.9%). The largest percentage decline occurred in Vermont (-26.1%, -4,000 jobs).

Association officials cautioned that even as the immediate impacts of the coronavirus appear to be easing, the industry is just beginning to appreciate the longer-term impacts of the pandemic. They warned that without new federal recovery measures, the industry was likely to experience a second wave of job losses. They urged Congress and the Trump administration to enact liability reform, pass new infrastructure funding measures, and find a way to incentivize laid-off employees to return to work.

“The economic boost that comes with lifting economic lockdowns will not be enough to sustain long-term growth for the industry,” said Stephen E. Sandherr, the association’s chief executive officer. “Boosting infrastructure spending, protecting firms that are operating safely and encouraging people to return to work will help convert short-term gains into longer-term growth.”

View the state employment data, rankings, map and high and lows. Click here for the association’s survey results and here for a video summary of the survey responses.

Related Stories

Market Data | Sep 19, 2018

August architecture firm billings rebound as building investment spurt continues

Southern region, multifamily residential sector lead growth.

Market Data | Sep 18, 2018

Altus Group report reveals shifts in trade policy, technology, and financing are disrupting global real estate development industry

International trade uncertainty, widespread construction skills shortage creating perfect storm for escalating project costs; property development leaders split on potential impact of emerging technologies.

Market Data | Sep 17, 2018

ABC’s Construction Backlog Indicator hits a new high in second quarter of 2018

Backlog is up 12.2% from the first quarter and 14% compared to the same time last year.

Market Data | Sep 12, 2018

Construction material prices fall in August

Softwood lumber prices plummeted 9.6% in August yet are up 5% on a yearly basis (down from a 19.5% increase year-over-year in July).

Market Data | Sep 7, 2018

Safety risks in commercial construction industry exacerbated by workforce shortages

The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years.

Market Data | Sep 5, 2018

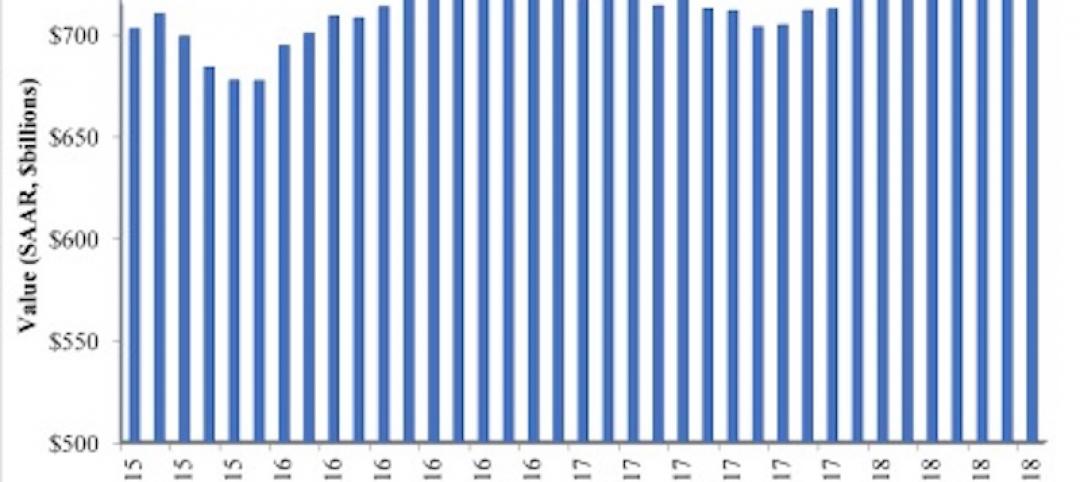

Public nonresidential construction up in July

Private nonresidential spending fell 1% in July, while public nonresidential spending expanded 0.7%.

Market Data | Aug 30, 2018

Construction in ASEAN region to grow by over 6% annually over next five years

Although there are disparities in the pace of growth in construction output among the ASEAN member states, the region’s construction industry as a whole will grow by 6.1% on an annual average basis in the next five years.

Market Data | Aug 22, 2018

July architecture firm billings remain positive despite growth slowing

Architecture firms located in the South remain especially strong.

Market Data | Aug 15, 2018

National asking rents for office space rise again

The rise in rental rates marks the 21st consecutive quarterly increase.