Construction contractors expect increasing demand for numerous types of projects in 2022 despite ongoing supply chain and labor challenges, as most firms plan to add workers this year, according to survey results released today by the Associated General Contractors of America and Sage. The findings are detailed in Expecting Growth While Coping with the Lingering Impacts of the Pandemic: The 2022 Construction Hiring & Business Outlook.

“Contractors are, overall, very optimistic about the outlook for the construction industry in 2022,” said Stephen E. Sandherr, the association's chief executive officer. “While contractors face challenges this year, most of those will be centered on the need to keep pace with growing demand for construction projects.”

The percentage of respondents who expect a market segment to expand exceeds the percentage who expect it to contract – known as the net reading – in 15 of the 17 categories of projects included in the survey. Contractors are most optimistic about the market for highway and bridge construction, which has a net reading of positive 57%. They are similarly optimistic about transit, rail and airports projects, with a net reading of 51%, and water and sewer projects, with a net reading of 50%.

These segments all stand to see increased federal investments because of the recently passed Bipartisan Infrastructure bill. Contractors are also upbeat about demand for federal construction projects, with a net reading of 37%, and power construction, with a net reading of 29%.

The highest expectations among predominantly private-sector categories, with a net reading of 41% each, are for warehouses and other healthcare facilities, which includes clinics, testing facilities and medical labs. The outlook for hospital construction is also strong, with a net reading of 38%.

Contractors were also optimistic about multifamily residential construction, with a net reading of 32%, and manufacturing construction, with a net reading of 27%. Expectations were more subdued, however, for public buildings, with a net reading of 20%; kindergarten through 12th grade school construction, with a net reading of 19%; higher education facilities, with a 16% net reading; and lodging, with a 6% net reading. Only two categories received negative net readings, both of -8%: retail and private office construction.

Optimism about growing demand for many types of construction projects is leading many firms to plan to hire workers this year. Seventy-four% of respondents expect their firms will expand headcount in 2022, compared to just 9% that who expect a decrease. Forty-seven percent of firms expect to increase their headcount by 10% or less. However, 22% say their headcount will grow by 11 to 25% and 5% anticipate an increase of more than 25%.

Adding those workers will be a challenge, however. An overwhelming 83% report they are having a hard time filling some or all salaried or hourly craft positions, compared to only 8% who say they are having no difficulty. And three-fourths of respondents say it will continue to be hard to hire or will become harder to hire this year.

The pandemic continues to impact the construction industry, association officials noted. Eighty-four percent of respondents report costs have been higher than anticipated, while 72% say projects have taken longer than anticipated because of the pandemic. As a result, 69% have put higher prices into bids or contracts, while 44% have specified longer completion times.

Supply chain bottlenecks are also impacting construction. Only 10% of firms report they have not had any significant supply chain problems. Sixty-one percent have turned to alternative suppliers for materials and 48% have specified alternative materials or products.

Rising construction costs and slowing schedules have contributed to a significant number of project delays and cancellations. Forty-six percent of contractors report having a project delayed in 2021 but rescheduled, while 32% had a project postponed or canceled that has not been rescheduled.

“The last two years have become increasingly unpredictable, due in large part to the coronavirus and public officials’ varied reactions to it,” said Ken Simonson, the association's chief economist. “But, assuming current trends hold, 2022 should be a relatively strong year for the construction industry.”

Officials with Sage noted that firms are being more strategic about information technology as they try to remain competitive in the current environment. Sixty-one% of contractors indicate they currently have a formal IT plan that supports business objectives. An additional 7% plan to create a formal plan in 2022.

“Amid the challenges the industry faces, technology plays an essential role in keeping teams connected and projects moving,” said Dustin Stephens, vice president of Construction and Real Estate, Sage. “The past few years have highlighted just how crucial mobile and cloud-based solutions are, and we will continue to see these technologies play an integral role in helping construction firms bounce back.”

Stephens added that most firms plan to keep their technology investment about the same as last year. When asked whether they planned to increase or decrease investment or stay the same in 15 different types of technologies, the majority of respondents – ranging between 69 and 89% – said their investments would remain the same.

Association officials urged public officials to take steps to help the industry recover in 2022 and avoid measures that will undermine the sector. They noted that the Biden administration’s vaccine mandates will prompt many vaccine-hesitant workers to leave the relatively few employers covered by the orders and move to smaller firms that are not covered by the rule and employ over 60% of the industry’s workforce.

“Given how many firms are currently looking to hire, many vaccine-hesitant workers will be able to switch jobs instead of taking a shot they have already resisted for over a year,” Sandherr said. He added that the administration’s plans to increase tariffs on Canadian lumber and maintain existing ones on other key construction materials will make it harder for firms to accurately bid upcoming projects and complete them on schedule.

Sandherr said the association will continue to push for new federal investments in workforce development and make sure Congress keeps its promise to boost funds for infrastructure. He added the association would continue to encourage construction workers to get vaccinated, and is planning to release new Spanish-language public service ads on the subject later this month to accompany a series of ads encouraging vaccinations AGC released last year.

“Our ultimate goal is to make sure that contractors’ optimistic outlook for 2022 becomes a reality,” Sandherr said.

The Outlook was based on survey results from more than 1,000 firms from all 50 states and the District of Columbia. Varying numbers responded to each question. Contractors of every size answered over 20 questions about their hiring, workforce, business and information technology plans. Click here for Expecting Growth While Coping with the Lingering Impacts of the Pandemic: The 2022 Construction Hiring & Business Outlook. Click here for the survey results.

Related Stories

Market Data | Jun 14, 2016

Transwestern: Market fundamentals and global stimulus driving economic growth

A new report from commercial real estate firm Transwestern indicates steady progress for the U.S. economy. Consistent job gains, wage growth, and consumer spending have offset declining corporate profits, and global stimulus plans appear to be effective.

Market Data | Jun 7, 2016

Global construction disputes took longer to resolve in 2015

The good news: the length and value of disputes in the U.S. fell last year, according to latest Arcadis report.

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

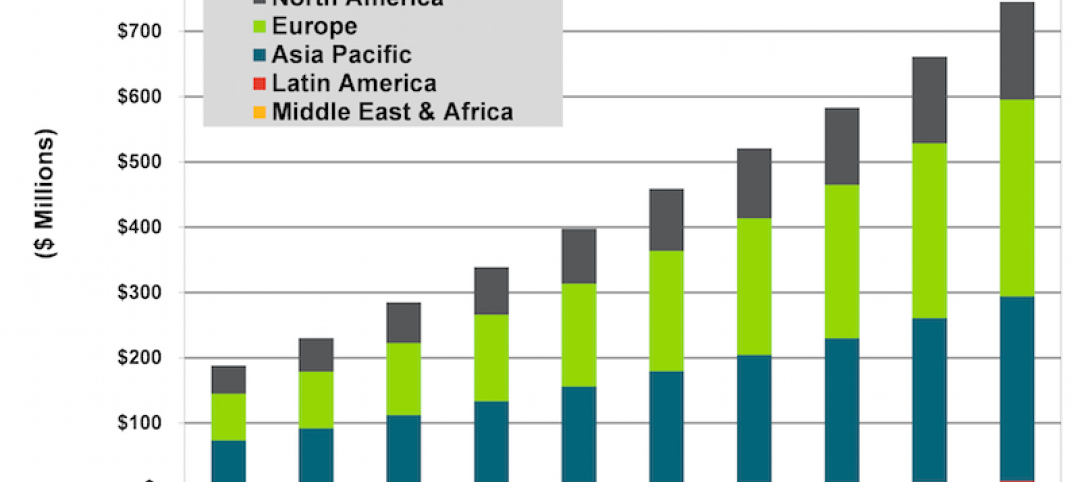

A nascent commercial wireless sensor market is poised to ascend in the next decade

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.