Gilbane has released its Spring 2014 edition of the periodic report "Construction Economics: Market Conditions in Construction" (download the full report).

Among the findings from the Executive Summary:

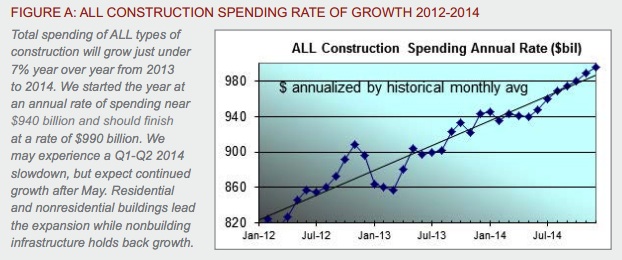

CONSTRUCTION GROWTH IS LOOKING UP

- Construction Spending for 2014 will finish the year 6.6% higher than 2013. Nonresidential buildings will contribute substantially to the growth.

- The Architecture Billings Index (ABI) in 2013 dropped below 50 in April, November and December briefly, indicating declining workload. Overall the ABI portrays a good leading indicator for future new construction work.

- Selling price data for 2013 shows contractors adding to their margins.

- Construction jobs grew by 156,000 in 2013, less than anticipated. However, hours worked also grew by 3%, the equivalent of another 150,000+ jobs.

SOME ECONOMIC FACTORS ARE STILL NEGATIVE

- We are experiencing a slight slowdown in construction spending that could last through May, influenced by a slight dip in nonresidential buildings and a brief flattening in residential, but more so by a steep decline in nonbuilding infrastructure spending. The monthly rate of spending for nonbuilding infrastructure may decline by 10% through Q3 2014.

- The construction workforce and hours worked is still 22% below the 2006 peak. At peak average growth rates, it will take a minimum of five more years to return to previous peak levels.

- Construction volume is 23% below peak inflation adjusted spending, which was almost constant from 2000 through 2006. At average peak growth rates of 8% per year, and factoring out inflation to get real volume growth, it will take eight more years to regain previous peak volume levels.

- As workload expands in the next few years, a shortage of available skilled workers may have a detrimental effect on cost, productivity and the ability to readily increase construction volume.

THE EFFECTS OF GROWTH

- Construction spending during the first five months of 2013 declined from the rate of spending in Q4 2012. Growth has been inconsistent, even in the booming residential sector, which has seen recent declines. We see more consistent growth in 2014 for buildings.

- As spending continues to increase, contractors gain more ability to pass along costs and increase margins. The growth in contractor margins slowed since last year. However, expected increases in volume should reverse that in 2014.

- ENR’s Third Quarter 2013 Cost Report shows general purpose and material cost indices increased on average about 2% to 2.5% year over year. However, selling price indices increased 4% on average. The difference between these indices is increased margins.

IMPACT OF RECENT EVENTS

- There are several reasons why spending is not rapidly increasing: public sector construction remains depressed as sequestration continues; the government is spending less on schools and infrastructure; lenders are just beginning to loosen lending criteria; consumers are still cautious about increasing debt load, including the consumers’ share of public debt and we may be constrained by a skilled labor shortage.

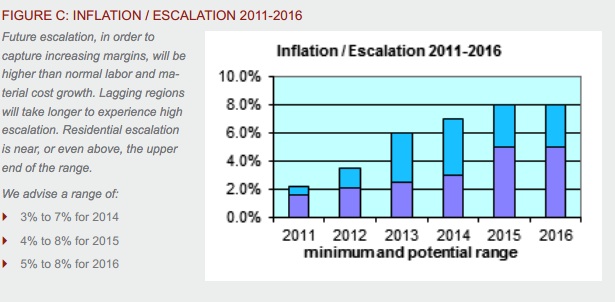

- Supported by overall positive growth trends for year 2014, Gilbane expects margins and overall escalation to climb more rapidly than we have seen in six years.

- Growth in nonresidential buildings and residential construction in 2014 will lead to more significant labor demand, resulting in labor shortages and productivity losses. Margins regained a positive footing in 2012 and extended those gains in 2013. Expect margins to grow stronger in 2014. When activity picks up in all sectors, escalation will begin to advance rapidly.

Click here to download the complete report and a list of data sources.

ABOUT THIS REPORT

Gilbane Inc. is a full service construction and real estate development company, composed of Gilbane Building Company and Gilbane Development Company. The company (www.gilbaneco.com) is one of the nation’s largest construction and program managers providing a full slate of facilities related services for clients in education, healthcare, life sciences, mission critical, corporate, sports and recreation, criminal justice, public and aviation markets. Gilbane has more than 50 offices worldwide, with its corporate office located in Providence, Rhode Island. The information in this report is not specific to any one region.

Related Stories

Adaptive Reuse | Oct 22, 2024

Adaptive reuse project transforms 1840s-era mill building into rental housing

A recently opened multifamily property in Lawrence, Mass., is an adaptive reuse of an 1840s-era mill building. Stone Mill Lofts is one of the first all-electric mixed-income multifamily properties in Massachusetts. The all-electric building meets ambitious modern energy codes and stringent National Park Service historic preservation guidelines.

MFPRO+ News | Oct 22, 2024

Project financing tempers robust demand for multifamily housing

AEC Giants with multifamily practices report that the sector has been struggling over the past year, despite the high demand for housing, especially affordable products.

Performing Arts Centers | Oct 21, 2024

The New Jersey Performing Arts Center breaks ground on $336 million redevelopment of its 12-acre campus

In Newark, N.J., the New Jersey Performing Arts Center (NJPAC) has broken grown on the three-year, $336 million redevelopment of its 12-acre campus. The project will provide downtown Newark 350 mixed-income residential units, along with shops, restaurants, outdoor gathering spaces, and an education and community center with professional rehearsal spaces.

Office Buildings | Oct 21, 2024

3 surprises impacting the return to the office

This blog series exploring Gensler's Workplace Survey shows the top three surprises uncovered in the return to the office.

Healthcare Facilities | Oct 18, 2024

7 design lessons for future-proofing academic medical centers

HOK’s Paul Strohm and Scott Rawlings and Indiana University Health’s Jim Mladucky share strategies for planning and designing academic medical centers that remain impactful for generations to come.

Sports and Recreational Facilities | Oct 17, 2024

In the NIL era, colleges and universities are stepping up their sports facilities game

NIL policies have raised expectations among student-athletes about the quality of sports training and performing facilities, in ways that present new opportunities for AEC firms.

Codes and Standards | Oct 17, 2024

Austin, Texas, adopts AI-driven building permit software

After a successful pilot program, Austin has adopted AI-driven building permit software to speed up the building permitting process.

Resiliency | Oct 17, 2024

U.S. is reducing floodplain development in most areas

The perception that the U.S. has not been able to curb development in flood-prone areas is mostly inaccurate, according to new research from climate adaptation experts. A national survey of floodplain development between 2001 and 2019 found that fewer structures were built in floodplains than might be expected if cities were building at random.

Seismic Design | Oct 17, 2024

Calif. governor signs limited extension to hospital seismic retrofit mandate

Some California hospitals will have three additional years to comply with the state’s seismic retrofit mandate, after Gov. Gavin Newsom signed a bill extending the 2030 deadline.

MFPRO+ News | Oct 16, 2024

One-third of young adults say hurricanes like Helene and Milton will impact where they choose to live

Nearly one-third of U.S. residents between 18 and 34 years old say they are reconsidering where they want to move after seeing the damage wrought by Hurricane Helene, according to a Redfin report. About 15% of those over age 35 echoed their younger cohort’s sentiment.