Gilbane has released its Spring 2014 edition of the periodic report "Construction Economics: Market Conditions in Construction" (download the full report).

Among the findings from the Executive Summary:

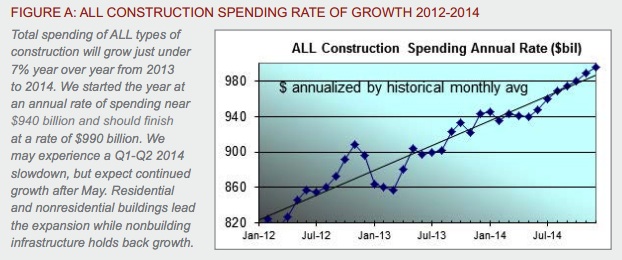

CONSTRUCTION GROWTH IS LOOKING UP

- Construction Spending for 2014 will finish the year 6.6% higher than 2013. Nonresidential buildings will contribute substantially to the growth.

- The Architecture Billings Index (ABI) in 2013 dropped below 50 in April, November and December briefly, indicating declining workload. Overall the ABI portrays a good leading indicator for future new construction work.

- Selling price data for 2013 shows contractors adding to their margins.

- Construction jobs grew by 156,000 in 2013, less than anticipated. However, hours worked also grew by 3%, the equivalent of another 150,000+ jobs.

SOME ECONOMIC FACTORS ARE STILL NEGATIVE

- We are experiencing a slight slowdown in construction spending that could last through May, influenced by a slight dip in nonresidential buildings and a brief flattening in residential, but more so by a steep decline in nonbuilding infrastructure spending. The monthly rate of spending for nonbuilding infrastructure may decline by 10% through Q3 2014.

- The construction workforce and hours worked is still 22% below the 2006 peak. At peak average growth rates, it will take a minimum of five more years to return to previous peak levels.

- Construction volume is 23% below peak inflation adjusted spending, which was almost constant from 2000 through 2006. At average peak growth rates of 8% per year, and factoring out inflation to get real volume growth, it will take eight more years to regain previous peak volume levels.

- As workload expands in the next few years, a shortage of available skilled workers may have a detrimental effect on cost, productivity and the ability to readily increase construction volume.

THE EFFECTS OF GROWTH

- Construction spending during the first five months of 2013 declined from the rate of spending in Q4 2012. Growth has been inconsistent, even in the booming residential sector, which has seen recent declines. We see more consistent growth in 2014 for buildings.

- As spending continues to increase, contractors gain more ability to pass along costs and increase margins. The growth in contractor margins slowed since last year. However, expected increases in volume should reverse that in 2014.

- ENR’s Third Quarter 2013 Cost Report shows general purpose and material cost indices increased on average about 2% to 2.5% year over year. However, selling price indices increased 4% on average. The difference between these indices is increased margins.

IMPACT OF RECENT EVENTS

- There are several reasons why spending is not rapidly increasing: public sector construction remains depressed as sequestration continues; the government is spending less on schools and infrastructure; lenders are just beginning to loosen lending criteria; consumers are still cautious about increasing debt load, including the consumers’ share of public debt and we may be constrained by a skilled labor shortage.

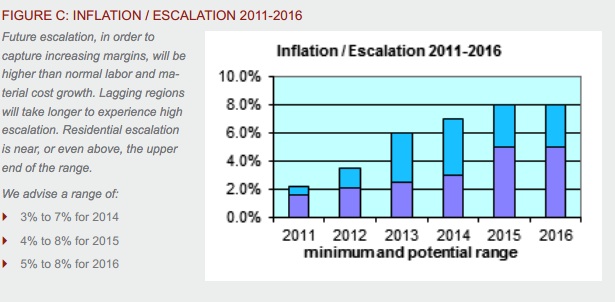

- Supported by overall positive growth trends for year 2014, Gilbane expects margins and overall escalation to climb more rapidly than we have seen in six years.

- Growth in nonresidential buildings and residential construction in 2014 will lead to more significant labor demand, resulting in labor shortages and productivity losses. Margins regained a positive footing in 2012 and extended those gains in 2013. Expect margins to grow stronger in 2014. When activity picks up in all sectors, escalation will begin to advance rapidly.

Click here to download the complete report and a list of data sources.

ABOUT THIS REPORT

Gilbane Inc. is a full service construction and real estate development company, composed of Gilbane Building Company and Gilbane Development Company. The company (www.gilbaneco.com) is one of the nation’s largest construction and program managers providing a full slate of facilities related services for clients in education, healthcare, life sciences, mission critical, corporate, sports and recreation, criminal justice, public and aviation markets. Gilbane has more than 50 offices worldwide, with its corporate office located in Providence, Rhode Island. The information in this report is not specific to any one region.

Related Stories

Designers | Oct 1, 2024

Global entertainment design firm WATG acquires SOSH Architects

Entertainment design firm WATG has acquired SOSH Architects, an interior design and planning firm based in Atlantic City, N.J.

Higher Education | Sep 30, 2024

Studio Gang turns tobacco warehouse into the new home of the University of Kentucky’s College of Design

Studio Gang has completed the Gray Design Building, the new home of the University of Kentucky’s College of Design. In partnership with K. Norman Berry Associates Architects, Studio Gang has turned a former tobacco warehouse into a contemporary facility for interdisciplinary learning and collaboration.

Warehouses | Sep 27, 2024

California bill would limit where distribution centers can be built

A bill that passed the California legislature would limit where distribution centers can be located and impose other rules aimed at reducing air pollution and traffic. Assembly Bill 98 would tighten building standards for new warehouses and ban heavy diesel truck traffic next to sensitive sites including homes, schools, parks and nursing homes.

Laboratories | Sep 27, 2024

Traditional lab design doesn't address neurodiverse needs, study finds

A study conducted by ARC, HOK, and the University of the West of Scotland, has revealed that half (48.1%) of all survey respondents who work in laboratory settings identify as neurodivergent.

Laboratories | Sep 26, 2024

BSL conversions: A cost-efficient method to support high-containment research

Some institutions are creating flexible lab spaces that can operate at a BSL-2 and modulate up to a BSL-3 when the need arises. Here are key aspects to consider when accommodating a rapid modulation between BSL-2 and BSL-3 space.

MFPRO+ News | Sep 24, 2024

Major Massachusetts housing law aims to build or save 65,000 multifamily and single-family homes

Massachusetts Gov. Maura Healey recently signed far-reaching legislation to boost housing production and address the high cost of housing in the Bay State. The Affordable Homes Act aims to build or save 65,000 homes through $5.1 billion in spending and 49 policy initiatives.

Designers | Sep 20, 2024

The growing moral responsibility of designing for shade

Elliot Glassman, AIA, NCARB, LEED AP BD+C, CPHD, Building Performance Leader, CannonDesign, makes the argument for architects to consider better shade solutions through these four strategies.

Mixed-Use | Sep 19, 2024

A Toronto development will transform a 32-acre shopping center site into a mixed-use urban neighborhood

Toronto developers Mattamy Homes and QuadReal Property Group have launched The Clove, the first phase in the Cloverdale, a $6 billion multi-tower development. The project will transform Cloverdale Mall, a 32-acre shopping center in Toronto, into a mixed-use urban neighborhood.

Codes and Standards | Sep 19, 2024

Navigating the intricacies of code compliance and authorities having jurisdiction

The construction of a building entails navigating through a maze of regulations, permits, and codes. Architects are more than mere designers; we are stewards of safety and navigators of code compliance.

Higher Education | Sep 18, 2024

Modernizing dental schools: The intersection of design and education

Page's John Smith and Jennifer Amster share the how firm's approach to dental education facilities builds on the success of evidence-based design techniques pioneered in the healthcare built environment.