Construction employment increased by 20,000 jobs in July but the gains were limited to housing, while employment related to infrastructure and nonresidential building construction slipped by 4,000, according to an analysis by the Associated General Contractors of America of government data released today. Association officials cautioned that non-housing construction job losses will continue unless the federal government provides infrastructure funding for state and local budgets, enacts liability reforms and other relief measures.

“It is gratifying that the construction industry continued to add jobs in July, but last month’s gains were entirely in residential building and specialty trades,” said Ken Simonson, the association’s chief economist. “It is likely that many nonresidential jobs are in jeopardy following the completion of emergency projects and ones begun before the pandemic. Projects that had been scheduled to start this summer or later are being canceled by both public agencies and private owners, while few new facilities are breaking ground.”

The employment pickup in July follow gains of 163,000 jobs in June and 456,000 in May, the economist noted. Nevertheless, construction employment in July remained 444,000 jobs or 5.6% below the recent peak in February.

Residential building and specialty trade construction firms—firms that concentrate on residential new construction, additions and renovations—accounted for 24,000 additional jobs in July. In contrast, employment among nonresidential segments declined by 4,000 jobs.

Compared to the most recent peak in February, employment in the heavy and civil engineering construction segment of the industry, representing firms that work mainly on highways and other infrastructure—was 7.4% below the February total. Employment at nonresidential building and specialty trade construction firms was 6.8% less than in February. Employment at residential building and specialty trade construction firms combined slipped by a more modest 4.1%.

The industry’s unemployment rate in July was 8.9%, with 870,000 former construction workers idled. These figures were more than double the July 2019 figures and were the highest July totals since 2013 and 2012, respectively.

Association officials said the best way to avoid the expected future construction job losses is for federal officials to quickly enact and implement funding for infrastructure, pass needed liability reforms and other pro-growth recovery measures. They said that investing in infrastructure will add to employment in many manufacturing, trucking and other sectors and will create assets that improve productivity, safety and well-being for all.

“It is vital for officials of both parties, both sides of Capitol Hill, and the Administration to come to agreement promptly on meaningful increases in infrastructure funding and other recovery measures,” said Stephen E. Sandherr, the association’s chief executive officer. “Without quick action, the nonresidential job losses that began in July will be quickly worsen and the nation will lose a golden opportunity to start on improving infrastructure at a time of high labor availability and low materials and borrowing costs.”

Related Stories

Market Data | Jul 18, 2019

Construction contractors remain confident as summer begins

Contractors were slightly less upbeat regarding profit margins and staffing levels compared to April.

Market Data | Jul 17, 2019

Design services demand stalled in June

Project inquiry gains hit a 10-year low.

Market Data | Jul 16, 2019

ABC’s Construction Backlog Indicator increases modestly in May

The Construction Backlog Indicator expanded to 8.9 months in May 2019.

K-12 Schools | Jul 15, 2019

Summer assignments: 2019 K-12 school construction costs

Using RSMeans data from Gordian, here are the most recent costs per square foot for K-12 school buildings in 10 cities across the U.S.

Market Data | Jul 12, 2019

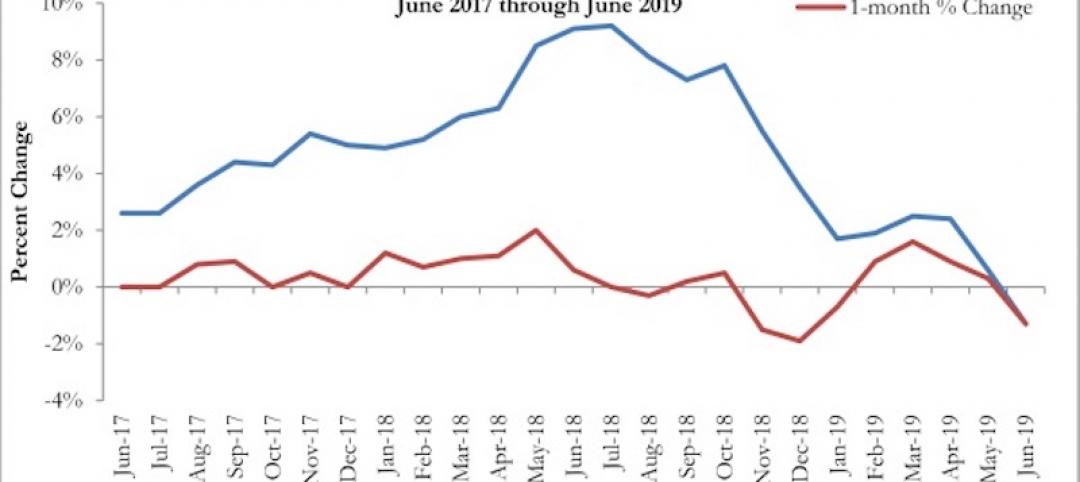

Construction input prices plummet in June

This is the first time in nearly three years that input prices have fallen on a year-over-year basis.

Market Data | Jul 1, 2019

Nonresidential construction spending slips modestly in May

Among the 16 nonresidential construction spending categories tracked by the Census Bureau, five experienced increases in monthly spending.

Market Data | Jul 1, 2019

Almost 60% of the U.S. construction project pipeline value is concentrated in 10 major states

With a total of 1,302 projects worth $524.6 billion, California has both the largest number and value of projects in the U.S. construction project pipeline.

Market Data | Jun 21, 2019

Architecture billings remain flat

AIA’s Architecture Billings Index (ABI) score for May showed a small increase in design services at 50.2.

Market Data | Jun 19, 2019

Number of U.S. architects continues to rise

New data from NCARB reveals that the number of architects continues to increase.

Market Data | Jun 12, 2019

Construction input prices see slight increase in May

Among the 11 subcategories, six saw prices fall last month, with the largest decreases in natural gas.