Construction employment declined by 975,000 jobs in April as a new survey by the Associated General Contractors of America and data from construction technology firm Procore show deteriorating demand for construction, officials with the association announced today. The new economic data underscores the need for new federal measures to help the construction industry recover, including infrastructure funding, safe harbor provisions and fixes to the Paycheck Protection Program guidance, association officials added.

“Today’s jobs report, our new survey results and Procore’s data make it clear that the construction industry is not immune to the economic damage being inflicted on our country by the pandemic,” said Ken Simonson, the association’s chief economist. “Without new federal help, it is hard to see a scenario where the construction industry will be able to recover any time soon.”

The economist said the loss of 975,000 construction jobs from March to April constituted nearly 13% of the industry’s employment and was, by far, the worst one-month decline ever. He added that unemployment among workers with recent construction experience soared by 1.1 million from a year earlier, to 1,531,000, while the unemployment rate in construction jumped from 4.7% in April 2019 to 16.6%.

Simonson noted that a survey of over 800 construction firms the association released today found that while only 30% of firms report projects have been halted by government order – down from 35% two weeks ago – 37% say their owners have voluntarily halted work out of fears of the pandemic. Thirty-one percent report that owners have canceled projects because of a predicted reduction in demand. And 21% report having projects canceled as a result of a loss of private funding.

All told, 67% of firms report having a project canceled or delayed since the start of the outbreak in early March. These cancellations have forced some firms to cut staff. Twenty-three percent, for example, report cutting staff in March and 22% cut staff in April. Yet the economist said the job losses would likely have been worse if not for the federal government’s Paycheck Protection Program loans, noting that 80% of respondents report having applied for the loans and most having been approved.

The association economist cautioned, however, that recent revisions by the Treasury Department to its guidance for the loans have prompted quite a few firms to consider returning the funds. Eighteen percent of firms report they are considering returning the funds because of the vague guidance, and most of these will be forced to cut staff as a result. Simonson added that is one reason why 12% of firms report they plan to make additional layoffs within the next four weeks.

“Unfortunately, our survey indicates that layoffs are continuing to occur throughout the nation,” Simonson added. “Between March 1 and May 1, 39% of responding firms reduced their headcount. Reductions were particularly severe in the Northeast, where 53% of firms terminated or furloughed employees. The South had the fewest firms reporting staff reductions—29%, while 38% of firms in the Midwest and 45% in the West reduced headcount.”

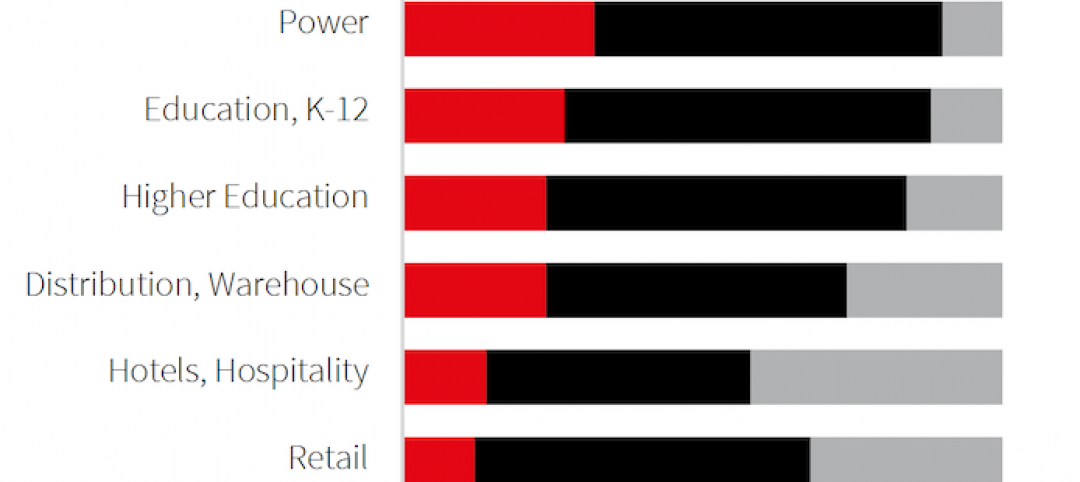

In addition to the new survey results, the association also shared new data released by construction technology firm Procore. The data is based on the transactions logged via the company’s software by tens of thousands of construction firms across the country. That data is available here and shows how demand and hours-worked have declined in most states since the start of the pandemic. Procore also released a new blog post about the data that can be found here.

“We realized that the construction industry primarily gathers data through surveys, which can take a long time, and it’s pretty tough to get a quick visualization or snapshot of what’s going on with construction at a national and state level. So we decided to do something about it,” said Kristopher Lengieza, Senior Director of Business Development at Procore. “These insights are helping industry organizations and economists analyze trends, debate potential courses of action, and decide on the best path forward, in an effort to support the construction industry through the current pandemic.”

Simonson noted that the construction association was calling on federal officials to take additional steps to prevent additional industry layoffs. Among those steps are clarifying the guidance regarding the paycheck protection program. He also noted that 61% of survey respondents say Congress should enact a “safe harbor” set of protocols to provide firms that are following safe practices with protection from tort or employment liability for failing to prevent a Covid-19 infection.

In addition, 43% of survey respondents hope for a larger federal investment in infrastructure, which will be especially vital as budget constraints force many state and local officials to curtail capital expenditures. And 32% of firms report they would like Washington to enact a Covid-19 business and employee continuity and recovery fund. And an equal percent wants Congress to fill state highway transportation departments’ immediate, $50 billion funding gap.

“Federal officials can, and should, take additional steps to help avoid more layoffs and economic hardship,” Simonson added. “The construction industry’s job losses have little to do with temporary work-stoppages, but a lot to do with longer-term economic problems that will not end with the stay-at-home orders.”

Click here for the association’s survey results and here for a video summary of the survey responses. Click here for Procore’s new construction data.

Related Stories

Coronavirus | Mar 20, 2020

Pandemic has halted or delayed projects for 28% of contractors

Coronavirus-caused slowdown contrasts with January figures showing a majority of metro areas added construction jobs; Officials note New infrastructure funding and paid family leave fixes are needed.

Market Data | Mar 17, 2020

Construction spending to grow modestly in 2020, predicts JLL’s annual outlook

But the coronavirus has made economic forecasting perilous.

Market Data | Mar 16, 2020

Grumman/Butkus Associates publishes 2019 edition of Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Mar 12, 2020

New study from FMI and Autodesk finds construction organizations with the highest levels of trust perform twice as well on crucial business metrics

Higher levels of trust within organizations and across project teams correlate with increased profit margins, employee retention and repeat business that can all add up to millions of dollars of profitability annually.

Market Data | Mar 11, 2020

The global hotel construction pipeline hits record high at 2019 year-end

Projects currently under construction stand at a record 991 projects with 224,354 rooms.

Market Data | Mar 6, 2020

Construction employment increases by 43,000 in February and 223,000 over 12 months

Average hourly earnings in construction top private sector average by 9.9% as construction firms continue to boost pay and benefits in effort to attract and retain qualified hourly craft workers.

Market Data | Mar 4, 2020

Nonresidential construction spending attains all-time high in January

Private nonresidential spending rose 0.8% on a monthly basis and is up 0.5% compared to the same time last year.

Market Data | Feb 21, 2020

Construction contractor confidence remains steady

70% of contractors expect their sales to increase over the first half of 2020.

Market Data | Feb 20, 2020

U.S. multifamily market gains despite seasonal lull

The economy’s steady growth buoys prospects for continued strong performance.

Market Data | Feb 19, 2020

Architecture billings continue growth into 2020

Demand for design services increases across all building sectors.