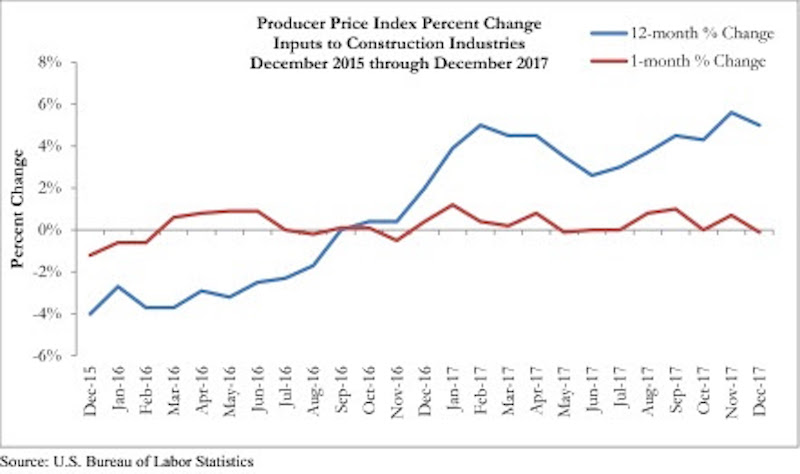

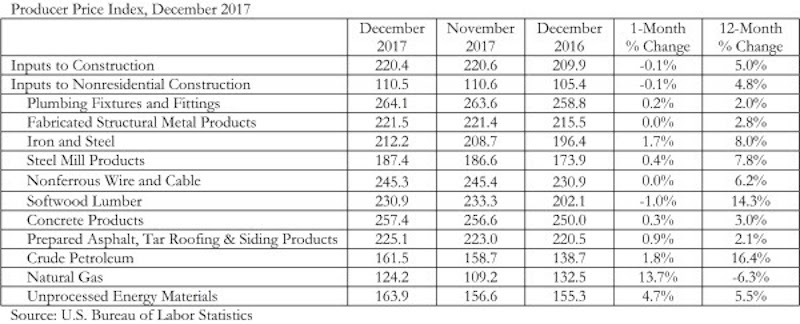

Overall construction input prices declined 0.1% in December, yet despite the lack of inflation for the month, prices are up 5% on a year-over-year basis, according to an Associated Builders and Contractors (ABC) analysis of Bureau of Labor Statistics data released today. Nonresidential construction materials prices also declined 0.1% for the month and are up 4.8% from the same time one year ago.

Energy prices have been more volatile lately. Natural gas prices increased 13.7% from November, but are 6.3% lower on a year-over-year basis. Crude petroleum prices rose 16.4% between December 2016 and December 2017 and have been climbing higher during the first days of 2018.

“Given stronger global and domestic economic growth, elevated liquidity in international financial markets, burgeoning trade disputes and efforts by certain energy producers to limit supply growth even as prices rise, one would have expected a sharper increase in construction materials prices in December,” said ABC Chief Economist Anirban Basu. “The fact that inflation remains contained should be viewed by most contractors as very good news. Not only are many contractors vulnerable to sudden increases in certain materials prices, but faster inflation can trigger higher interest rates, which ultimately reduce the demand for construction services.

“Though the overall Producer Price Index (PPI) indicates low December inflation, a number of materials prices increased, including iron and steel and the category that includes prepared asphalt,” said Basu. “Softwood lumber prices, by contrast, fell.

“Despite December’s reprieve from rising inflationary pressures, many economists expect inflation to become more apparent as 2018 proceeds,” said Basu. “Recently enacted federal tax cuts stand to supercharge the economy, which should translate into more construction starts later this year and into 2019. At the same time, growth in Europe and in much of Asia remains solid. India’s economy is expected to expand more than 7% this year, and China’s by more than 6%. The upshot is that December’s data may come to represent an exception during an increasingly inflationary period.”

Related Stories

Market Data | Mar 24, 2021

Architecture billings climb into positive territory after a year of monthly declines

AIA’s ABI score for February was 53.3 compared to 44.9 in January.

Market Data | Mar 22, 2021

Construction employment slips in 225 metros from January 2020 to January 2021

Rampant cancellations augur further declines ahead.

Market Data | Mar 18, 2021

Commercial Construction Contractors’ Outlook lifts on rising revenue expectations

Concerns about finding skilled workers, material costs, and steel tariffs linger.

Market Data | Mar 16, 2021

Construction employment in January lags pre-pandemic mark in 42 states

Canceled projects, supply-chain woes threaten future jobs.

Market Data | Mar 15, 2021

Rising materials prices and supply chain disruptions are hurting many construction firms

The same firms are already struggling to cope with pandemic impacts.

Market Data | Mar 11, 2021

Soaring materials costs, supply-chain problems, and project cancellations continue to impact construction industry

Costs and delayed deliveries of materials, parts, and supplies are vexing many contractors.

Market Data | Mar 8, 2021

Construction employment declines by 61,000 in February

Association officials urge congress and Biden administration to focus on new infrastructure funding.

Market Data | Mar 2, 2021

Construction spending rises in January as private nonresidential sector stages rare gain

Private nonresidential market shrinks 10% since January 2020 with declines in all 11 segments.

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.

Market Data | Feb 23, 2021

Architectural billings continue to contract in 2021

AIA’s Architecture Billings Index (ABI) score for January was 44.9 compared to 42.3 in December.