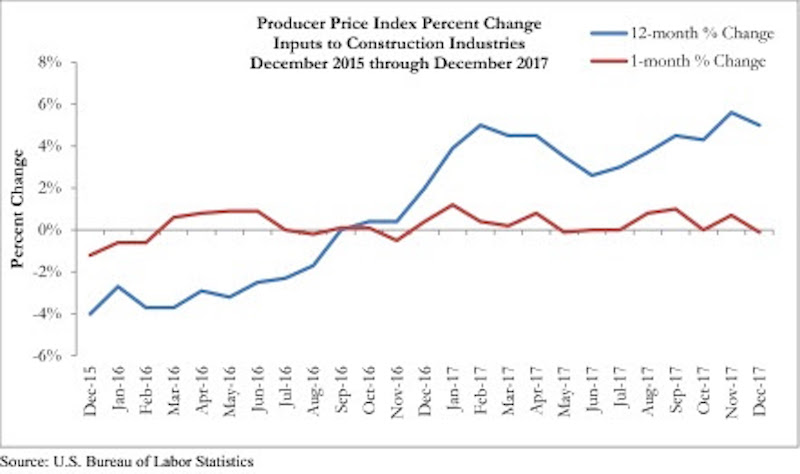

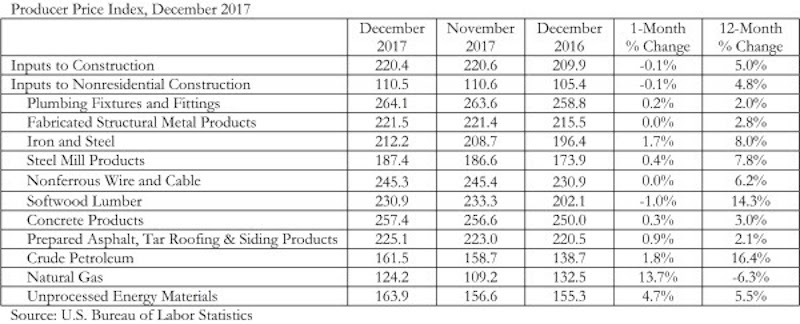

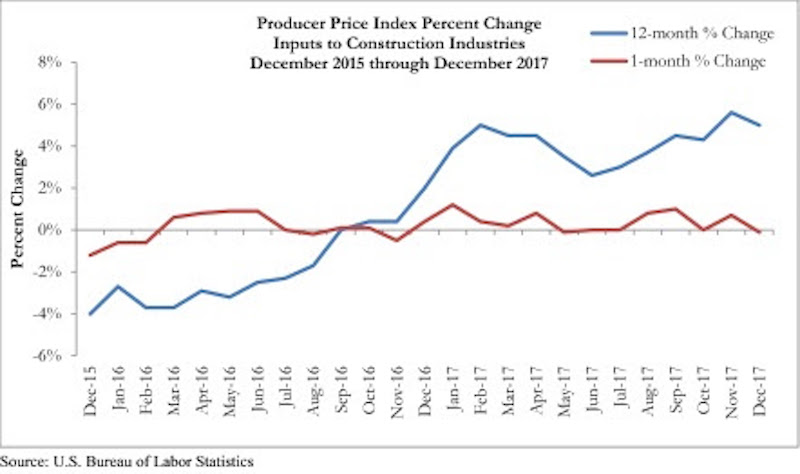

Overall construction input prices declined 0.1% in December, yet despite the lack of inflation for the month, prices are up 5% on a year-over-year basis, according to an Associated Builders and Contractors (ABC) analysis of Bureau of Labor Statistics data released today. Nonresidential construction materials prices also declined 0.1% for the month and are up 4.8% from the same time one year ago.

Energy prices have been more volatile lately. Natural gas prices increased 13.7% from November, but are 6.3% lower on a year-over-year basis. Crude petroleum prices rose 16.4% between December 2016 and December 2017 and have been climbing higher during the first days of 2018.

“Given stronger global and domestic economic growth, elevated liquidity in international financial markets, burgeoning trade disputes and efforts by certain energy producers to limit supply growth even as prices rise, one would have expected a sharper increase in construction materials prices in December,” said ABC Chief Economist Anirban Basu. “The fact that inflation remains contained should be viewed by most contractors as very good news. Not only are many contractors vulnerable to sudden increases in certain materials prices, but faster inflation can trigger higher interest rates, which ultimately reduce the demand for construction services.

“Though the overall Producer Price Index (PPI) indicates low December inflation, a number of materials prices increased, including iron and steel and the category that includes prepared asphalt,” said Basu. “Softwood lumber prices, by contrast, fell.

“Despite December’s reprieve from rising inflationary pressures, many economists expect inflation to become more apparent as 2018 proceeds,” said Basu. “Recently enacted federal tax cuts stand to supercharge the economy, which should translate into more construction starts later this year and into 2019. At the same time, growth in Europe and in much of Asia remains solid. India’s economy is expected to expand more than 7% this year, and China’s by more than 6%. The upshot is that December’s data may come to represent an exception during an increasingly inflationary period.”

Related Stories

Market Data | Nov 2, 2020

More contractors report canceled projects than starts, survey finds

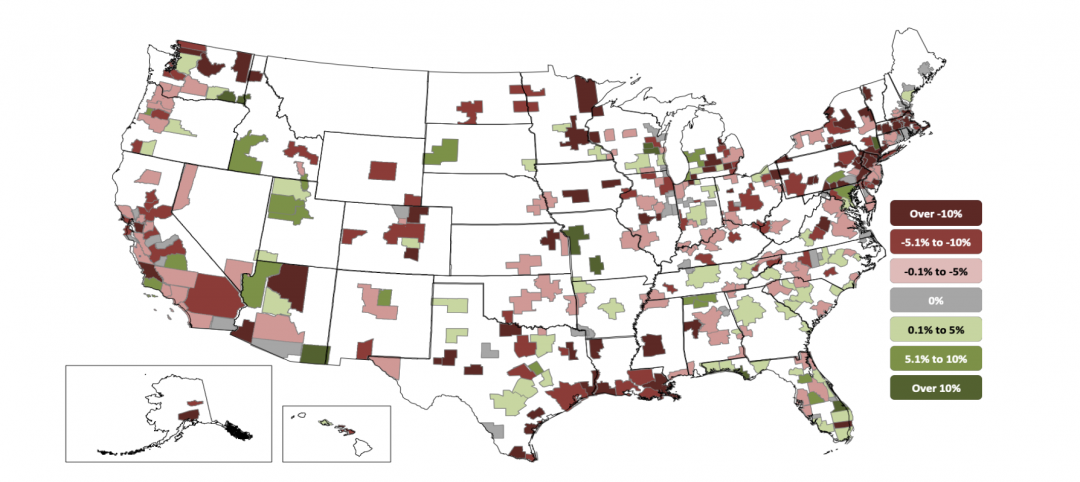

Construction employment declined in most metros in latest 12 months.

Multifamily Housing | Oct 30, 2020

The Weekly show: Multifamily security tips, the state of construction industry research, and AGC's market update

BD+C editors speak with experts from AGC, Charles Pankow Foundation, and Silva Consultants on the October 29 episode of "The Weekly." The episode is available for viewing on demand.

Hotel Facilities | Oct 27, 2020

Hotel construction pipeline dips 7% in Q3 2020

Hospitality developers continue to closely monitor the impact the coronavirus will have on travel demand, according to Lodging Econometrics.

Market Data | Oct 22, 2020

Multifamily’s long-term outlook rebounds to pre-covid levels in Q3

Slump was a short one for multifamily market as 3rd quarter proposal activity soars.

Market Data | Oct 21, 2020

Architectural billings slowdown moderated in September

AIA’s ABI score for September was 47.0 compared to 40.0 in August.

Market Data | Oct 21, 2020

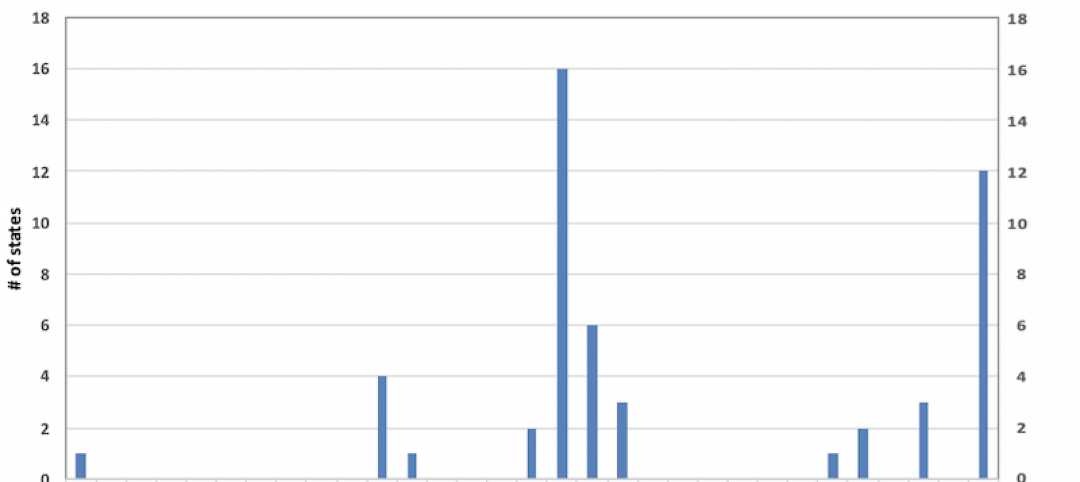

Only eight states top February peak construction employment despite gains in 32 states last month

California and Vermont post worst losses since February as Virginia and South Dakota add the most.

Market Data | Oct 20, 2020

AIA releases updated contracts for multi-family residential and prototype residential projects

New resources provide insights into mitigating and managing risk on complex residential design and construction projects.

Market Data | Oct 20, 2020

Construction officials call on Trump and Biden to establish a nationwide vaccine distribution plan to avoid confusion and delays

Officials say nationwide plan should set clear distribution priorities.

Market Data | Oct 19, 2020

5 must reads for the AEC industry today: October 19, 2020

Lower cost metros outperform pricey gateway markets and E-commerce fuels industrial's unstoppable engine.

Market Data | Oct 19, 2020

Lower-cost metros continue to outperform pricey gateway markets, Yardi Matrix reports

But year-over-year multifamily trendline remained negative at -0.3%, unchanged from July.