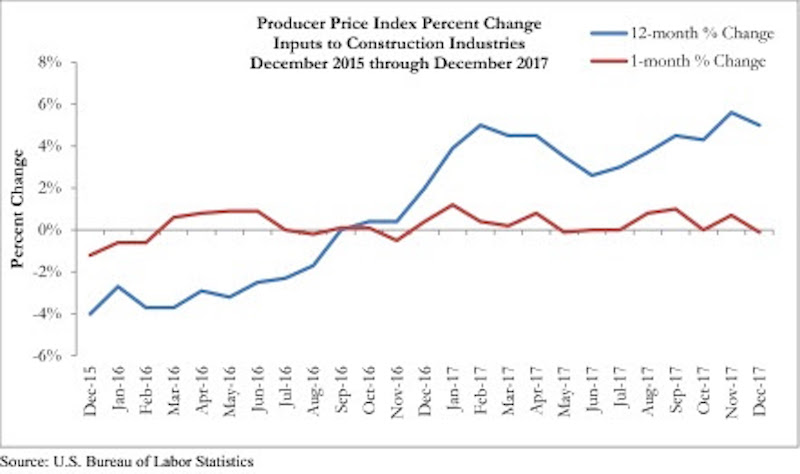

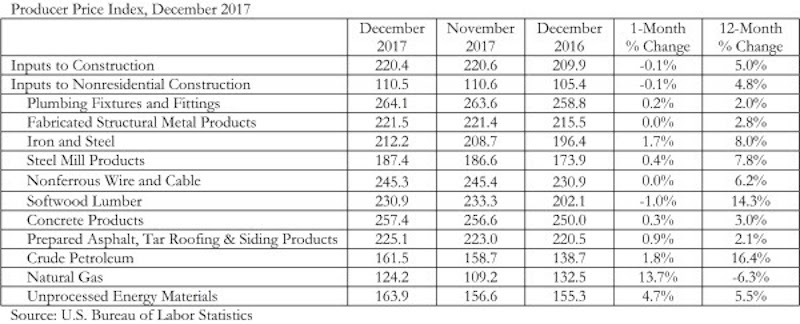

Overall construction input prices declined 0.1% in December, yet despite the lack of inflation for the month, prices are up 5% on a year-over-year basis, according to an Associated Builders and Contractors (ABC) analysis of Bureau of Labor Statistics data released today. Nonresidential construction materials prices also declined 0.1% for the month and are up 4.8% from the same time one year ago.

Energy prices have been more volatile lately. Natural gas prices increased 13.7% from November, but are 6.3% lower on a year-over-year basis. Crude petroleum prices rose 16.4% between December 2016 and December 2017 and have been climbing higher during the first days of 2018.

“Given stronger global and domestic economic growth, elevated liquidity in international financial markets, burgeoning trade disputes and efforts by certain energy producers to limit supply growth even as prices rise, one would have expected a sharper increase in construction materials prices in December,” said ABC Chief Economist Anirban Basu. “The fact that inflation remains contained should be viewed by most contractors as very good news. Not only are many contractors vulnerable to sudden increases in certain materials prices, but faster inflation can trigger higher interest rates, which ultimately reduce the demand for construction services.

“Though the overall Producer Price Index (PPI) indicates low December inflation, a number of materials prices increased, including iron and steel and the category that includes prepared asphalt,” said Basu. “Softwood lumber prices, by contrast, fell.

“Despite December’s reprieve from rising inflationary pressures, many economists expect inflation to become more apparent as 2018 proceeds,” said Basu. “Recently enacted federal tax cuts stand to supercharge the economy, which should translate into more construction starts later this year and into 2019. At the same time, growth in Europe and in much of Asia remains solid. India’s economy is expected to expand more than 7% this year, and China’s by more than 6%. The upshot is that December’s data may come to represent an exception during an increasingly inflationary period.”

Related Stories

Market Data | Jun 2, 2020

5 must reads for the AEC industry today: June 2, 2020

New Luxembourg office complex breaks ground and nonresidential construction spending falls.

Market Data | Jun 1, 2020

Nonresidential construction spending falls in April

Of the 16 subcategories, 13 were down on a monthly basis.

Market Data | Jun 1, 2020

7 must reads for the AEC industry today: June 1, 2020

Energy storage as an amenity and an entry-point for wellness screening everywhere.

Market Data | May 29, 2020

House-passed bill making needed improvements to paycheck protection program will allow construction firms to save more jobs

Construction official urges senate and White House to quickly pass and sign into law the Paycheck Protection Program Flexibility Act.

Market Data | May 29, 2020

7 must reads for the AEC industry today: May 29, 2020

Using lighting IoT data to inform a safer office reentry strategy and Ghafari joins forces with Eview 360.

Market Data | May 27, 2020

5 must reads for the AEC industry today: May 28, 2020

Biophilic design on the High Line and the office market could be a COVID-19 casualty.

Market Data | May 27, 2020

6 must reads for the AEC industry today: May 27, 2020

AIA's COTE Top Ten Awards and OSHA now requires employers to track COVID-19 cases.

Market Data | May 26, 2020

6 must reads for the AEC industry today: May 26, 2020

Apple's new Austin hotel and is CLT really a green solution?

Market Data | May 21, 2020

7 must reads for the AEC industry today: May 21, 2020

'Creepy' tech invades post-pandemic offices, and meet the new darling of commercial real estate.

Market Data | May 20, 2020

6 must reads for the AEC industry today: May 20, 2020

A wave 'inside' a South Korean building and architecture billings continues historic contraction.