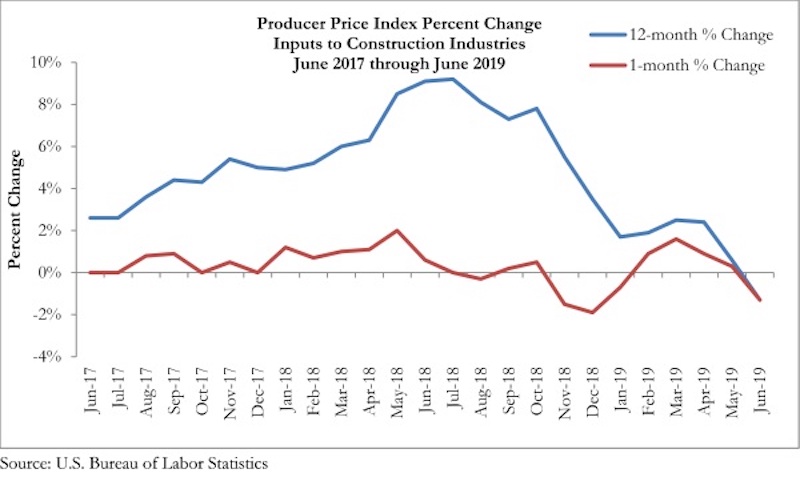

Construction input prices decreased 1.3% on both a monthly and yearly basis in June, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. This is the first time in nearly three years that input prices have fallen on a year-over-year basis.

Overall, nonresidential construction input prices declined 1.4% from May 2019 but are down just 0.8% from June 2018. Among the 11 sub-categories, only natural gas (+1.6%) and concrete products (+0.9%) prices increased compared to May 2019. On a yearly basis, three of the sub-category prices have declined by more than 20%, including softwood lumber (-23.1%), crude petroleum (-22.2%) and natural gas (-22.3%).

“Eighteen months ago, surging construction materials prices represented one of the leading sources of concern among construction executives,” said ABC Chief Economist Anirban Basu. “That was a time of solid global economic growth and the first synchronized worldwide global expansion in approximately a decade. Yet things can change dramatically in a year and a half. According to today’s data release, construction materials prices are falling, in part a reflection of a weakening global economy.

“Given that the United States is in the midst of its lengthiest economic expansion with an unemployment rate at approximately a 50-year low, such low inflation remains a conundrum,” said Basu. “However, the June PPI numbers indicate that those commodities exposed to global economic weakness have been the ones to experience declines in prices, with the exception of concrete products and natural gas. While America has begun to export more natural gas, today’s prices largely reflect the domestic demand and supply.

“With the global economy continuing to stumble, there is little reason to believe that materials prices will bounce back significantly,” said Basu. “Of course, trade issues and other disputes can quickly alter the trajectories of prices. If economic forces are allowed to play out, contractors should be able to focus the bulk of their attention on labor compensation costs and worry relatively less about materials prices.”

Related Stories

Market Data | Aug 18, 2020

6 must reads for the AEC industry today: August 18, 2020

The world's first AI-driven facade system and LA's Greek Theatre restoriation completes.

Market Data | Aug 17, 2020

5 must reads for the AEC industry today: August 17, 2020

5 strategies for creating safer hotel experiences and how to manage multifamily assets when residents no longer leave.

Market Data | Aug 14, 2020

6 must reads for the AEC industry today: August 14, 2020

The largest single sloped solar array in the country and renewing the healing role of public parks.

Market Data | Aug 13, 2020

5 must reads for the AEC industry today: August 13, 2020

Apple Central World opens in Bangkok and 7-Eleven to buy Speedway.

Market Data | Aug 12, 2020

6 must reads for the AEC industry today: August 12, 2020

UC Davis's new dining commons and the pandemic is revolutionizing healthcare benefits.

Market Data | Aug 11, 2020

6 must reads for the AEC industry today: August 11, 2020

Elevators can be a 100% touch-free experience and the construction industry adds 20,000 employees in July.

Market Data | Aug 10, 2020

Dodge Momentum Index increases in July

This month’s increase in the Dodge Momentum Index was the first in all of 2020.

Market Data | Aug 10, 2020

Construction industry adds 20,000 employees in July but nonresidential employment dips

Association warns skid will worsen without new relief.

Market Data | Aug 10, 2020

5 must reads for the AEC industry today: August 10, 2020

Private student housing owners reap the benefits as campus housing de-densifies and race for COVID vaccine boosts real estate in life sciences hubs.

Market Data | Aug 7, 2020

6 must reads for the AEC industry today: August 7, 2020

BD+C's 2020 Color Trends Report and HMC releases COVID-19 Campus Reboot Guide for Prek-12 schools.