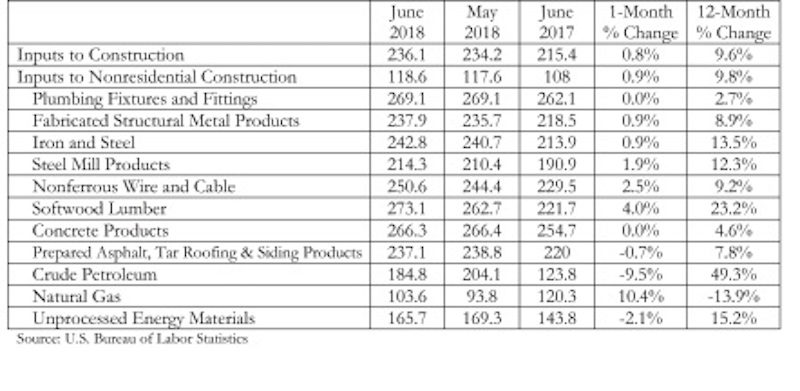

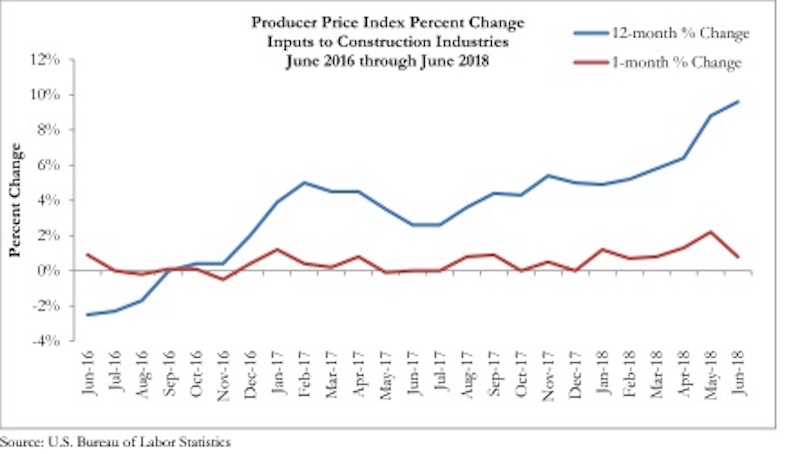

According to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data released today, construction material prices rose another 0.8% in June and are 9.6% higher than they were at the same time one year ago.

June represents the latest month associated with rapidly rising construction input prices. Nonresidential construction materials prices effectively mirrored overall construction prices by rising 0.9% on a month-over-month basis and 9.8% on a year-over-year basis.

“In general, this emerging state of affairs is unfavorable,” said ABC Chief Economist Anirban Basu. “Rapidly rising materials prices interfere with economic progress in numerous ways, including by making it less likely that a particular development will move forward. They also increase the cost of delivering government-financed infrastructure, raise costs for final consumers such as homeowners, renters and office tenants, and exacerbate overall inflationary pressures, which serves to push nominal borrowing costs higher.

“Materials prices are up roughly 10% in just one year, and certain categories have experienced significant rates of price increase,” said Basu. “Among these are key inputs that appear to have been impacted by evolving policymaking, including the price of crude petroleum, which is up 49% over the past year, iron and steel, which is up nearly 14%, and softwood lumber, up 23%.

“Some contractors may note the similarities between the current period and the period immediately preceding the onset of the global financial crisis,” said Basu. “Materials prices, for instance, were rising rapidly for much of 2006 and 2007 as the economic expansion that began in 2001 reached its final stages. Today’s data will provide further ammunition for policymakers committed to tightening monetary policy and raising short-term interest rates.

“With no end in sight regarding the ongoing tariff spat between the United States and a number of leading trading partners, and with the domestic economy continuing to expand briskly, construction input prices are positioned to increase further going forward, though the current rate of increase appears unsustainable.”

Related Stories

Market Data | Apr 10, 2020

5 must reads for the AEC industry today: April 10, 2020

Designing for the next generation of student life and a mass timber Ramada Hotel rises in British Columbia.

Market Data | Apr 9, 2020

7 must reads for the AEC industry today: April 9, 2020

Urine could be the key to building in outer space and how to turn a high school into a patient care center in just over two weeks.

Market Data | Apr 8, 2020

6 must reads for the AEC industry today: April 8, 2020

Stantec discusses how hospitals can adapt buildings to address worst-case scenarios and FXCollaborative Architects tells us why cities will survive the pandemic.

Market Data | Apr 7, 2020

7 must reads for the AEC industry today: April 7, 2020

Leo A Daly's Hotel2Hospital prototype takes shape, while the number of delayed projects reaches 2,550 in the U.S. amid coronavirus pandemic.

Market Data | Apr 3, 2020

COVID-19 cuts nonresidential construction employment in March

The construction unemployment rate was 6.9% in March, up 1.7 percentage points from the same time one year ago.

Market Data | Apr 1, 2020

February’s construction spending decline indicates what’s to come

Private nonresidential spending declined 2% on a monthly basis and is down 0.7% compared to February 2019.

Market Data | Mar 26, 2020

Architects taking action to support COVID-19 response

New AIA task force will offer insights for adapting buildings into healthcare facilities.

Market Data | Mar 26, 2020

Senate coronavirus relief bill's tax and lending provisions will help construction firms, but industry needs additional measures

Construction officials say measure will help firms cope with immediate cash flow crunch, but industry needs compensation for losses.

Market Data | Mar 25, 2020

Engineering and construction materials prices fall for first time in 40 months on coronavirus impacts, IHS Markit says

Survey respondents reported falling prices for five out of the 12 components within the materials and equipment sub-index.